How a Seasoned CFO Appointment Could Shape Mesoblast's (ASX:MSB) Commercial Transformation

Reviewed by Sasha Jovanovic

- Mesoblast Limited recently announced the appointment of James M. O’Brien as its new US-based Chief Financial Officer, drawing on his extensive financial leadership across global life sciences, biotechnology, and pharmaceutical companies.

- O’Brien’s expertise in orchestrating large-scale corporate transactions and public offerings brings significant operational and financial acumen to Mesoblast's transition into a fully integrated commercial organization.

- We’ll now explore how the addition of an experienced CFO may influence Mesoblast’s investment narrative during this phase of company transformation.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Mesoblast's Investment Narrative?

To hold Mesoblast shares, investors need to believe in the company’s ability to evolve from an innovative biotech into a revenue-producing commercial business, especially as it pushes key products like Ryoncil and rexlemestrocel-L through regulatory and market milestones. A central short-term catalyst remains the upcoming FDA meeting for rexlemestrocel-L, with hopes pinned on positive news about opioid reduction in chronic low back pain, a potential inflection point for adoption and partnerships. The recent hiring of James M. O’Brien as CFO looks timely: his transaction expertise could help Mesoblast handle financial complexity if new approvals accelerate launches or prompt capital needs. This leadership could support smoother integration of commercial operations and financial planning, possibly reducing risks tied to cash burn and execution missteps flagged in earlier analysis. Still, major risks, like ongoing net losses, class action lawsuits and the real challenge of scaling profitable sales, remain front of mind despite this strengthening of the financial team. In contrast, the status of upcoming regulatory decisions is something investors should stay alert to.

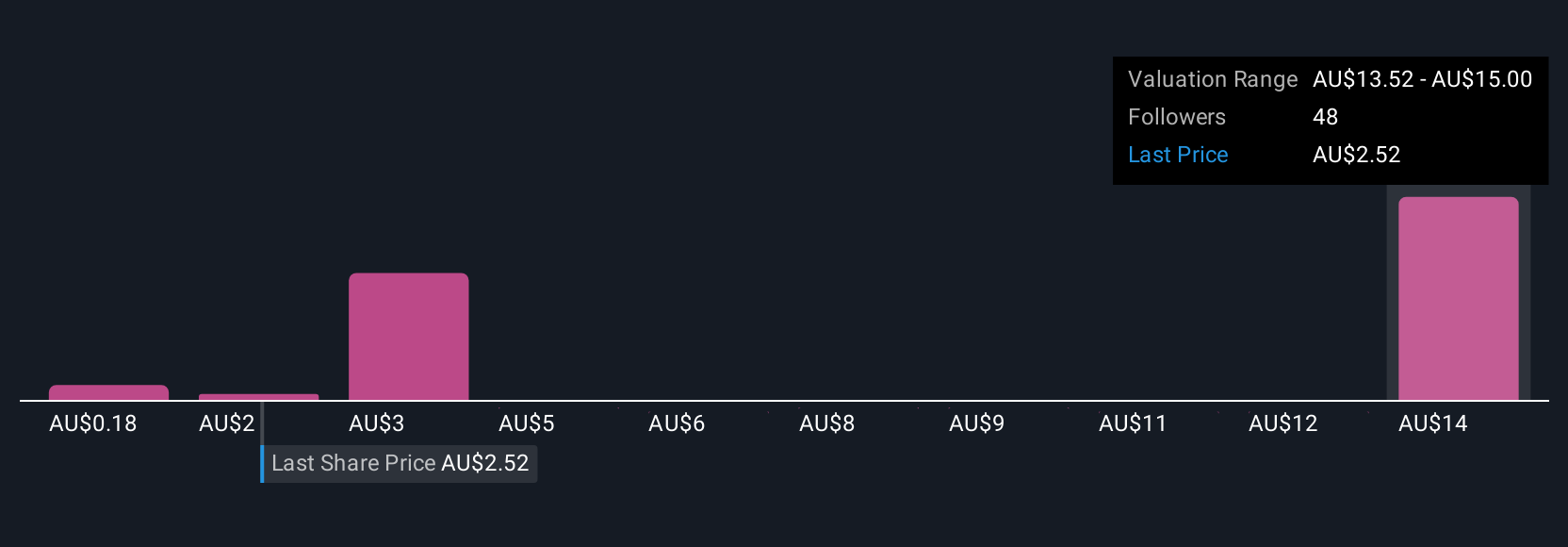

Mesoblast's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 20 other fair value estimates on Mesoblast - why the stock might be a potential multi-bagger!

Build Your Own Mesoblast Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mesoblast research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mesoblast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mesoblast's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives