A Look at Mesoblast (ASX:MSB) Valuation as New Ryoncil Sales Forecast and Pivotal Trial Spark Attention

Reviewed by Simply Wall St

Mesoblast (ASX:MSB) has caught the market's attention with a new revenue forecast for December 2025, expecting sales of Ryoncil to top $30 million, an increase of 37% from the previous quarter. The company also announced a collaboration to launch a pivotal trial that could expand Ryoncil’s use in adults with severe graft versus host disease.

See our latest analysis for Mesoblast.

Mesoblast’s upbeat revenue guidance and new clinical trial plans have reinvigorated investor sentiment, reflected in a sharp 14% single-day share price return and a 20% gain this week. Despite recent momentum, the stock’s year-to-date price return remains negative, but its 1-year total shareholder return of 54% points to meaningful long-term gains as confidence in the Ryoncil franchise grows.

If this resurgence in biotech leadership sparks your curiosity, it is worth exploring other healthcare stocks charting their own course. See the full list for free.

With positive revenue momentum, a robust pipeline, and the share price still trading below analyst targets, the question now is whether Mesoblast remains undervalued or if the market has already considered its future growth story.

Price-to-Book Ratio of 3.8x: Is it justified?

Mesoblast’s shares trade at a price-to-book (P/B) ratio of 3.8x, which is below both its peer group average of 4.5x and the broader Australian Biotechs industry average of 5.5x. This signals the market is valuing Mesoblast’s assets at a discount relative to comparable companies, despite recent momentum.

The price-to-book ratio compares a company's market value to its book value, highlighting how much investors are willing to pay for every dollar of net assets. In the biotech space, this metric is often used to gauge market confidence in a business with ongoing research and development spending, unprofitable operations, or significant intangible assets.

Mesoblast’s lower P/B multiple suggests that either the market is discounting its long-term growth prospects or has yet to fully recognize the company’s pipeline and future revenue model. With the company’s forecasted annual revenue growth of over 44% and expectations to become profitable in the next three years, this gap could close if execution continues and investor confidence strengthens.

Compared to both its direct peers and the industry norm, Mesoblast's shares appear attractively valued on a price-to-book basis and may offer an entry point at a relative discount. If the market begins aligning the company’s valuation with industry averages, there may be substantial upside potential.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.8x (UNDERVALUED)

However, clinical setbacks or delays in regulatory approvals could quickly alter Mesoblast’s growth trajectory and impact its current valuation optimism.

Find out about the key risks to this Mesoblast narrative.

Another View: What Does the SWS DCF Model Show?

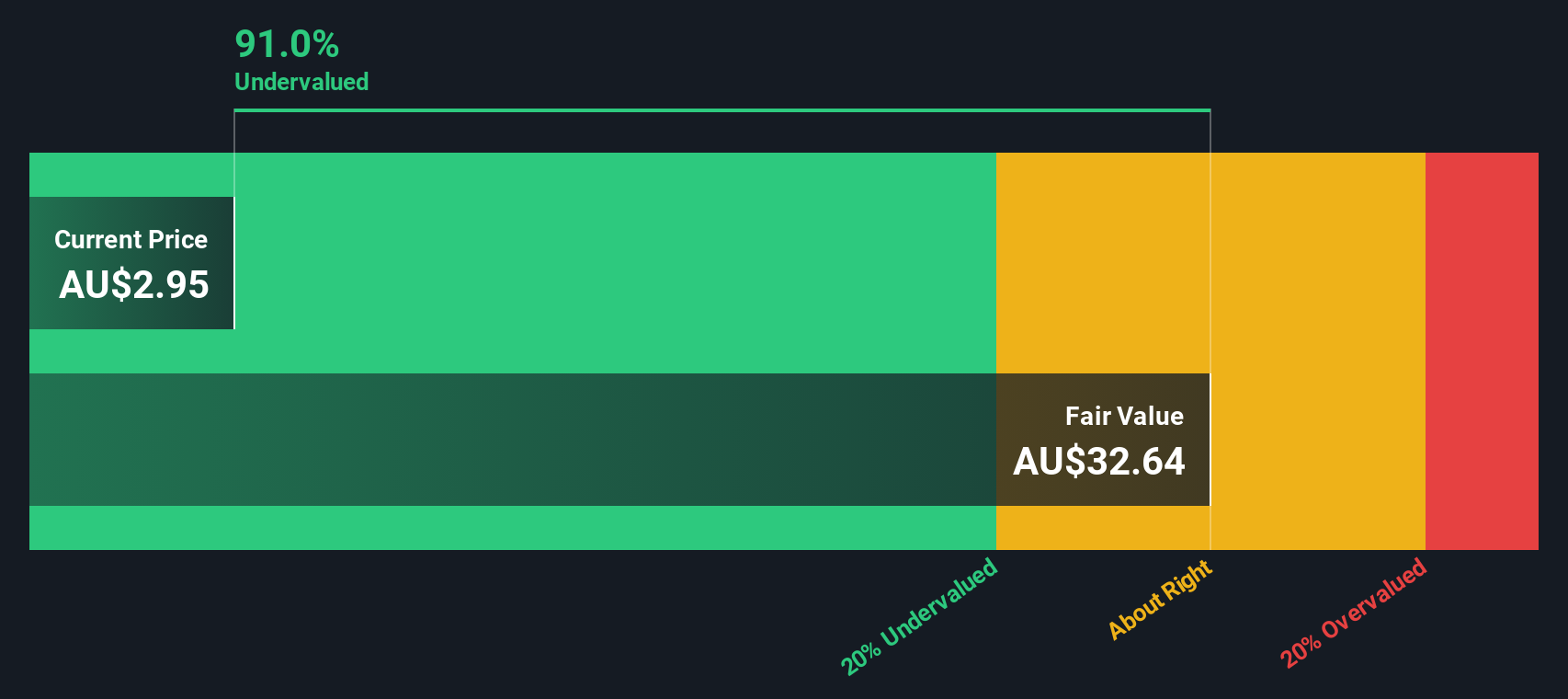

Looking from a different angle, our DCF model places Mesoblast’s fair value at A$31.35, which is much higher than its current trading price of A$2.72. This notable gap could indicate a potential opportunity, or it may suggest that the market is maintaining caution about future risks. Is the market being overly conservative, or is the DCF model projecting an optimistic outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mesoblast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mesoblast Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mesoblast.

Looking for more investment ideas?

Smart investors stay ahead by seeking fresh opportunities before the crowd spots them. Don't let game-changing stocks pass you by while you're watching from the sidelines.

- Unlock steady passive income streams and strengthen your portfolio with these 15 dividend stocks with yields > 3%, which boasts yields above 3% for income-focused investors.

- Tap into the artificial intelligence boom by checking out these 25 AI penny stocks, powering the next wave of innovation and growth.

- Position yourself for tomorrow's tech breakthroughs by exploring these 27 quantum computing stocks, accelerating advancements in quantum computing and shaping the digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success