Stock Analysis

The Australian market is experiencing a cautious sentiment, with the ASX200 set to decline following mixed performances on Wall Street. Amid these fluctuations, investors often seek opportunities that can offer growth potential despite broader market uncertainties. Penny stocks, though an outdated term, remain relevant as they represent smaller or newer companies that might provide surprising value when backed by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Little Green Pharma (ASX:LGP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Little Green Pharma Ltd is involved in the cultivation, production, and distribution of medicinal cannabis products both in Australia and internationally, with a market cap of A$48.28 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, amounting to A$25.63 million.

Market Cap: A$48.28M

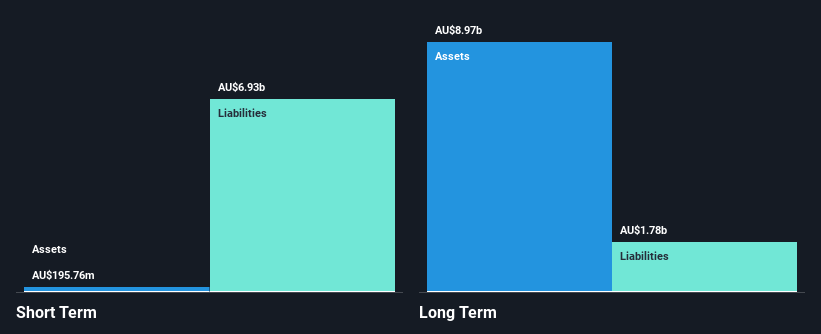

Little Green Pharma Ltd, with a market cap of A$48.28 million, operates in the medicinal cannabis sector and generates revenue primarily from its Pharmaceuticals segment amounting to A$25.63 million. Despite being unprofitable with a negative return on equity of -10.55%, the company has more cash than total debt and sufficient cash runway for over three years based on current free cash flow. Its short-term assets exceed both short- and long-term liabilities, providing some financial stability. The stock is trading at good value compared to peers but remains highly volatile with stable weekly volatility over the past year.

- Click here to discover the nuances of Little Green Pharma with our detailed analytical financial health report.

- Assess Little Green Pharma's future earnings estimates with our detailed growth reports.

Lunnon Metals (ASX:LM8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lunnon Metals Limited is engaged in the exploration and development of nickel and gold in Australia, with a market cap of A$74.96 million.

Operations: The company's revenue is primarily derived from mineral exploration, amounting to A$0.001551 million.

Market Cap: A$74.96M

Lunnon Metals, with a market cap of A$74.96 million, is focused on nickel and gold exploration but remains pre-revenue with minimal income from mineral exploration. The company is debt-free and maintains a cash runway exceeding one year under stable conditions, yet its share price has been highly volatile recently. Despite negative return on equity and increasing losses over five years, short-term assets significantly surpass liabilities. Recent executive changes include the resignation of CFO Hayden Bartrop amid challenging nickel market conditions, leading to deferred development plans for its nickel deposits while shifting focus to gold prospects in St Ives.

- Get an in-depth perspective on Lunnon Metals' performance by reading our balance sheet health report here.

- Gain insights into Lunnon Metals' future direction by reviewing our growth report.

MyState (ASX:MYS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MyState Limited, with a market cap of A$423.80 million, operates in Australia offering banking, trustee, and managed fund products and services through its subsidiaries.

Operations: The company's revenue is primarily derived from its Banking segment at A$135.47 million, supplemented by Wealth Management which contributes A$15.68 million.

Market Cap: A$423.8M

MyState Limited, with a market cap of A$423.80 million, derives most of its revenue from banking services, totaling A$135.47 million. Despite a slight decline in net income to A$35.29 million for the year ending June 2024, the company maintains an appropriate level of non-performing loans at 1% and has stable weekly volatility at 4%. The board is experienced with an average tenure of seven years, and management's tenure averages five years. MyState's price-to-earnings ratio is competitive at 12x compared to the broader Australian market average of 19.7x, reflecting potential value for investors seeking stability in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of MyState.

- Understand MyState's earnings outlook by examining our growth report.

Seize The Opportunity

- Click this link to deep-dive into the 1,026 companies within our ASX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGP

Little Green Pharma

Engages in the cultivation, production, and distribution of medicinal cannabis products in Australia and internationally.