- Australia

- /

- Life Sciences

- /

- ASX:GSS

After Leaping 42% Genetic Signatures Limited (ASX:GSS) Shares Are Not Flying Under The Radar

Genetic Signatures Limited (ASX:GSS) shareholders have had their patience rewarded with a 42% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

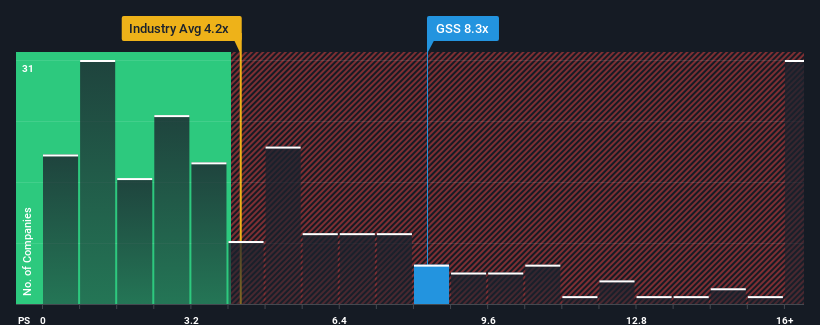

Following the firm bounce in price, Genetic Signatures may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 8.3x, since almost half of all companies in the Life Sciences industry in Australia have P/S ratios under 5.5x and even P/S lower than 1.5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Genetic Signatures

What Does Genetic Signatures' Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Genetic Signatures has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Genetic Signatures will help you uncover what's on the horizon.How Is Genetic Signatures' Revenue Growth Trending?

In order to justify its P/S ratio, Genetic Signatures would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 45% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 14% over the next year. That's shaping up to be materially higher than the 5.3% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Genetic Signatures' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Genetic Signatures have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Genetic Signatures' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Genetic Signatures that you should be aware of.

If these risks are making you reconsider your opinion on Genetic Signatures, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GSS

Genetic Signatures

Operates as a molecular diagnostic company in Australia, the Asia Pacific, Europe, the Middle East, Asia, and the Americas.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives