The recent earnings release from EZZ Life Science Holdings Limited (ASX:EZZ ) was disappointing to investors. We think that they may have more to worry about than just soft profit numbers.

Examining Cashflow Against EZZ Life Science Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

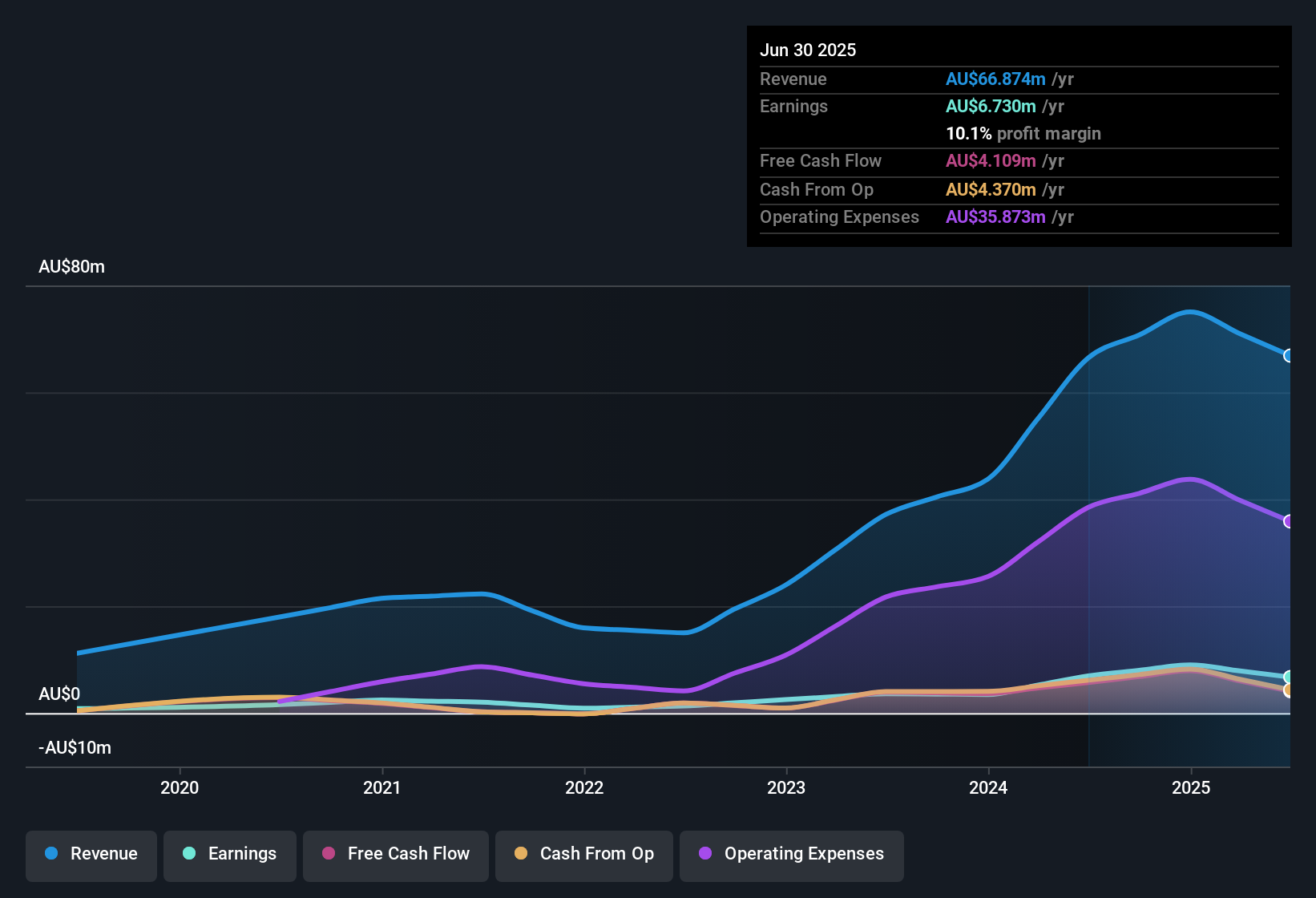

For the year to June 2025, EZZ Life Science Holdings had an accrual ratio of 0.65. That means it didn't generate anywhere near enough free cash flow to match its profit. As a general rule, that bodes poorly for future profitability. Indeed, in the last twelve months it reported free cash flow of AU$4.1m, which is significantly less than its profit of AU$6.73m. EZZ Life Science Holdings' free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, EZZ Life Science Holdings issued 6.2% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of EZZ Life Science Holdings' EPS by clicking here.

How Is Dilution Impacting EZZ Life Science Holdings' Earnings Per Share (EPS)?

As you can see above, EZZ Life Science Holdings has been growing its net income over the last few years, with an annualized gain of 413% over three years. But EPS was only up 372% per year, in the exact same period. Net profit actually dropped by 3.4% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 9.8%. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If EZZ Life Science Holdings' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On EZZ Life Science Holdings' Profit Performance

In conclusion, EZZ Life Science Holdings has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). Considering all this we'd argue EZZ Life Science Holdings' profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into EZZ Life Science Holdings, you'd also look into what risks it is currently facing. To that end, you should learn about the 3 warning signs we've spotted with EZZ Life Science Holdings (including 1 which is potentially serious).

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if EZZ Life Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EZZ

EZZ Life Science Holdings

Engages in formulation, production, marketing, and sale of the health and wellbeing products in Australia, New Zealand, Mainland China, and South-East Asia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives