- Australia

- /

- Life Sciences

- /

- ASX:EZZ

Even With A 52% Surge, Cautious Investors Are Not Rewarding EZZ Life Science Holdings Limited's (ASX:EZZ) Performance Completely

EZZ Life Science Holdings Limited (ASX:EZZ) shareholders have had their patience rewarded with a 52% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.5% in the last twelve months.

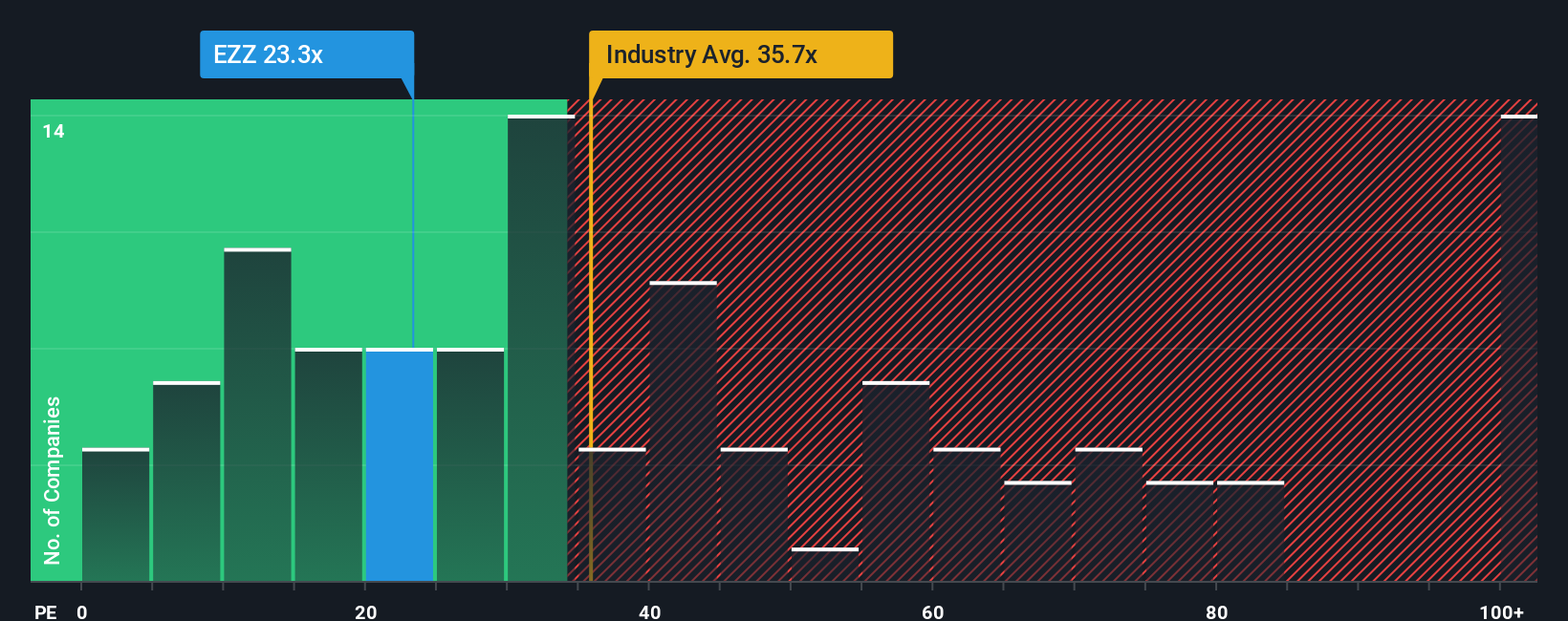

Even after such a large jump in price, there still wouldn't be many who think EZZ Life Science Holdings' price-to-earnings (or "P/E") ratio of 23.3x is worth a mention when the median P/E in Australia is similar at about 22x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, EZZ Life Science Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for EZZ Life Science Holdings

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, EZZ Life Science Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 9.8% decrease to the company's bottom line. Even so, admirably EPS has lifted 362% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 38% as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it interesting that EZZ Life Science Holdings is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now EZZ Life Science Holdings' P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of EZZ Life Science Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for EZZ Life Science Holdings that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EZZ Life Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EZZ

EZZ Life Science Holdings

Engages in formulation, production, marketing, and sale of the health and wellbeing products in Australia, New Zealand, Mainland China, and South-East Asia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives