- Australia

- /

- Healthtech

- /

- ASX:ALC

ASX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the Australian market experiences a cautious optimism amid ongoing global economic uncertainties, investors are keeping a close eye on potential opportunities. Penny stocks, often seen as relics of past speculative fervor, continue to offer intriguing possibilities for those willing to explore smaller or newer companies with strong financial health. With this in mind, we'll examine several penny stocks that could offer both value and growth potential in today's ever-evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.845 | A$52.62M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.06 | A$470.29M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.63 | A$267.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.86 | A$411.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.31 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.74 | A$253.67M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.28 | A$126.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alcidion Group (ASX:ALC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alcidion Group Limited develops and licenses healthcare software products in Australia, New Zealand, and the United Kingdom, with a market cap of A$141.01 million.

Operations: The company's revenue is generated from the provision of healthcare software solutions, amounting to A$40.79 million.

Market Cap: A$141.01M

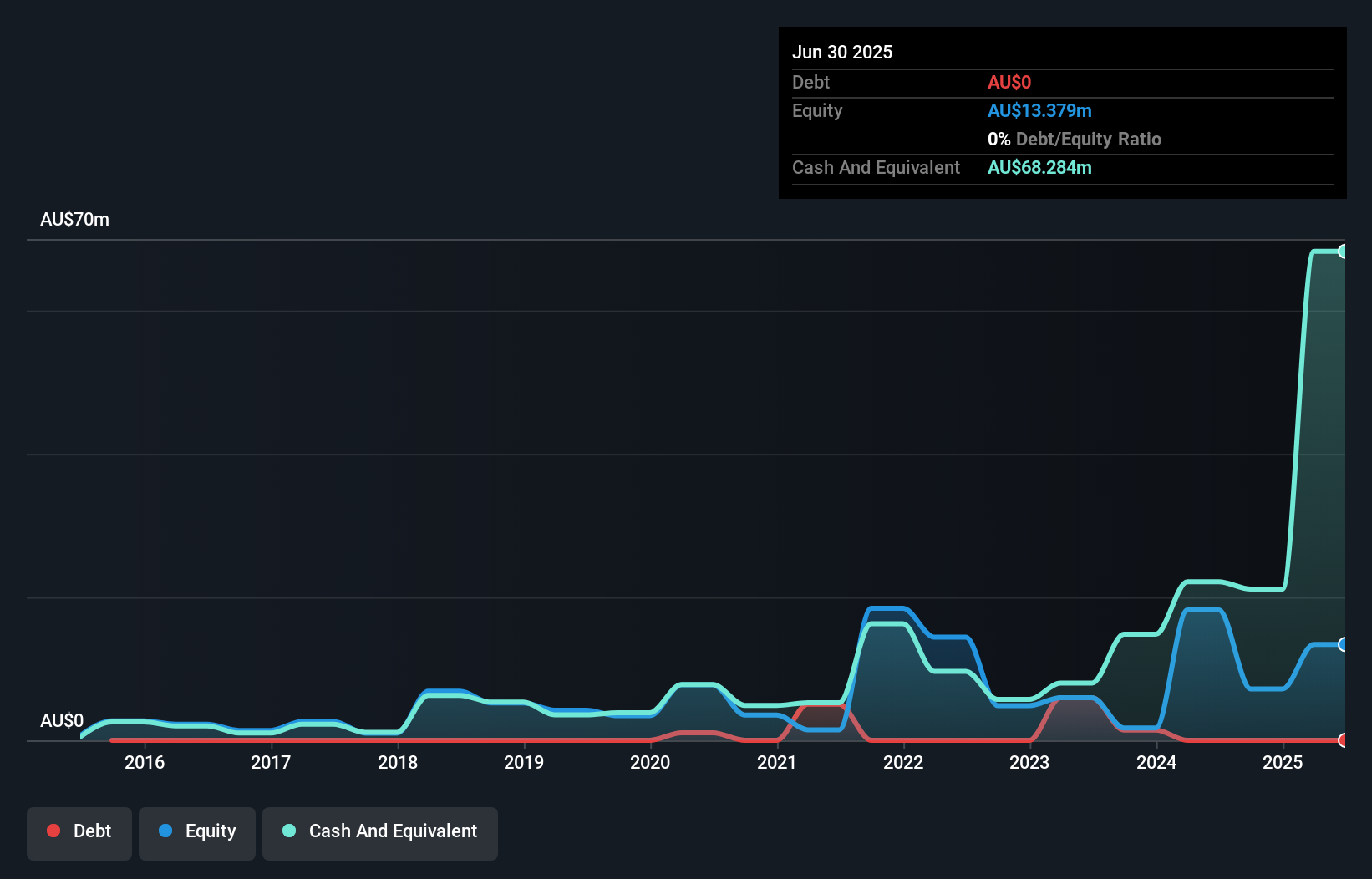

Alcidion Group Limited, with a market cap of A$141.01 million, has shown significant progress by becoming profitable in the last year, reporting a net income of A$1.65 million for the year ended June 30, 2025. The company generates revenue from healthcare software solutions amounting to A$40.79 million and maintains a debt-free status, ensuring no concerns over interest payments or cash flow coverage for liabilities. However, its return on equity remains low at 1.9%. The board is experienced with an average tenure of 4.2 years while the management team is relatively new with an average tenure of 1.9 years.

- Take a closer look at Alcidion Group's potential here in our financial health report.

- Explore Alcidion Group's analyst forecasts in our growth report.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dimerix Limited is an Australian biopharmaceutical company focused on developing and commercializing pharmaceutical products for unmet medical needs, with a market cap of A$297.20 million.

Operations: The company generates revenue of A$5.59 million from developing occupational drug testing devices and new therapeutic agents.

Market Cap: A$297.2M

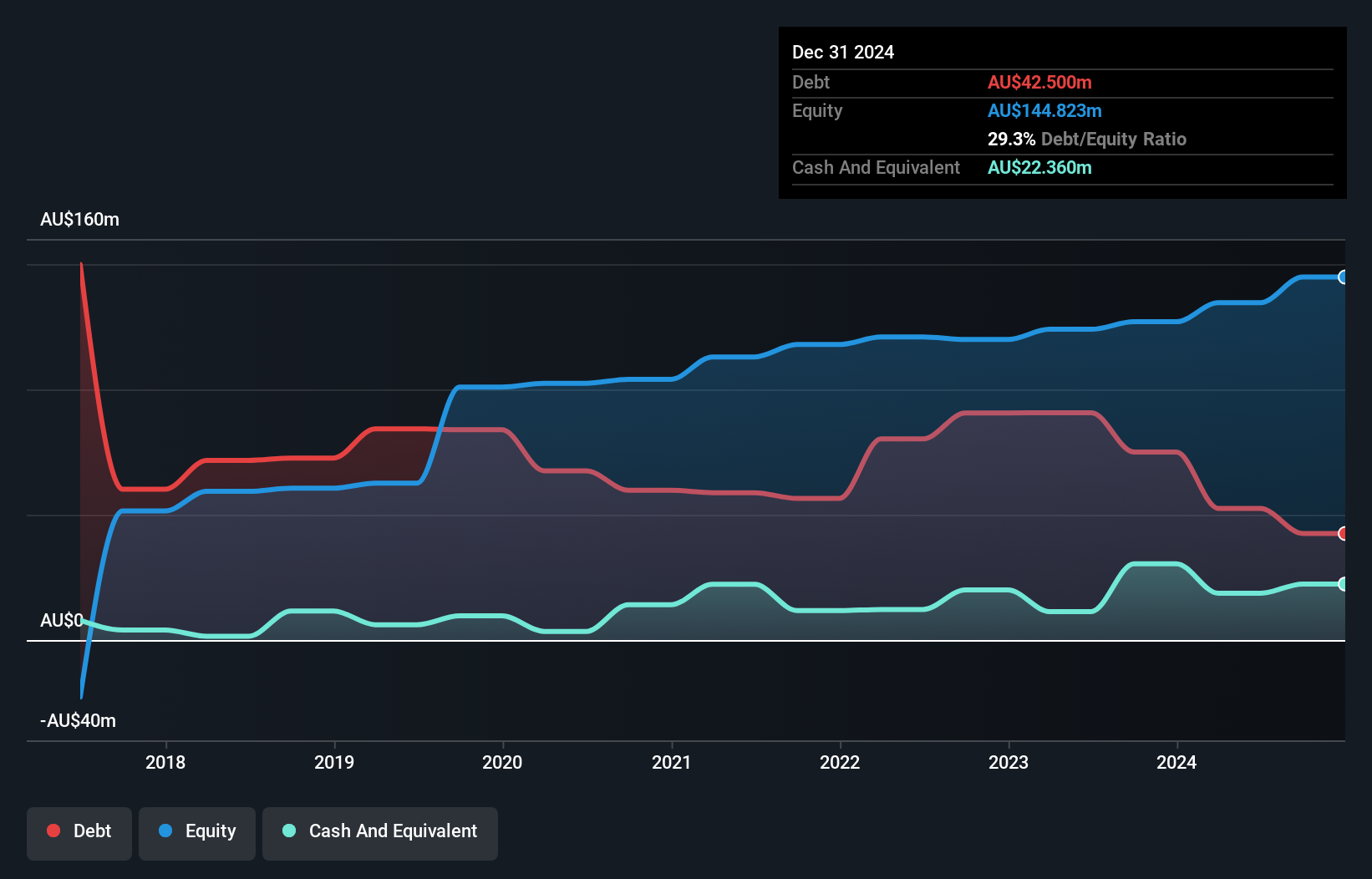

Dimerix Limited, with a market cap of A$297.20 million, remains pre-revenue despite reporting sales of A$5.59 million for the year ended June 30, 2025. The company is unprofitable but has improved its net loss to A$13.25 million from the previous year's A$17.08 million and maintains a strong cash position with short-term assets exceeding both short- and long-term liabilities. Dimerix is debt-free and benefits from an experienced board with an average tenure of 8.1 years, ensuring strategic guidance as it navigates its development phase in the biopharmaceutical sector while trading significantly below estimated fair value.

- Click here to discover the nuances of Dimerix with our detailed analytical financial health report.

- Examine Dimerix's past performance report to understand how it has performed in prior years.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wagners Holding Company Limited operates in the production and sale of construction and building materials across Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia with a market cap of A$657.09 million.

Operations: Wagners Holding generates revenue through its Construction Materials segment, which contributes A$257.69 million; Project Services, accounting for A$105.71 million; and Composite Fibre Technology, adding A$68.45 million to its financial performance.

Market Cap: A$657.09M

Wagners Holding has demonstrated robust earnings growth, with a recent annual increase of 120.9%, significantly outpacing the Basic Materials industry. Despite a decrease in sales to A$431.27 million, net income rose to A$22.72 million, reflecting improved profit margins from 2.1% to 5.3%. The company's financial health is supported by satisfactory debt management and strong operating cash flow coverage of its debt at 130.5%. While short-term assets cover immediate liabilities, long-term liabilities remain uncovered by current assets. Recent inclusion in the S&P/ASX Emerging Companies Index highlights its growing market presence amidst stable weekly volatility and strategic equity offerings raising A$30 million.

- Dive into the specifics of Wagners Holding here with our thorough balance sheet health report.

- Learn about Wagners Holding's future growth trajectory here.

Next Steps

- Access the full spectrum of 416 ASX Penny Stocks by clicking on this link.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALC

Alcidion Group

Engages in the development and licensing of healthcare software products in Australia, New Zealand, and the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives