Imagine Owning Tinybeans Group (ASX:TNY) While The Price Tanked 56%

While not a mind-blowing move, it is good to see that the Tinybeans Group Limited (ASX:TNY) share price has gained 26% in the last three months. But that's small comfort given the dismal price performance over the last year. During that time the share price has sank like a stone, descending 56%. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

View our latest analysis for Tinybeans Group

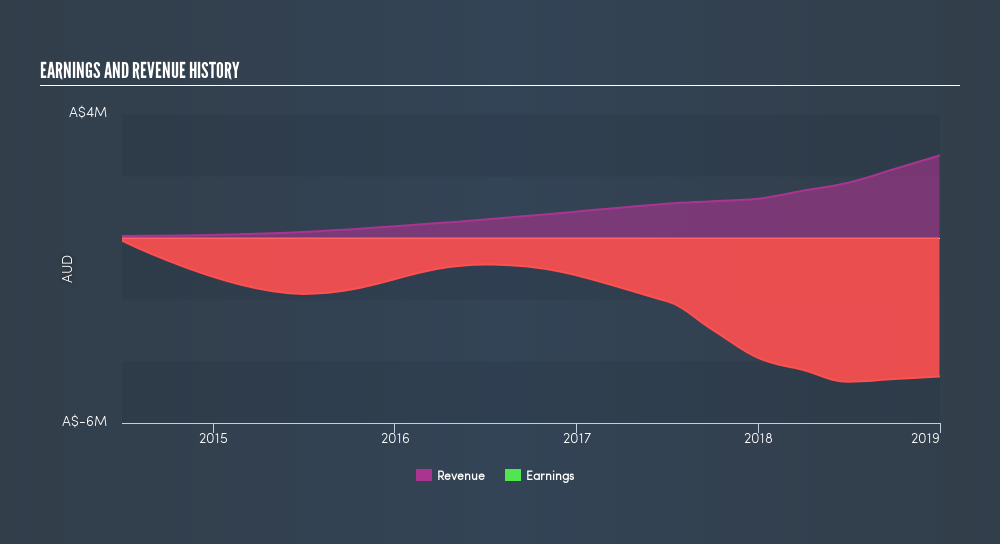

Given that Tinybeans Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Tinybeans Group increased its revenue by 111%. That's a strong result which is better than most other loss making companies. In contrast the share price is down 56% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at Tinybeans Group's financial health with this freereport on its balance sheet.

A Different Perspective

Given that the market gained 11% in the last year, Tinybeans Group shareholders might be miffed that they lost 56%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 26% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Before spending more time on Tinybeans Group it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:TNY

Tinybeans Group

Operates a private communication application in the United States and Australia.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives