- Australia

- /

- Entertainment

- /

- ASX:PLY

Market Might Still Lack Some Conviction On PlaySide Studios Limited (ASX:PLY) Even After 31% Share Price Boost

The PlaySide Studios Limited (ASX:PLY) share price has done very well over the last month, posting an excellent gain of 31%. But the last month did very little to improve the 72% share price decline over the last year.

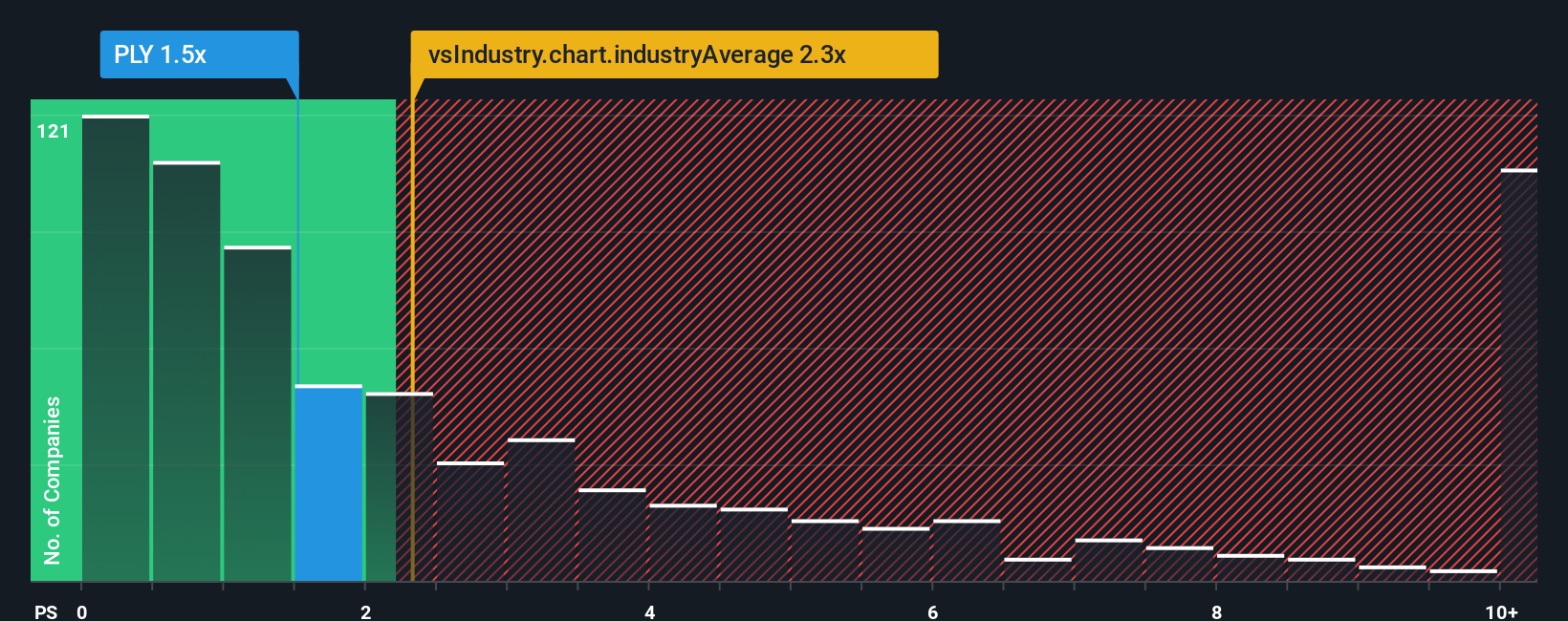

Although its price has surged higher, PlaySide Studios' price-to-sales (or "P/S") ratio of 1.5x might still make it look like a buy right now compared to the Entertainment industry in Australia, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for PlaySide Studios

How Has PlaySide Studios Performed Recently?

There hasn't been much to differentiate PlaySide Studios' and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PlaySide Studios.How Is PlaySide Studios' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like PlaySide Studios' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 273% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the two analysts watching the company. That's shaping up to be similar to the 13% per annum growth forecast for the broader industry.

With this information, we find it odd that PlaySide Studios is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does PlaySide Studios' P/S Mean For Investors?

The latest share price surge wasn't enough to lift PlaySide Studios' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that PlaySide Studios currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 2 warning signs for PlaySide Studios you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PLY

PlaySide Studios

Develops and sells mobile, PC, and console video games in Australia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives