- Australia

- /

- Capital Markets

- /

- ASX:DJW

Discovering Hidden Stock Gems in Australia June 2025

Reviewed by Simply Wall St

As the Australian market mirrors Wall Street with a flat performance, sectors such as Health Care and Financials are showing resilience amidst broader sell-offs in IT, Real Estate, and Industrials. In this environment of mixed sector performances, identifying hidden stock gems requires a focus on companies that demonstrate strong fundamentals and unique growth opportunities despite prevailing market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Value Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market capitalization of A$791.79 million.

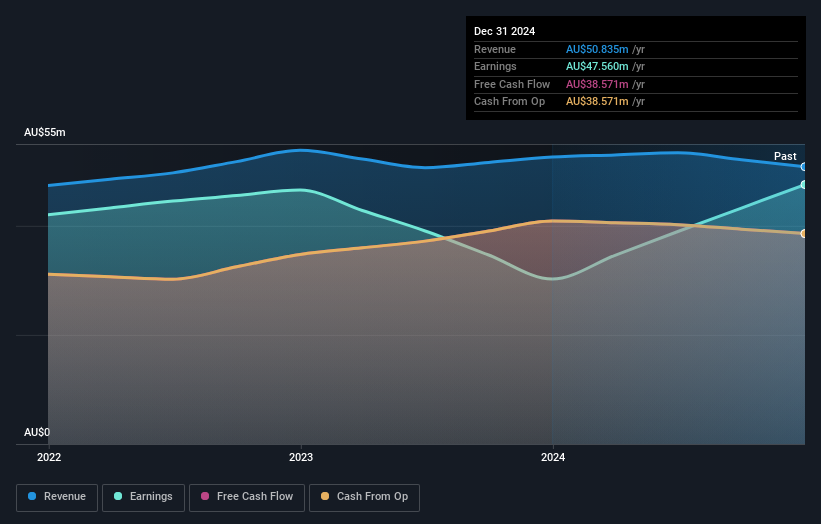

Operations: Djerriwarrh Investments generates revenue primarily through its portfolio of investments, amounting to A$50.84 million.

Djerriwarrh Investments, a notable player in Australia's investment landscape, has shown significant financial health and growth. Its debt to equity ratio impressively dropped from 9.7% to 1.1% over five years, indicating robust financial management. Earnings surged by 57%, outpacing the Capital Markets industry average of 23%. With a price-to-earnings ratio of 16.6x, it offers potential value compared to the broader Australian market at 18.1x. Additionally, Djerriwarrh's interest payments are well-covered by EBIT at a multiple of 21x, showcasing strong operational efficiency and positioning it favorably for future opportunities in the sector.

- Get an in-depth perspective on Djerriwarrh Investments' performance by reading our health report here.

Evaluate Djerriwarrh Investments' historical performance by accessing our past performance report.

IVE Group (ASX:IGL)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$430.17 million.

Operations: IVE Group generates revenue primarily from its advertising segment, amounting to A$975.43 million.

Australia's IVE Group, a small player in the media and logistics landscape, is positioning itself for growth with strategic expansions. The company is enhancing its packaging sector and 3PL services, aiming to boost revenue capacity to A$150 million over five years through a new facility in New South Wales. With net margins projected to increase from 4.3% to 5.4%, IVE could see earnings reach A$55.4 million by May 2028. Trading at a price-to-earnings ratio of 10.7x against an industry average of 23.3x suggests room for share price appreciation towards A$3.1 from A$2.64 currently, despite potential economic challenges impacting revenue stability and new initiatives like Lasoo facing profitability hurdles.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments, trading under the name HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$811.08 million.

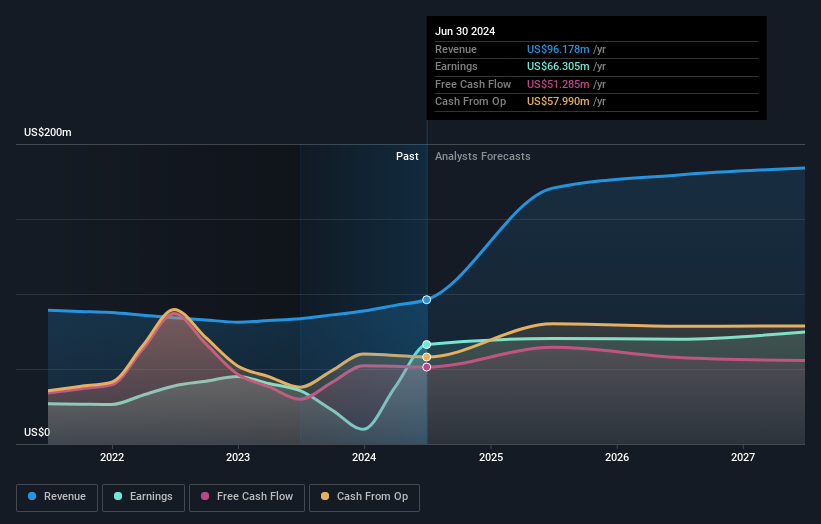

Operations: HFA Holdings Limited generates revenue primarily from its Lighthouse segment, amounting to $137.95 million. The company's market capitalization stands at A$811.08 million.

Navigator Global Investments, a dynamic player in the financial landscape, has demonstrated remarkable growth with earnings surging 306.8% over the past year. The company enjoys a solid interest coverage and boasts more cash than total debt, indicating robust financial health. Despite trading at 50.8% below its fair value estimate, NGI's recent performance includes a notable one-off gain of A$53.8M affecting its annual results to December 2024. However, future earnings are projected to decline by an average of 11.7% annually over the next three years due to variable performance fees and competitive pressures in securing high-quality partners.

Where To Now?

- Click this link to deep-dive into the 46 companies within our ASX Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DJW

Flawless balance sheet with solid track record.

Market Insights

Community Narratives