If You Had Bought iSentric (ASX:ICU) Stock Three Years Ago, You'd Be Sitting On A 92% Loss, Today

iSentric Limited (ASX:ICU) shareholders should be happy to see the share price up 17% in the last quarter. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 92%. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for iSentric

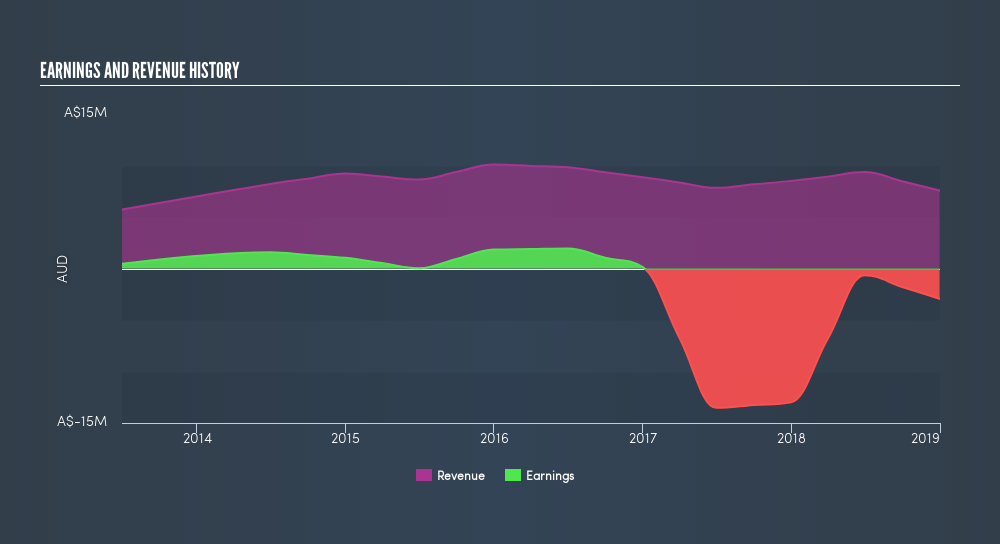

iSentric isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, iSentric's revenue dropped 6.6% per year. That's not what investors generally want to see. Having said that the 56% annualized share price decline highlights the risk of investing in unprofitable companies. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

Take a more thorough look at iSentric's financial health with this free report on its balance sheet.

A Different Perspective

iSentric shareholders are down 67% for the year, but the broader market is up 9.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 56% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of iSentric's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course iSentric may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:OVT

Ovanti

Provides fintech and digital commerce software and services that enable institutional customers to authenticate end-user customers and process banking, purchase, and payment transactions in Australia, Malaysia, Singapore, and Indonesia.

Excellent balance sheet moderate.

Market Insights

Community Narratives