Shareholders Will Probably Not Have Any Issues With HT&E Limited's (ASX:HT1) CEO Compensation

The share price of HT&E Limited (ASX:HT1) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 05 May 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for HT&E

How Does Total Compensation For Ciaran Davis Compare With Other Companies In The Industry?

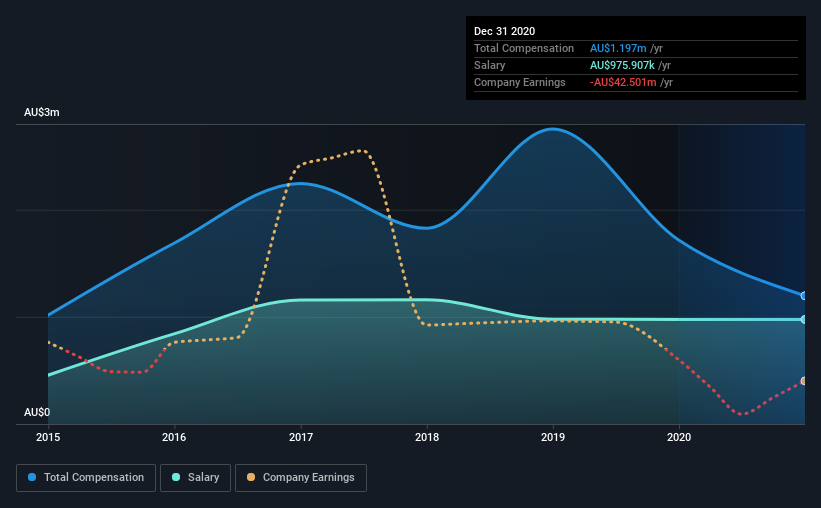

Our data indicates that HT&E Limited has a market capitalization of AU$503m, and total annual CEO compensation was reported as AU$1.2m for the year to December 2020. Notably, that's a decrease of 30% over the year before. We note that the salary portion, which stands at AU$975.9k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between AU$257m and AU$1.0b had a median total CEO compensation of AU$1.2m. So it looks like HT&E compensates Ciaran Davis in line with the median for the industry. Moreover, Ciaran Davis also holds AU$938k worth of HT&E stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$976k | AU$976k | 82% |

| Other | AU$221k | AU$741k | 18% |

| Total Compensation | AU$1.2m | AU$1.7m | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. It's interesting to note that HT&E pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

HT&E Limited's Growth

Over the last three years, HT&E Limited has shrunk its earnings per share by 94% per year. It saw its revenue drop 22% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has HT&E Limited Been A Good Investment?

HT&E Limited has served shareholders reasonably well, with a total return of 12% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

So you may want to check if insiders are buying HT&E shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading HT&E or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:A1N

ARN Media

Operates as a media and entertainment company in Australia and Hong Kong.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion