Frontier Digital Ventures (ASX:FDV) shareholders are up 16% this past week, but still in the red over the last three years

It is a pleasure to report that the Frontier Digital Ventures Limited (ASX:FDV) is up 35% in the last quarter. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 64% in that period. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

On a more encouraging note the company has added AU$30m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Frontier Digital Ventures

Because Frontier Digital Ventures made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

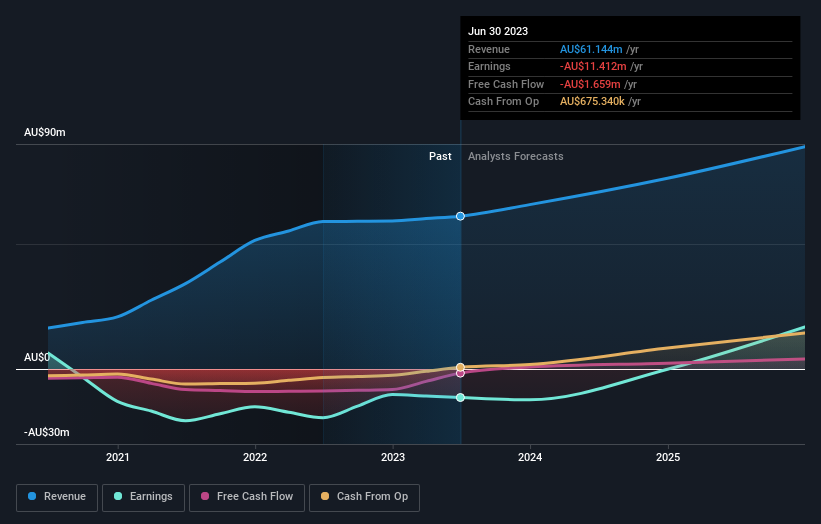

Over three years, Frontier Digital Ventures grew revenue at 40% per year. That is faster than most pre-profit companies. In contrast, the share price is down 18% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Frontier Digital Ventures stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Frontier Digital Ventures had a tough year, with a total loss of 26%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 0.8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Frontier Digital Ventures that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FDV

Frontier Digital Ventures

A private equity firm specializing in investing and developing online classifieds business in emerging markets.

Excellent balance sheet with reasonable growth potential.