Stock Analysis

Did Domain Holdings Australia's (ASX:DHG) Share Price Deserve to Gain 31%?

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, Domain Holdings Australia Limited (ASX:DHG) shareholders have seen the share price rise 31% over three years, well in excess of the market return (11%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 13% in the last year , including dividends .

Check out our latest analysis for Domain Holdings Australia

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Domain Holdings Australia has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So it might be better to look at other metrics to try to understand the share price.

It may well be that Domain Holdings Australia revenue growth rate of 18% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

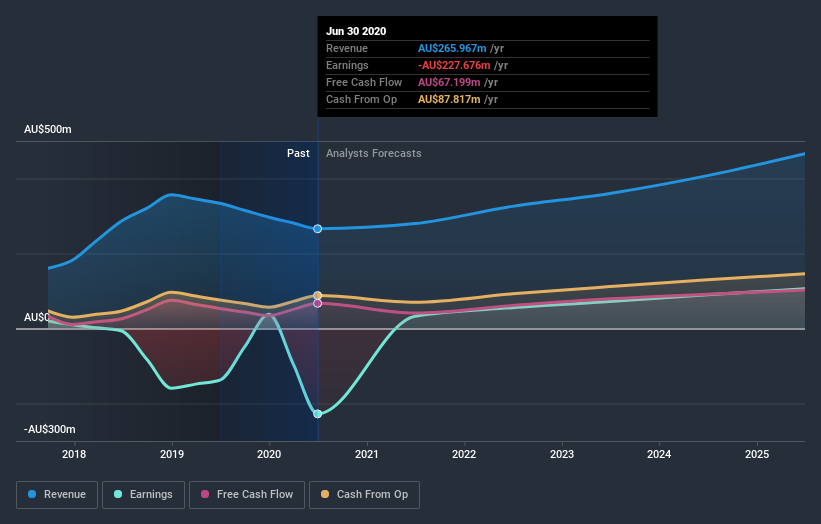

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Domain Holdings Australia is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Domain Holdings Australia in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Domain Holdings Australia's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Domain Holdings Australia shareholders, and that cash payout contributed to why its TSR of 38%, over the last 3 years, is better than the share price return.

A Different Perspective

It's nice to see that Domain Holdings Australia shareholders have gained 13% (in total) over the last year. That gain actually surpasses the 11% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Domain Holdings Australia on your watchlist. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Domain Holdings Australia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Domain Holdings Australia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DHG

Domain Holdings Australia

Engages in the real estate media and technology services business in Australia.

Proven track record with adequate balance sheet.