carsales.com (ASX:CAR) Will Pay A Larger Dividend Than Last Year At A$0.245

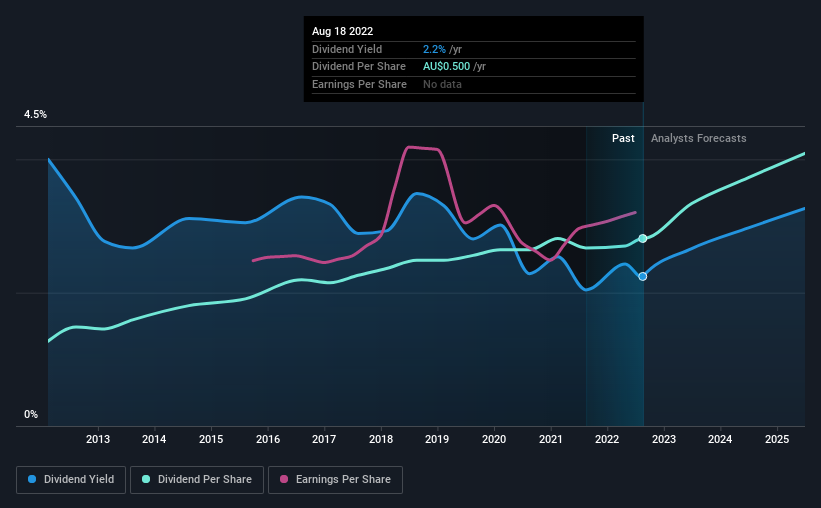

carsales.com Ltd (ASX:CAR) will increase its dividend from last year's comparable payment on the 17th of October to A$0.245. This takes the dividend yield to 2.2%, which shareholders will be pleased with.

View our latest analysis for carsales.com

carsales.com's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. At the time of the last dividend payment, carsales.com was paying out a very large proportion of what it was earning and 113% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS is forecast to expand by 63.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 70%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

carsales.com Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2012, the annual payment back then was A$0.226, compared to the most recent full-year payment of A$0.50. This means that it has been growing its distributions at 8.3% per annum over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

carsales.com May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, carsales.com's EPS was effectively flat over the past five years, which could stop the company from paying more every year. There are exceptions, but limited earnings growth and a high payout ratio can signal that a company has reached maturity. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

We should note that carsales.com has issued stock equal to 24% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Although they have been consistent in the past, we think the payments are a little high to be sustained. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for carsales.com that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CAR

CAR Group

Engages in the operation of online automotive, motorcycle, and marine classifieds business in Australia, New Zealand, Brazil, South Korea, Malaysia, Indonesia, Thailand, Chile, China, the United States, and Mexico.

Excellent balance sheet with moderate growth potential.