Investors Appear Satisfied With Aspermont Limited's (ASX:ASP) Prospects As Shares Rocket 33%

Aspermont Limited (ASX:ASP) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

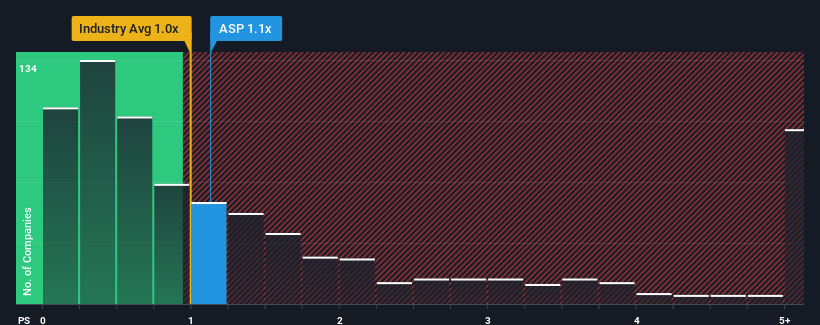

Since its price has surged higher, when almost half of the companies in Australia's Media industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Aspermont as a stock probably not worth researching with its 1.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Aspermont

What Does Aspermont's P/S Mean For Shareholders?

Recent times haven't been great for Aspermont as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aspermont.How Is Aspermont's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Aspermont's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 26% each year as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.5% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Aspermont's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Aspermont's P/S Mean For Investors?

Aspermont's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Aspermont maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Aspermont (1 doesn't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Aspermont, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ASP

Aspermont

Provides market specific content across the resource sectors through a combination of print, digital media channels, and face to face networking channels in Australia and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives