How Much Are Aspermont Limited (ASX:ASP) Insiders Taking Off The Table?

We often see insiders buying up shares in companies that perform well over the long term. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in Aspermont Limited (ASX:ASP).

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

See our latest analysis for Aspermont

Aspermont Insider Transactions Over The Last Year

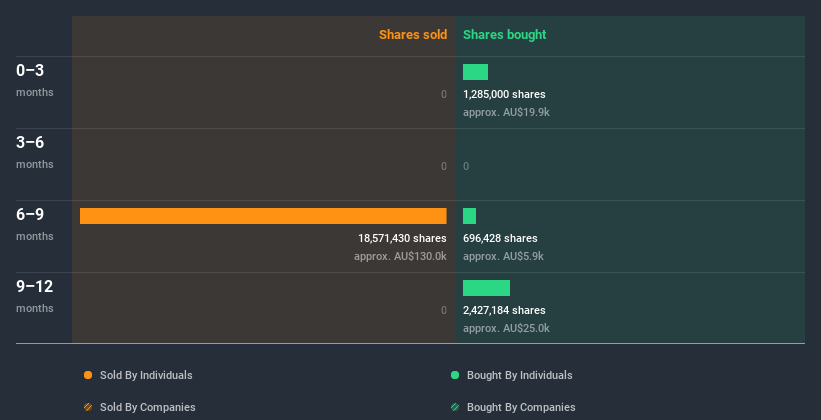

In the last twelve months, the biggest single sale by an insider was when the Non-Executive Chairman, Andrew Kent, sold AU$130k worth of shares at a price of AU$0.007 per share. That means that even when the share price was below the current price of AU$0.022, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was only 3.1% of Andrew Kent's holding. Andrew Kent was the only individual insider to sell shares in the last twelve months.

Over the last year, we can see that insiders have bought 4.41m shares worth AU$51k. On the other hand they divested 18.57m shares, for AU$130k. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

I will like Aspermont better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Aspermont Insiders Bought Stock Recently

We saw some Aspermont insider buying shares in the last three months. Non-Executive Chairman Andrew Kent bought AU$20k worth of shares in that time. It's great to see that insiders are only buying, not selling. But the amount invested in the last three months isn't enough for us too put much weight on it, as a single factor.

Insider Ownership of Aspermont

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Aspermont insiders own 47% of the company, currently worth about AU$24m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Aspermont Insiders?

Our data shows a little insider buying, but no selling, in the last three months. That said, the purchases were not large. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Aspermont insider transactions don't fill us with confidence. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we found 3 warning signs for Aspermont that deserve your attention before buying any shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Aspermont or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ASP

Aspermont

Provides market specific content across the resource sectors through a combination of print, digital media channels, and face to face networking channels in Australia and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives