Aspermont Limited's (ASX:ASP) Stock Retreats 37% But Revenues Haven't Escaped The Attention Of Investors

The Aspermont Limited (ASX:ASP) share price has softened a substantial 37% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

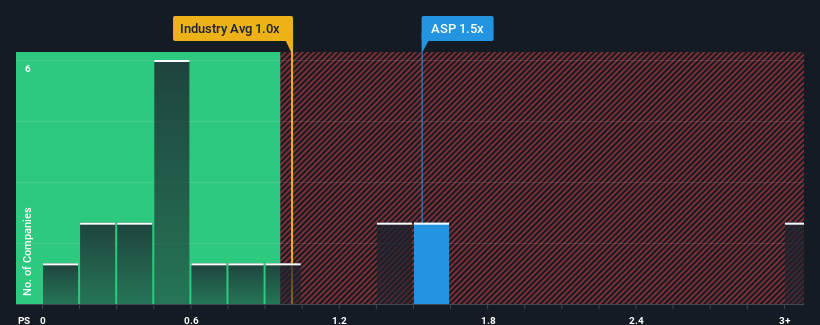

In spite of the heavy fall in price, you could still be forgiven for thinking Aspermont is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.5x, considering almost half the companies in Australia's Media industry have P/S ratios below 0.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Aspermont

How Aspermont Has Been Performing

Aspermont certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Aspermont will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Aspermont would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 2.8% gain to the company's revenues. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the one analyst following the company. With the industry only predicted to deliver 3.0% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Aspermont's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Aspermont's P/S

There's still some elevation in Aspermont's P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Aspermont maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Aspermont (of which 1 is concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ASP

Aspermont

Provides market specific content across the resource sectors through a combination of print, digital media channels, and face to face networking channels in Australia and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives