Did You Manage To Avoid Aeeris's (ASX:AER) Painful 63% Share Price Drop?

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Aeeris Limited (ASX:AER) shareholders. Sadly for them, the share price is down 63% in that time. Furthermore, it's down 20% in about a quarter. That's not much fun for holders.

See our latest analysis for Aeeris

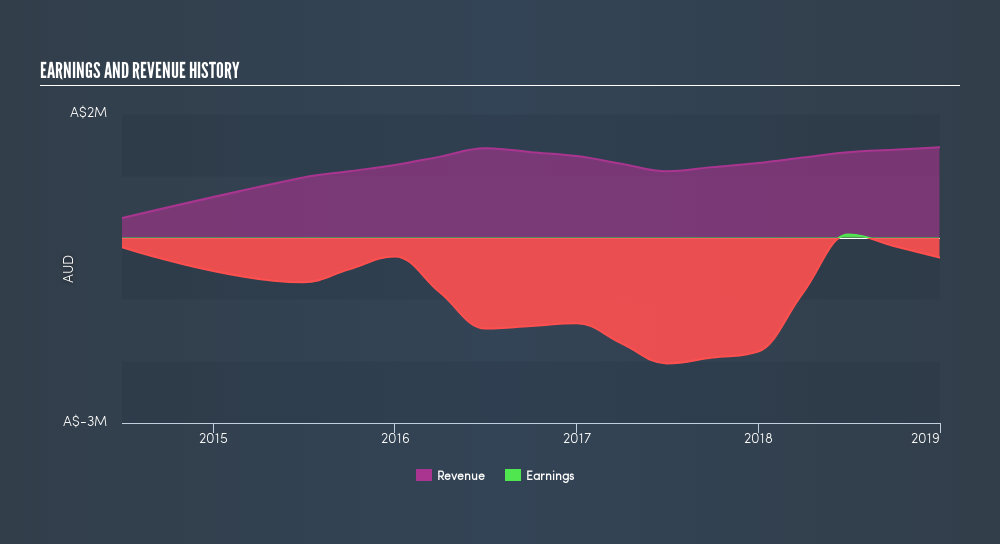

Aeeris isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Aeeris saw its revenue grow by 2.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 28% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our freereport on Aeeris's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Aeeris shares, which cost holders 12%, while the market was up about 11%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 28% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Aeeris better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:AER

Aeeris

A geospatial data aggregator company, provides location-based safety, operations management, severe weather, and various hazards data and content services in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives