In a turbulent week marked by significant market fluctuations and ongoing trade tensions between China and the U.S., Australian shares have felt the pressure, with the ASX 200 futures pointing to a challenging close. Despite these broader market challenges, penny stocks continue to capture attention as potential growth opportunities for investors willing to explore smaller or newer companies. Although the term "penny stocks" may seem outdated, these investments can still offer substantial upside when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.00 | A$147.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.785 | A$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.32 | A$62.27M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.38 | A$366.95M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$119.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.13 | A$148.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.72 | A$578.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.66 | A$438.69M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.41 | A$1.1B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 979 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GTN (ASX:GTN)

Simply Wall St Financial Health Rating: ★★★★★★

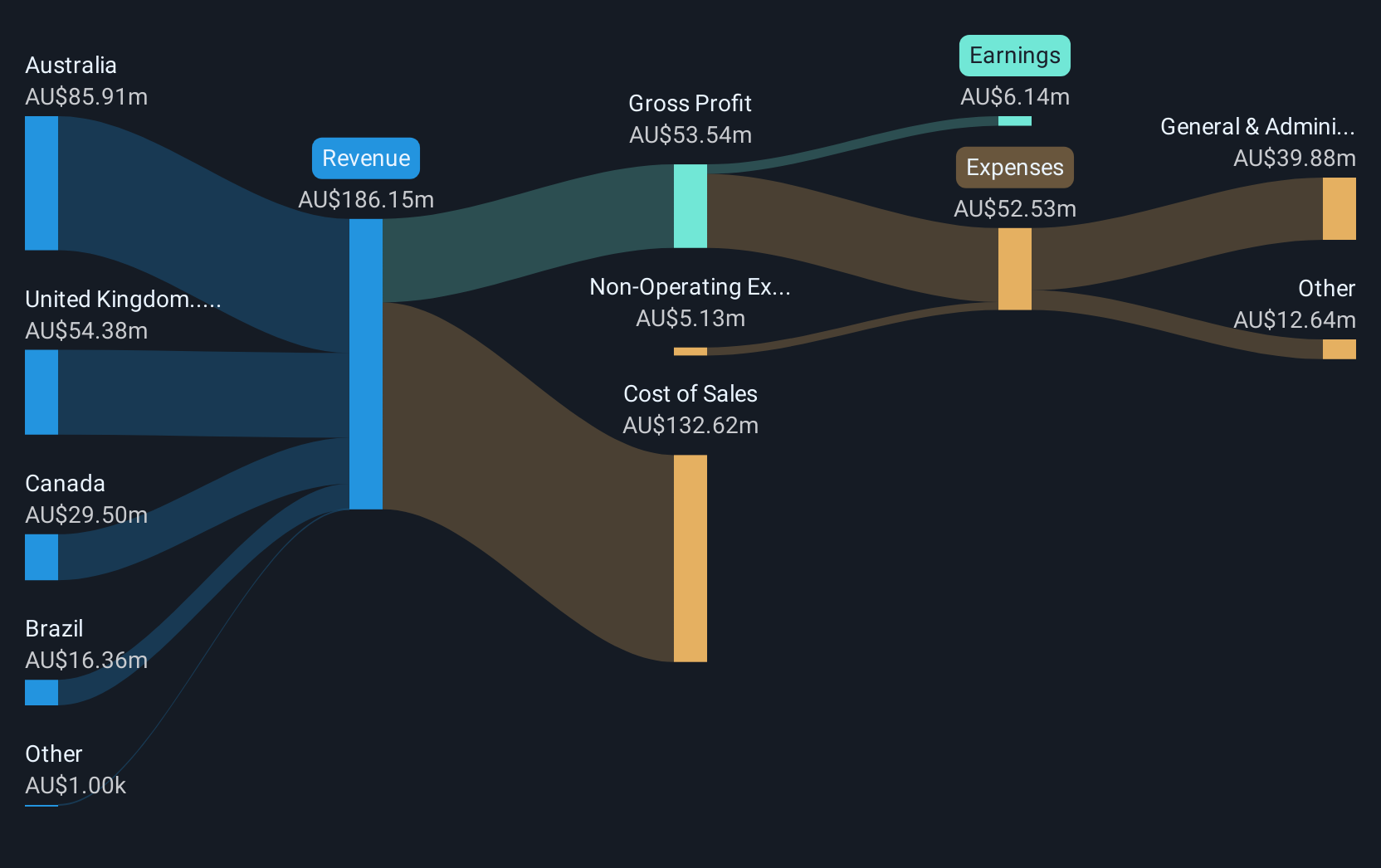

Overview: GTN Limited operates broadcast media advertising platforms providing traffic and news reports to radio stations in Australia, Canada, the United Kingdom, and Brazil with a market cap of A$119.49 million.

Operations: The company generates revenue from its advertising segment, totaling A$186.15 million.

Market Cap: A$119.49M

GTN Limited, with a market cap of A$119.49 million, has shown significant earnings growth, reporting A$96.7 million in sales for the half-year ending December 2024 and a net income increase to A$4.86 million. Its earnings have grown by 52.6% over the past year, surpassing industry averages and indicating robust financial health with more cash than total debt and well-covered interest payments. However, its dividend yield of 7.97% is not well covered by earnings, suggesting potential sustainability issues. Recent management changes include Ben Brooks as CFO, bringing extensive media experience to GTN's leadership team amidst an inexperienced board and management tenure.

- Click to explore a detailed breakdown of our findings in GTN's financial health report.

- Review our growth performance report to gain insights into GTN's future.

Harvey Norman Holdings (ASX:HVN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Harvey Norman Holdings Limited operates in the integrated retail, franchise, property, and digital systems sectors with a market cap of A$6.12 billion.

Operations: The company generates revenue through its retail operations in New Zealand (A$934.35 million), Slovenia & Croatia (A$222.08 million), Singapore & Malaysia (A$715.12 million), and from non-franchised retail activities (A$240.15 million).

Market Cap: A$6.12B

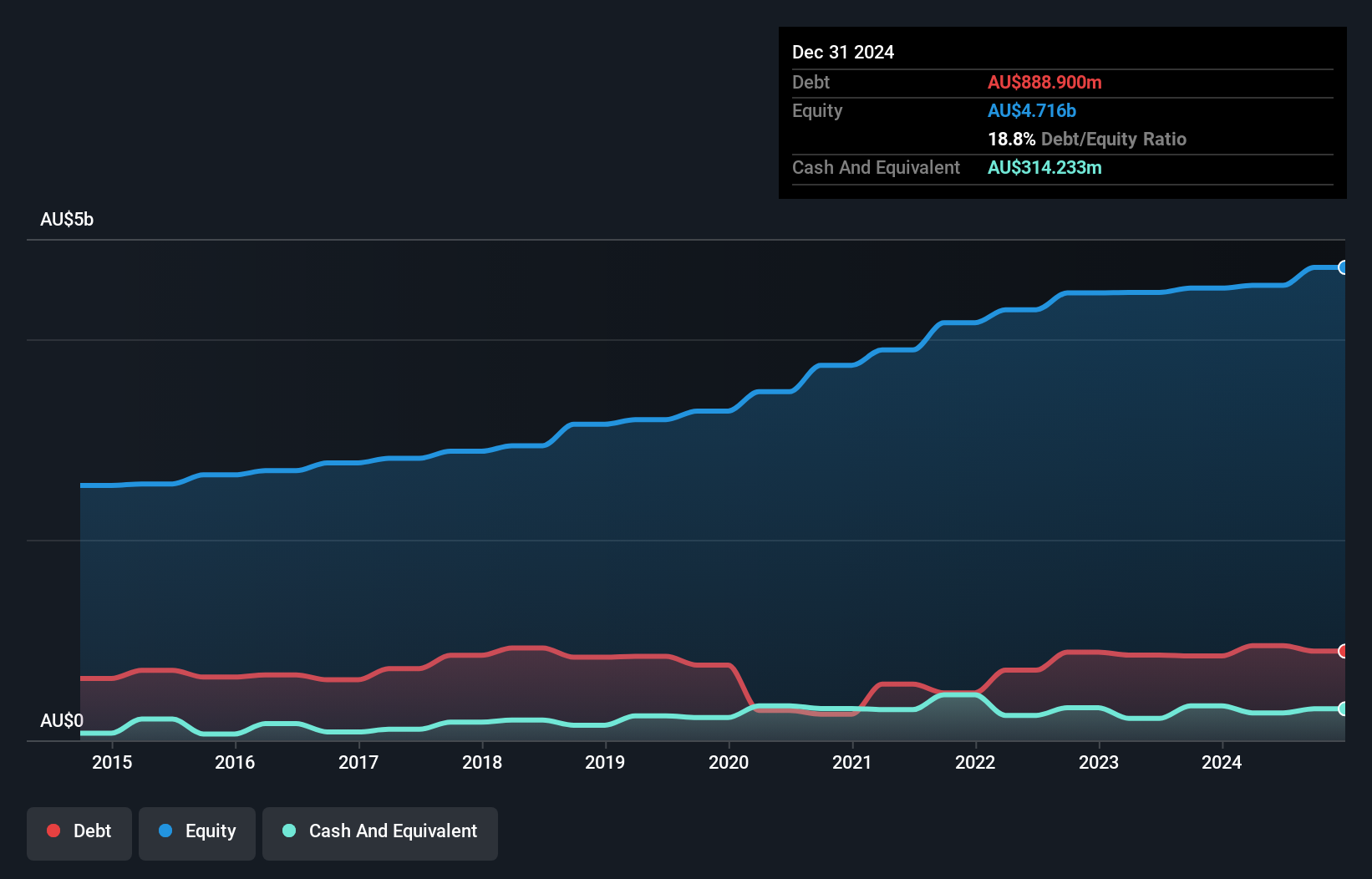

Harvey Norman Holdings, with a market cap of A$6.12 billion, has demonstrated stable financial performance despite challenges in the retail sector. The company's earnings grew by 15.6% over the past year, outpacing its five-year average decline of 7.3% annually, and exceeding industry averages. Its debt levels are satisfactory with a net debt to equity ratio of 12.2%, and interest payments are well covered by EBIT at 10.2 times coverage. Recent earnings reports show net income for the half-year ending December 2024 increased to A$279.39 million from A$200 million a year ago, reflecting improved profitability and operational efficiency amidst an unstable dividend track record.

- Navigate through the intricacies of Harvey Norman Holdings with our comprehensive balance sheet health report here.

- Examine Harvey Norman Holdings' earnings growth report to understand how analysts expect it to perform.

Danakali (NSX:DNK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Danakali Limited, with a market cap of A$25.08 million, is engaged in the exploration and development of mineral properties in Australia and the Kingdom of Saudi Arabia through its subsidiaries.

Operations: Danakali Limited has not reported any revenue segments.

Market Cap: A$25.08M

Danakali Limited, with a market cap of A$25.08 million, is pre-revenue and has been unprofitable, reporting a net loss of A$1.79 million for 2024. Despite its financial challenges, the company remains debt-free and boasts substantial short-term assets of A$31.4 million against minimal liabilities. Recent strategic moves include completing a share buyback program worth A$0.22 million to consolidate shareholder value by repurchasing 1.31% of its shares at A$0.045 each, although the stock's price has shown high volatility over the past three months. The management team is experienced with an average tenure of 4.3 years.

- Get an in-depth perspective on Danakali's performance by reading our balance sheet health report here.

- Explore historical data to track Danakali's performance over time in our past results report.

Summing It All Up

- Jump into our full catalog of 979 ASX Penny Stocks here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Neodymium and there are only 20 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSX:DNK

Danakali

Focuses on the exploration and development of mineral properties in Australia and the Kingdom of Saudi Arabia.

Flawless balance sheet low.

Market Insights

Community Narratives