- Australia

- /

- Metals and Mining

- /

- ASX:WGX

Will New Multi-Year Production Guidance and Record Gold Prices Change Westgold Resources' (ASX:WGX) Narrative

Reviewed by Sasha Jovanovic

- Westgold Resources Limited recently issued new multi-year production guidance through fiscal 2028 and reported operational results for the quarter ended September 30, 2025, including gold sales of 94,913 ounces at a record price of $5,296 per ounce.

- The company's updated outlook highlights expectations for increasing gold production levels and all-in sustaining costs, offering a clear indication of operational direction amid evolving market conditions.

- We'll explore how Westgold's outlook for higher future gold production factors into its broader investment narrative and growth prospects.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Westgold Resources Investment Narrative Recap

To be a shareholder in Westgold Resources today, you need to believe in the company’s ability to grow gold output while managing rising costs and maintaining operational discipline. The recent guidance for higher production into fiscal 2028 addresses a key catalyst, future volume growth, but doesn't materially change the principal short-term risk: pressure on all-in sustaining costs, especially if ore grades vary or inflation persists.

Among the latest announcements, the record gold sales of 94,913 ounces at A$5,296 per ounce in the September 2025 quarter stand out. While this achievement reflects Westgold’s ability to realize premium pricing, the decline in quarterly production compared to the previous period underlines how sustaining higher output consistently remains central to delivering on the company’s multi-year expansion plans.

However, investors should be aware that if improvement in ore grades fails to materialize at key sites...

Read the full narrative on Westgold Resources (it's free!)

Westgold Resources' outlook anticipates A$2.1 billion in revenue and A$618.3 million in earnings by 2028. This implies a 15.0% annual revenue growth rate and an increase in earnings of about A$583.5 million from the current level of A$34.8 million.

Uncover how Westgold Resources' forecasts yield a A$6.83 fair value, a 30% upside to its current price.

Exploring Other Perspectives

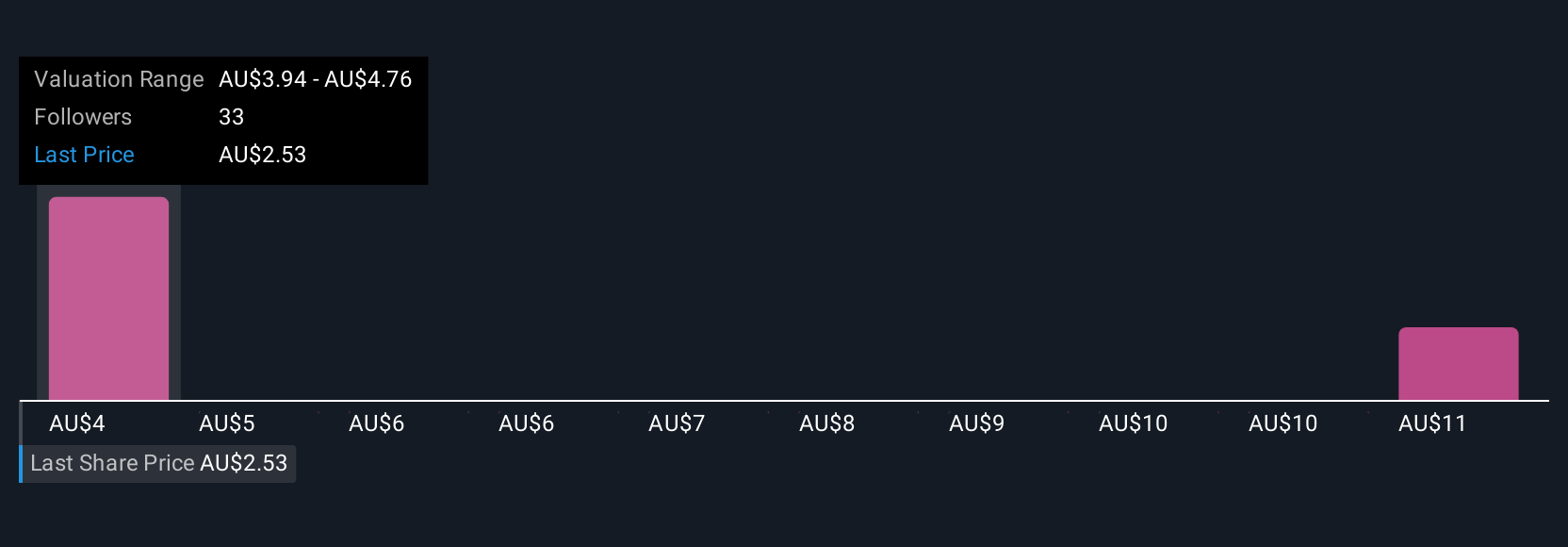

Simply Wall St Community contributors provided 8 fair value estimates for Westgold ranging from A$3.60 to A$29.73. As production targets increase, the risk remains that persistent high costs could limit future earnings, so consider how these divergent views may reflect differing expectations around operational delivery.

Explore 8 other fair value estimates on Westgold Resources - why the stock might be worth over 5x more than the current price!

Build Your Own Westgold Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westgold Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Westgold Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westgold Resources' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGX

Westgold Resources

Engages in the exploration, development, and operation of gold mines in Western Australia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives