- Australia

- /

- Metals and Mining

- /

- ASX:WGX

Westgold Resources (ASX:WGX) Eyes Growth with Fortnum Project Expansion and Strong Earnings Outlook

Reviewed by Simply Wall St

Westgold Resources (ASX:WGX) has recently announced its earnings for the first quarter ending September 30, 2024, reporting sales of AUD 269.83 million, a significant increase from the previous year's AUD 180.16 million. Despite this revenue boost, net income saw a slight decline to AUD 21.03 million from AUD 21.67 million. The company is also making strides with its Fortnum Project, revealing a 91% increase in the Starlight Mineral Resource Estimate, positioning itself for future growth. In the following discussion, we will explore these developments, the company's financial health, emerging opportunities, and the external challenges it faces.

Dive into the specifics of Westgold Resources here with our thorough analysis report.

Unique Capabilities Enhancing Westgold Resources's Market Position

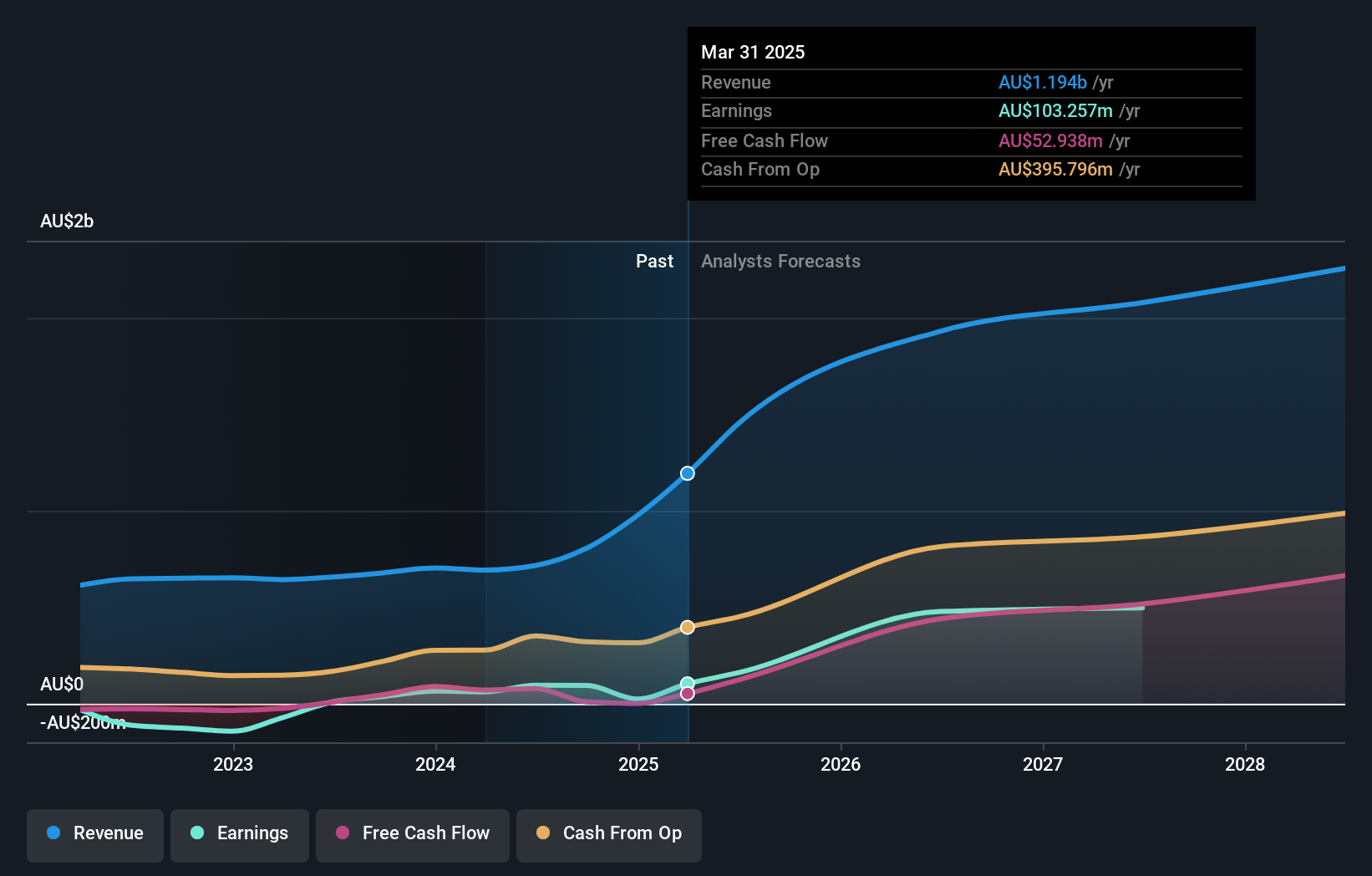

Westgold Resources has demonstrated strong financial health, with earnings projected to grow at 35.2% annually, surpassing the Australian market average. Revenue is also expected to increase by 17.7% per year, reinforcing its market position. The company's net profit margins have improved significantly, reaching 11.7% from 5.5% last year, indicating efficient cost management and profitability. Additionally, Westgold remains debt-free, underscoring its strong financial footing. The strategic leadership of Shane Murphy, CEO, and Wayne Bramwell, CFO, has been pivotal in steering the company towards innovation and customer satisfaction, as evidenced by the recent product line launch aimed at enhancing market share.

Challenges Constraining Westgold Resources's Potential

Westgold faces challenges, including a current Return on Equity of 8.8%, which is considered low compared to forecasts of 27.9% in three years. The company is trading at a high Price-To-Earnings Ratio of 27x, which is above the industry average of 11.6x, potentially impacting investor perception. Furthermore, the company has experienced a 3.3% annual decline in earnings over the past five years, which may concern stakeholders seeking consistent growth. The recent earnings report highlighted a net income of AUD 21.03 million, slightly down from AUD 21.67 million a year ago, reflecting these challenges.

Emerging Markets Or Trends for Westgold Resources

Opportunities for Westgold are abundant, particularly with the Fortnum Project in the Murchison region. The Starlight Mineral Resource Estimate has increased by 91% since June 2024, driven by a comprehensive two-year drilling program. This expansion positions Westgold to capitalize on future growth options, both underground and open pit. Analysts predict a 43.5% rise in stock price, suggesting potential capital appreciation. Additionally, significant insider buying indicates confidence in the company's future prospects, further supported by technological investments aimed at streamlining operations and enhancing customer experiences.

External Factors Threatening Westgold Resources

Westgold must navigate external threats, including economic headwinds and regulatory hurdles. The company is closely monitoring economic conditions that could impact performance, necessitating strategic planning. Regulatory changes present challenges that require careful navigation to maintain operational flexibility. Moreover, the lack of a notable dividend may deter income-focused investors, while substantial shareholder dilution in the past year could lead to dissatisfaction among existing investors. These factors underscore the importance of proactive risk management to sustain growth in a competitive environment.

Conclusion

Westgold Resources is poised for significant growth, driven by its strong financial health, strategic leadership, and promising projects like the Fortnum Project. Challenges such as a low current Return on Equity and a high Price-To-Earnings Ratio of 27x exist, but the company's projected earnings growth of 35.2% annually and revenue increase of 17.7% per year highlight its potential to outperform the market. The stock's target price, over 20% higher than the current share price, indicates potential capital appreciation, bolstered by insider confidence and technological advancements. However, Westgold must address external threats and investor concerns regarding dividends and shareholder dilution to maintain investor trust and sustain its competitive edge.

Next Steps

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:WGX

Westgold Resources

Engages in the exploration, operation, development, mining, and treatment of gold and other assets primarily in Western Australia.

Flawless balance sheet with high growth potential.