- Australia

- /

- Basic Materials

- /

- ASX:WGN

Wagners Holding Company Limited's (ASX:WGN) 30% Share Price Surge Not Quite Adding Up

Wagners Holding Company Limited (ASX:WGN) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last month tops off a massive increase of 182% in the last year.

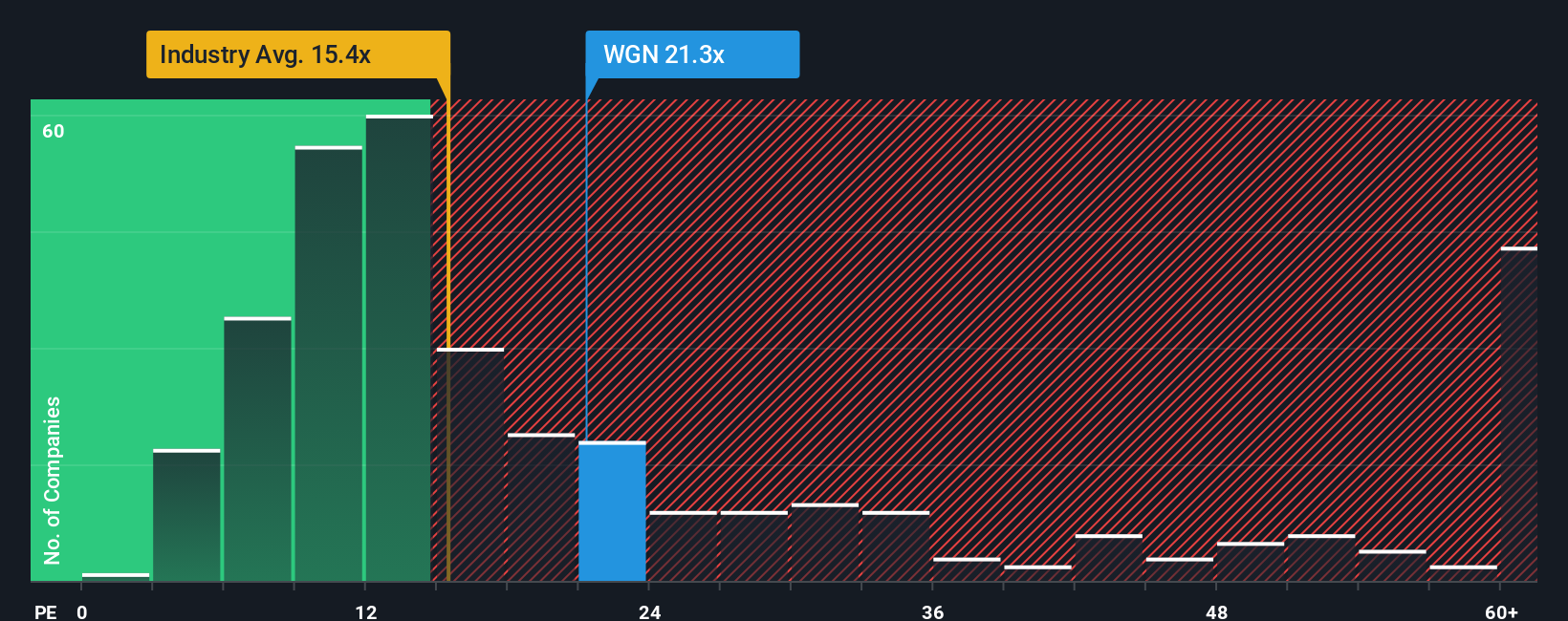

Although its price has surged higher, it's still not a stretch to say that Wagners Holding's price-to-earnings (or "P/E") ratio of 21.3x right now seems quite "middle-of-the-road" compared to the market in Australia, where the median P/E ratio is around 21x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Wagners Holding as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Wagners Holding

Does Growth Match The P/E?

Wagners Holding's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 120%. The latest three year period has also seen an excellent 196% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 16% per annum, which is noticeably more attractive.

With this information, we find it interesting that Wagners Holding is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Wagners Holding's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Wagners Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Wagners Holding with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials and related building materials in Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives