- Australia

- /

- Metals and Mining

- /

- ASX:GNG

Discovering Australia's Undiscovered Gems In September 2025

Reviewed by Simply Wall St

As we approach the final quarter of 2025, the Australian market is navigating a cautious path, with key indices like the S&P/ASX 200 reflecting a risk-off sentiment amid a return to headline inflation of 3%. In this environment, identifying promising small-cap stocks requires focusing on companies that can thrive despite economic challenges and capitalize on unique opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| MFF Capital Investments | NA | 40.81% | 44.64% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Diversified United Investment (ASX:DUI)

Simply Wall St Value Rating: ★★★★★☆

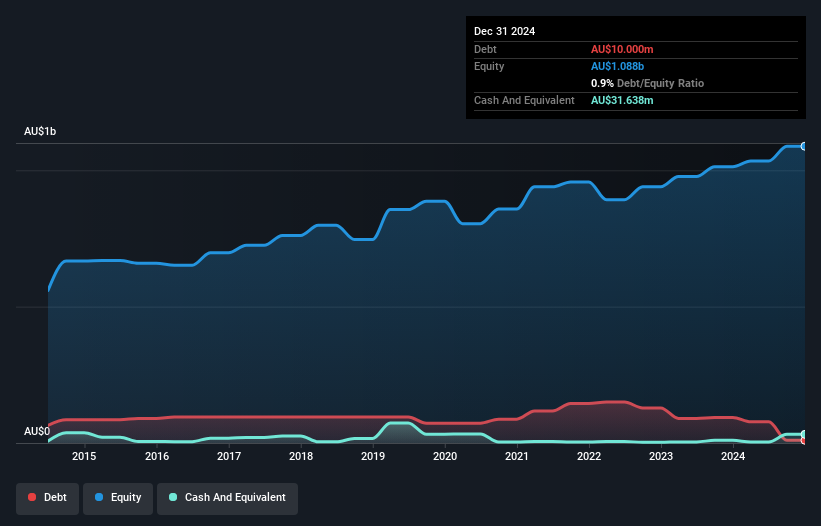

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.16 billion.

Operations: The company's revenue is primarily derived from its investment activities, generating A$46.71 million.

Diversified United Investment, a nimble player in the Australian market, is debt-free and boasts high-quality earnings. Over the past five years, its earnings have grown 5% annually. Despite significant insider selling recently, DUI remains profitable with free cash flow standing at A$39.23 million as of June 2025. The company announced a dividend of A$0.09 per share for the six months ending June 2025, reflecting stable shareholder returns. While its recent annual earnings growth of 5.4% slightly lagged behind industry peers at 5.9%, DUI's net income rose to A$37.99 million from A$36.03 million last year, showcasing resilience in challenging markets.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

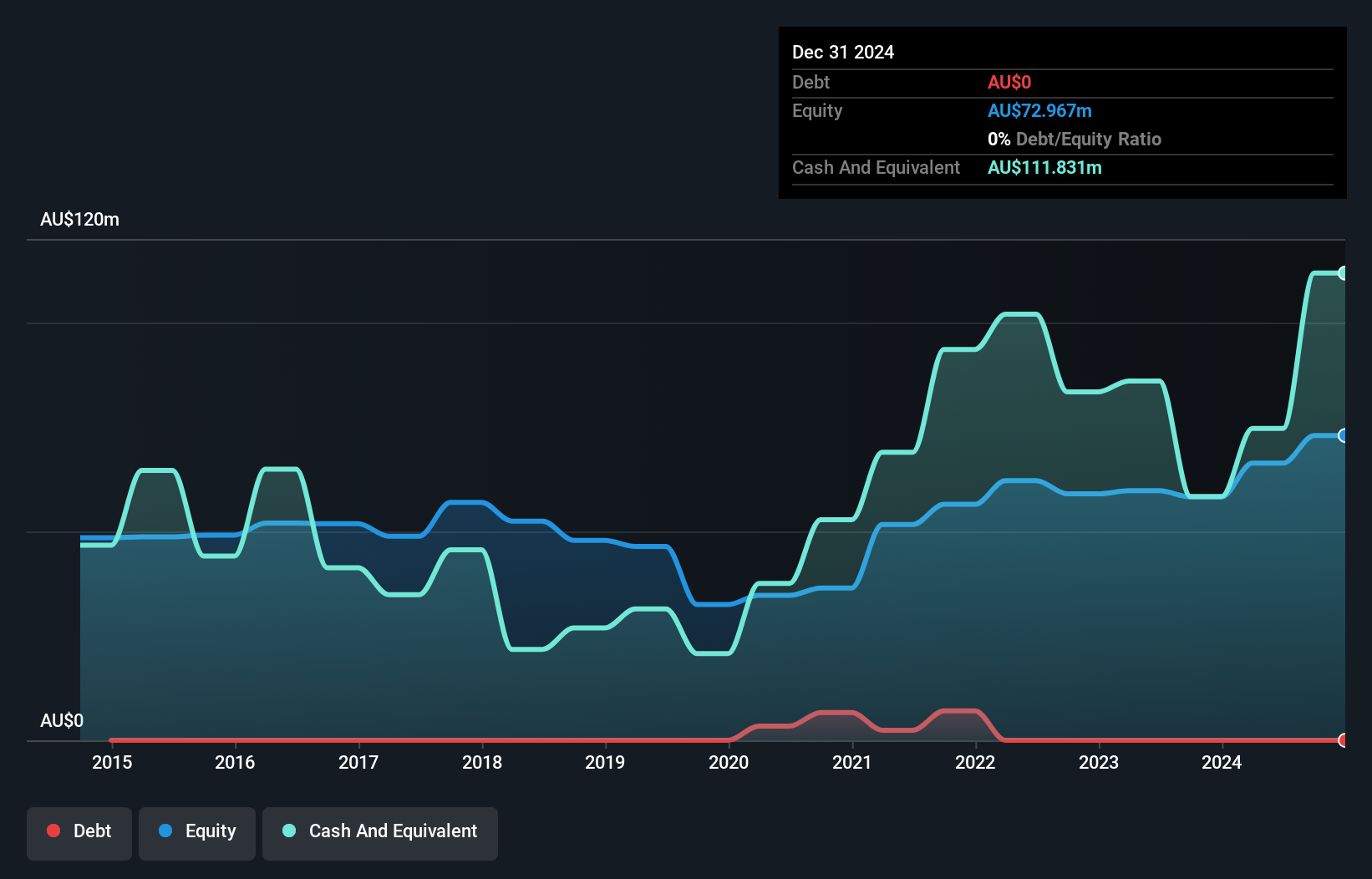

Overview: GR Engineering Services Limited offers engineering, process control, automation, and construction services to the mining and mineral processing sectors globally, with a market cap of A$639.60 million.

Operations: GR Engineering Services Limited generates revenue primarily from two segments: Mineral Processing, which contributes A$383.09 million, and Oil and Gas, contributing A$95.93 million.

GR Engineering Services stands out in Australia with its robust financial health and growth trajectory. Over the past five years, earnings have grown at an impressive 21.8% annually, highlighting its strong performance. The company is debt-free, a significant improvement from a debt to equity ratio of 9.8% five years ago, underscoring prudent financial management. Recent results show sales climbing to A$479 million from A$424 million last year, while net income rose to A$34.21 million from A$31.18 million previously. Trading at 53.5% below estimated fair value suggests potential upside for investors seeking value in this sector.

- Click to explore a detailed breakdown of our findings in GR Engineering Services' health report.

Assess GR Engineering Services' past performance with our detailed historical performance reports.

Wagners Holding (ASX:WGN)

Simply Wall St Value Rating: ★★★★★☆

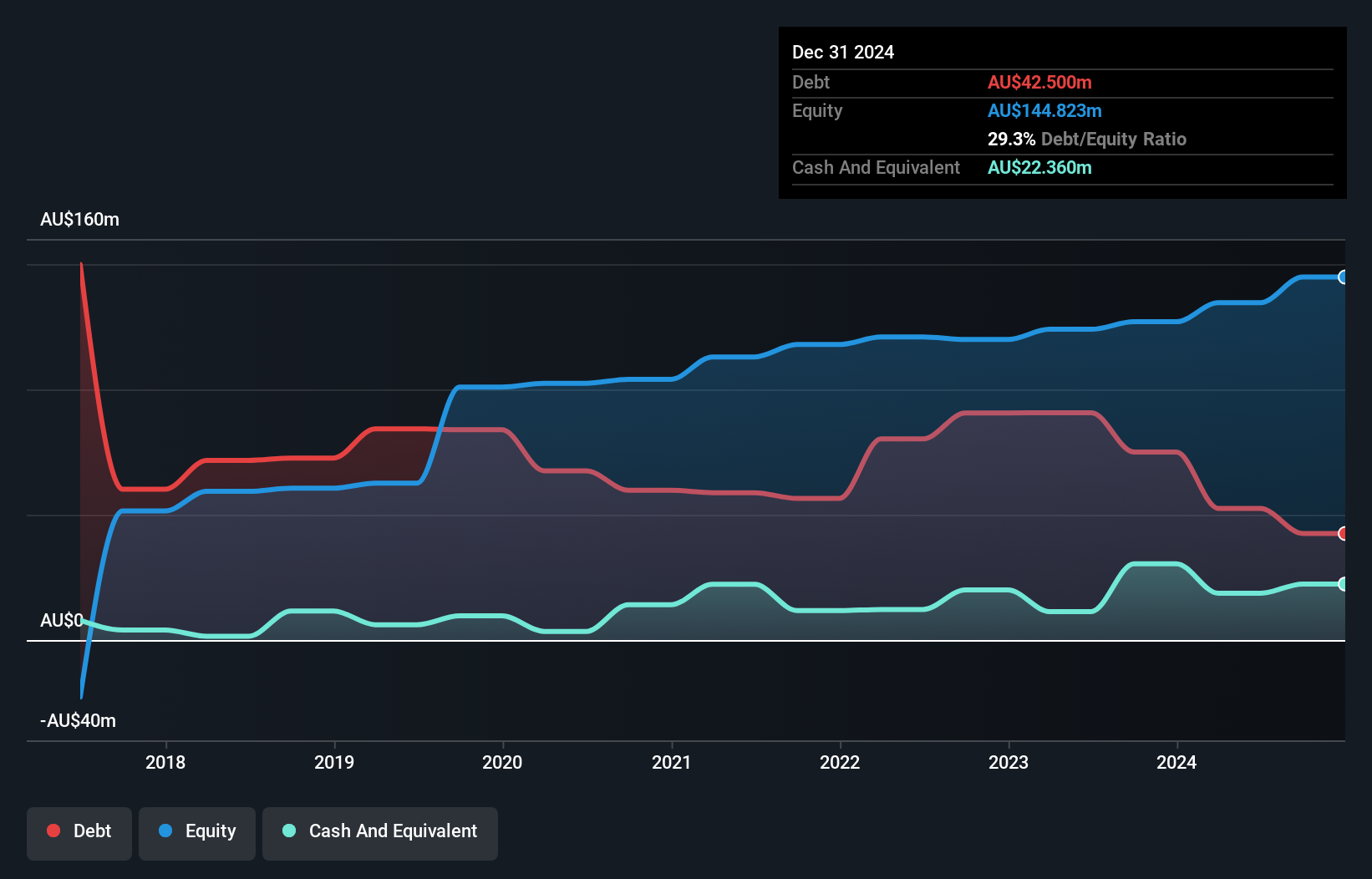

Overview: Wagners Holding Company Limited operates in the production and sale of construction materials and related building products across several countries, including Australia, the United States, and New Zealand, with a market capitalization of A$561.22 million.

Operations: Wagners Holding generates revenue primarily from Construction Materials (A$257.69 million), Project Services (A$105.71 million), and Composite Fibre Technology (A$68.45 million). The company also earns a smaller portion of its revenue from Earth Friendly Concrete, contributing A$0.16 million to the total revenue stream.

Wagners Holding, a player in the Australian construction materials scene, has shown impressive financial strides with its debt to equity ratio dropping from 65.9% to 27.5% over five years, indicating prudent financial management. The company reported a significant earnings growth of 120.9% last year, outpacing the industry average of 2.8%, and maintains a satisfactory net debt to equity ratio at 12.6%. Despite recent insider selling and challenges tied to capital expenditures for expansion, Wagners' strategic focus on concrete plant expansion and Composite Fiber Technologies positions it well for future demand in infrastructure projects across Australia and beyond.

Key Takeaways

- Explore the 51 names from our ASX Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNG

GR Engineering Services

Provides engineering, process control, automation, and construction services to the mining and mineral processing industries in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives