- Australia

- /

- Metals and Mining

- /

- ASX:VYS

Here's Why We Think Vysarn (ASX:VYS) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Vysarn (ASX:VYS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Vysarn

How Quickly Is Vysarn Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Vysarn's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 40%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

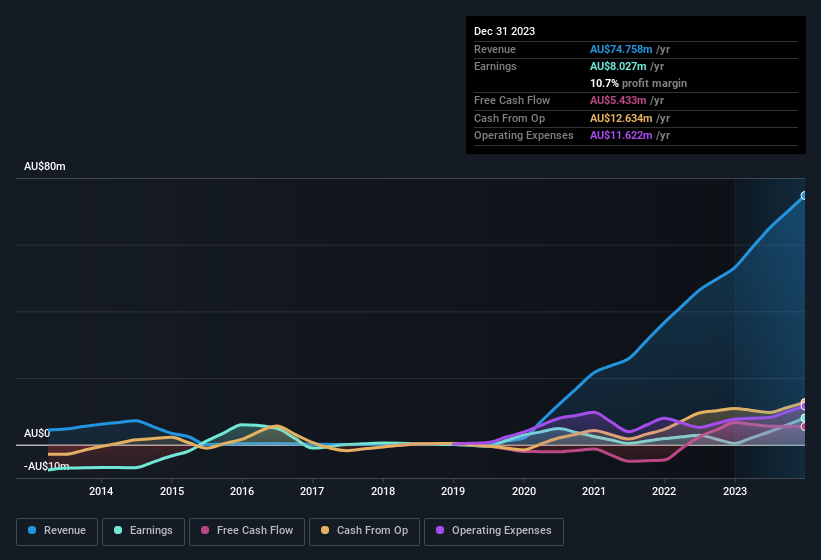

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Vysarn shareholders is that EBIT margins have grown from 5.4% to 16% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Vysarn isn't a huge company, given its market capitalisation of AU$106m. That makes it extra important to check on its balance sheet strength.

Are Vysarn Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Vysarn shares, in the last year. So it's definitely nice that Non-Executive Chairman Peter Hutchinson bought AU$9.1k worth of shares at an average price of around AU$0.09. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Vysarn.

On top of the insider buying, we can also see that Vysarn insiders own a large chunk of the company. Owning 39% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at AU$41m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Vysarn Deserve A Spot On Your Watchlist?

Vysarn's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Vysarn deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Vysarn that you should be aware of.

The good news is that Vysarn is not the only growth stock with insider buying. Here's a list of growth-focused companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VYS

Vysarn

Provides water services to various sectors, including resources, urban development, government and utilities in Australia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success