- Australia

- /

- Metals and Mining

- /

- ASX:VUL

Vulcan Energy Resources Limited's (ASX:VUL) Price Is Right But Growth Is Lacking

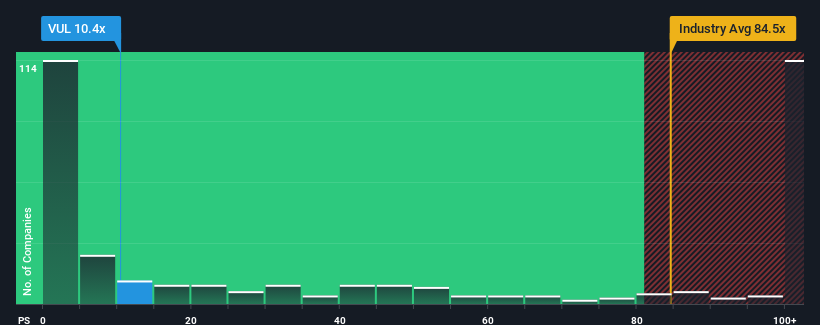

With a price-to-sales (or "P/S") ratio of 10.4x Vulcan Energy Resources Limited (ASX:VUL) may be sending very bullish signals at the moment, given that almost half of all the Metals and Mining companies in Australia have P/S ratios greater than 84.5x and even P/S higher than 509x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Vulcan Energy Resources

How Vulcan Energy Resources Has Been Performing

With revenue growth that's inferior to most other companies of late, Vulcan Energy Resources has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Vulcan Energy Resources will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Vulcan Energy Resources' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 112%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 79% per year during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 139% per annum growth forecast for the broader industry.

In light of this, it's understandable that Vulcan Energy Resources' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Vulcan Energy Resources' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Vulcan Energy Resources' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Vulcan Energy Resources (1 is significant!) that we have uncovered.

If these risks are making you reconsider your opinion on Vulcan Energy Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VUL

Vulcan Energy Resources

Engages in the geothermal energy, and lithium exploration and production activities in Europe, Germany, and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026