- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Will Vault Minerals’ (ASX:VAU) Stock Split Unlock New Retail Momentum or Signal a Shift in Strategy?

Reviewed by Sasha Jovanovic

- On November 18, 2025, Vault Minerals Limited carried out a 1-for-6.5 stock split, increasing the number of shares outstanding and lowering the per-share price for investors.

- This move is intended to make shares more accessible to a wider investor base, commonly generating new interest among retail investors.

- We'll explore how stronger retail appeal following the stock split could reshape Vault Minerals' investment narrative in the coming weeks.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Vault Minerals' Investment Narrative?

If you’re considering Vault Minerals, the big-picture belief is in the company’s improved profitability and production profile, further strengthened by steady double-digit earnings growth forecasts. The recent 1-for-6.5 stock split aims to spark more retail interest, and while this can increase liquidity and bring in a wider base of shareholders, it doesn’t fundamentally shift the main short-term catalysts already in play, namely gold production, operational results, and any potential M&A activity following reports of foreign suitors. The risks remain tied to management turnover, as a largely new board and executive team (with an average tenure under two years) now faces the challenge of delivering consistent results after a period of rapid transformation. Share buybacks and ongoing exploration add support, but the impact from the stock split is likely to be limited, aside from making shares more visible and tradable. Yet, executive changes are one risk investors should keep in mind going forward.

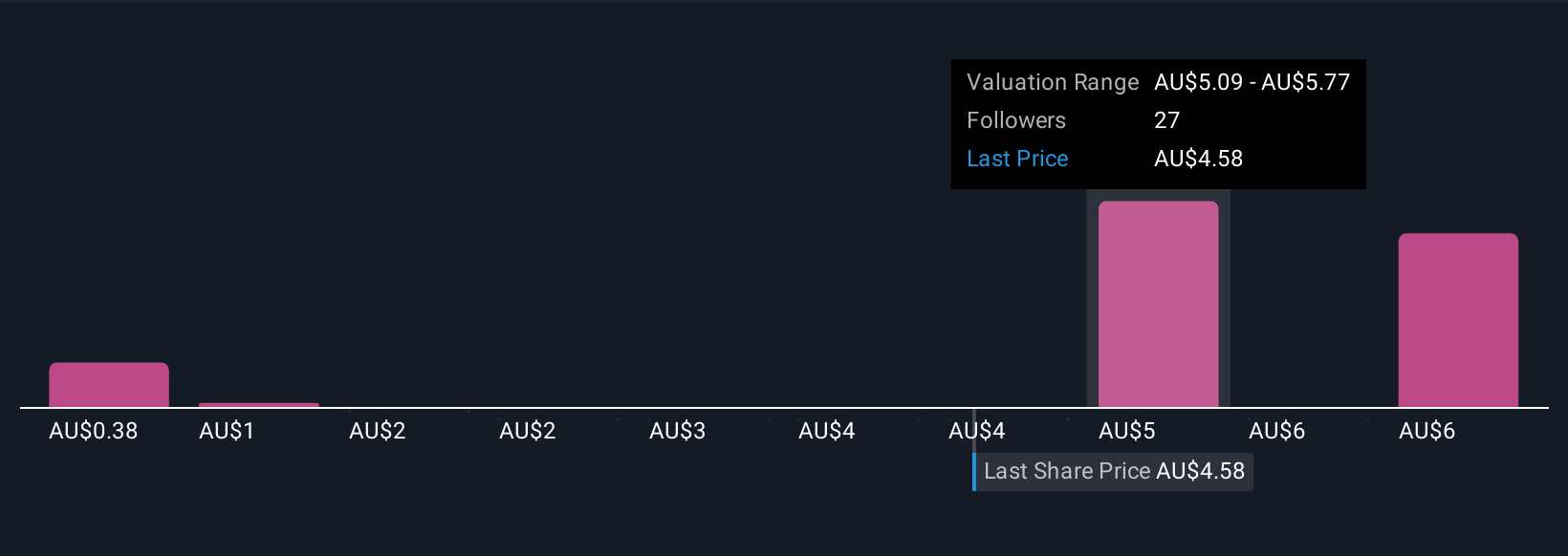

Despite retreating, Vault Minerals' shares might still be trading 35% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 13 other fair value estimates on Vault Minerals - why the stock might be worth as much as 55% more than the current price!

Build Your Own Vault Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vault Minerals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vault Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vault Minerals' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives