- Australia

- /

- Metals and Mining

- /

- ASX:GMD

ASX Stocks With Estimated Discounts Of Up To 49.5% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has shown resilience, with the XJO climbing back to 8,600 points despite inflation ticking up to 3.8% and mixed performances across sectors like materials and IT. In this environment, identifying undervalued stocks can be a strategic move for investors seeking potential growth opportunities amid fluctuating economic indicators and sector performances.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.47 | A$4.63 | 46.6% |

| SenSen Networks (ASX:SNS) | A$0.098 | A$0.19 | 48.1% |

| NRW Holdings (ASX:NWH) | A$5.12 | A$8.95 | 42.8% |

| Light & Wonder (ASX:LNW) | A$143.56 | A$244.96 | 41.4% |

| LGI (ASX:LGI) | A$4.20 | A$7.77 | 45.9% |

| Immutep (ASX:IMM) | A$0.27 | A$0.48 | 43.7% |

| Guzman y Gomez (ASX:GYG) | A$22.87 | A$39.35 | 41.9% |

| Genesis Minerals (ASX:GMD) | A$6.62 | A$13.10 | 49.5% |

| Cromwell Property Group (ASX:CMW) | A$0.465 | A$0.85 | 45.4% |

| Airtasker (ASX:ART) | A$0.34 | A$0.68 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited is involved in gold mining, project development, and exploration activities in Western Australia with a market capitalization of A$7.56 billion.

Operations: The company generates revenue of A$920.14 million from its activities in mineral production, exploration, and development in Western Australia.

Estimated Discount To Fair Value: 49.5%

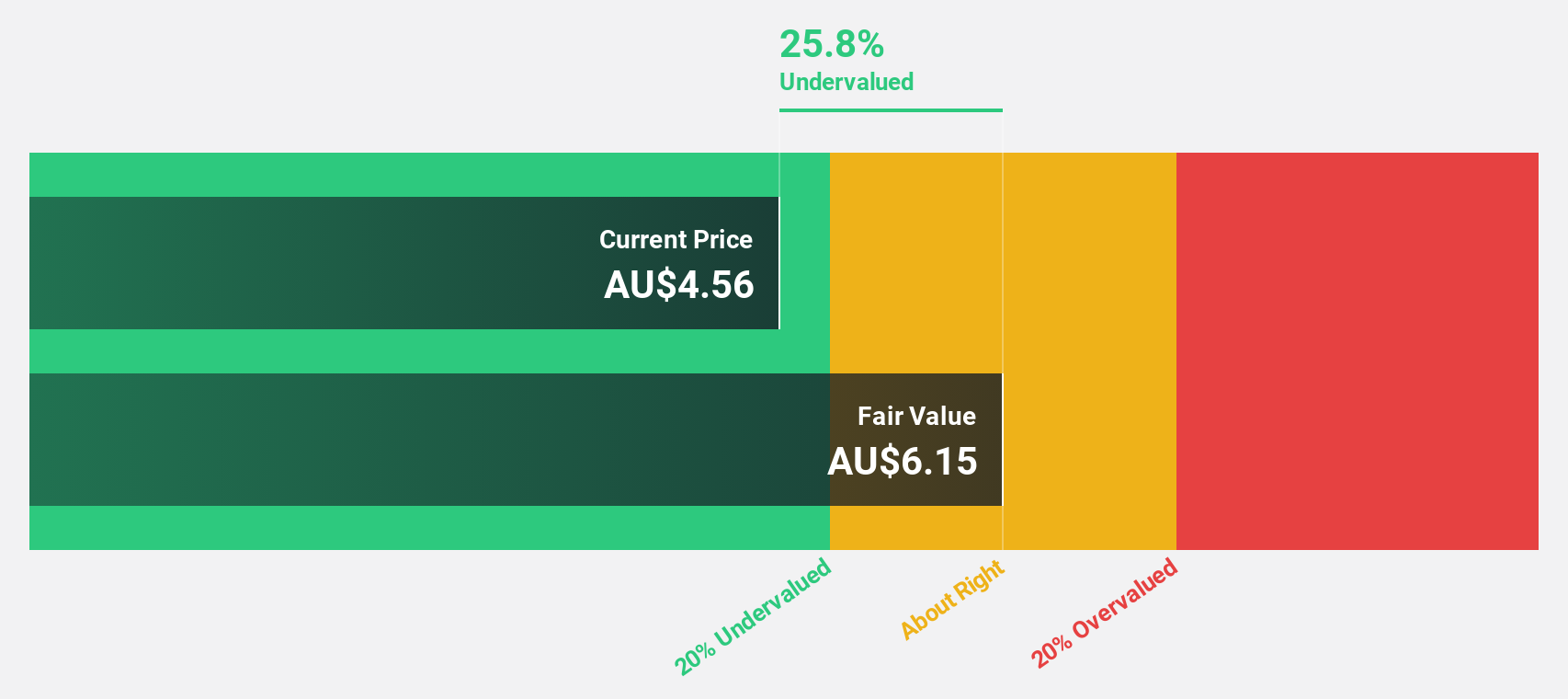

Genesis Minerals appears undervalued, trading at A$6.62, below its estimated fair value of A$13.1. Forecasted revenue growth of 14.6% annually surpasses the Australian market's 5.9%. Although earnings growth is not significant, it is expected to outpace the market at 19.9% per year compared to 12%. Despite recent index changes, including addition to S&P/ASX 100 and removal from Small Ordinaries Index, Genesis remains a compelling opportunity based on cash flow valuation metrics.

- Our expertly prepared growth report on Genesis Minerals implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Genesis Minerals.

Vault Minerals (ASX:VAU)

Overview: Vault Minerals Limited is involved in the exploration, mine development, and operations for gold and gold/copper concentrate in Australia and Canada, with a market cap of A$4.85 billion.

Operations: Vault Minerals Limited generates revenue from its operations at Deflector (A$477.79 million), Sugar Zone (A$0.23 million), Mount Monger (A$287.58 million), and Leonora Operation (A$666.50 million).

Estimated Discount To Fair Value: 34.2%

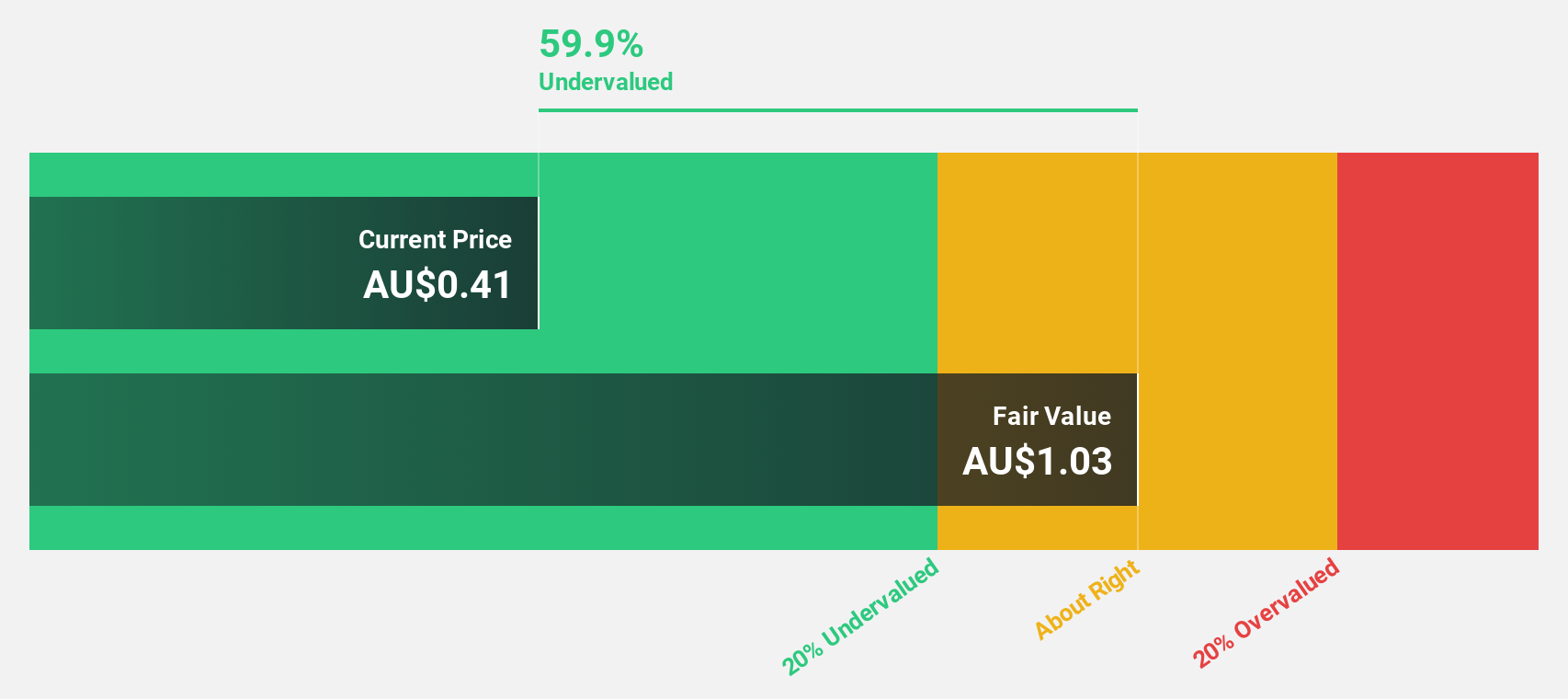

Vault Minerals, trading at A$4.74, is significantly undervalued with an estimated fair value of A$7.2. Its earnings are projected to grow 16.2% annually, outpacing the Australian market's 12%, while revenue growth is forecasted at 9% per year. Recent events include a stock split and board changes, with Ian Macpherson stepping down as Director and Chair of the Audit Committee, succeeded by Kelvin Flynn.

- According our earnings growth report, there's an indication that Vault Minerals might be ready to expand.

- Navigate through the intricacies of Vault Minerals with our comprehensive financial health report here.

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and other international markets with a market cap of A$1.63 billion.

Operations: Web Travel Group Limited generates revenue from its Business to Business Travel (B2B) segment, amounting to A$362.60 million.

Estimated Discount To Fair Value: 31%

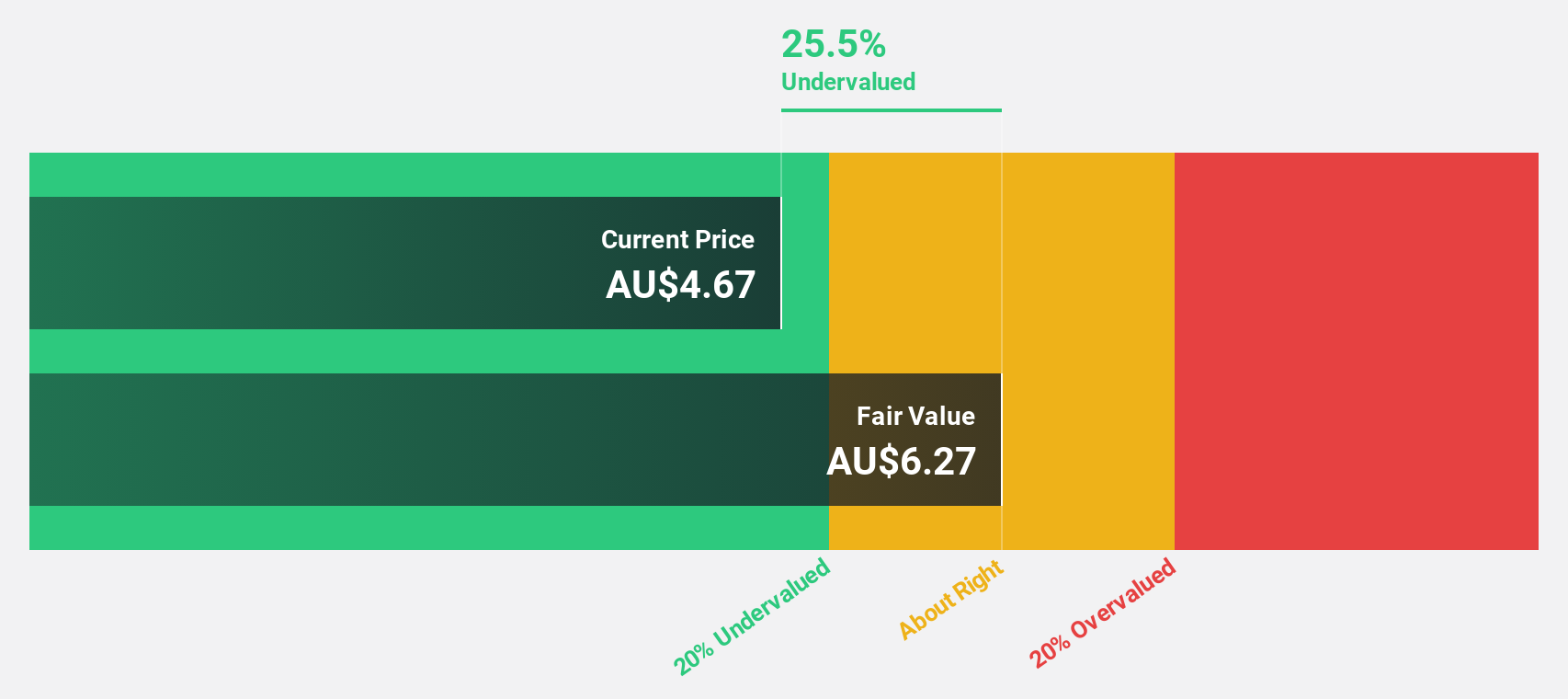

Web Travel Group, with its stock at A$4.52, is trading over 20% below its estimated fair value of A$6.55. Despite a significant drop in net income to A$26.9 million for the half year ended September 30, 2025, revenue grew to A$204.6 million from A$170.4 million a year ago. Earnings are expected to grow significantly at 43.34% annually over the next three years, surpassing the broader Australian market's growth rate of 12%.

- The growth report we've compiled suggests that Web Travel Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Web Travel Group stock in this financial health report.

Make It Happen

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 35 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMD

Genesis Minerals

Engages in the gold mining, project development and exploration activities in Western Australia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success