- Australia

- /

- Metals and Mining

- /

- ASX:VAU

A Look at Vault Minerals (ASX:VAU) Valuation Following Share Consolidation and Market Restructuring

Reviewed by Simply Wall St

Vault Minerals (ASX:VAU) is moving forward with a 6.5 to 1 share consolidation after receiving shareholder approval. This move is part of its capital structure streamlining strategy and brings a temporary trading code change as well as a deferred settlement period.

See our latest analysis for Vault Minerals.

Vault Minerals has been generating fresh attention after its share consolidation plan landed, with the 1-year total shareholder return surging to 112.67 percent and the stock up a remarkable 119.11 percent year to date. After some short-term volatility, recent momentum suggests investors are keeping a close watch for further catalysts.

If today’s capital moves have you thinking bigger, this could be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership.

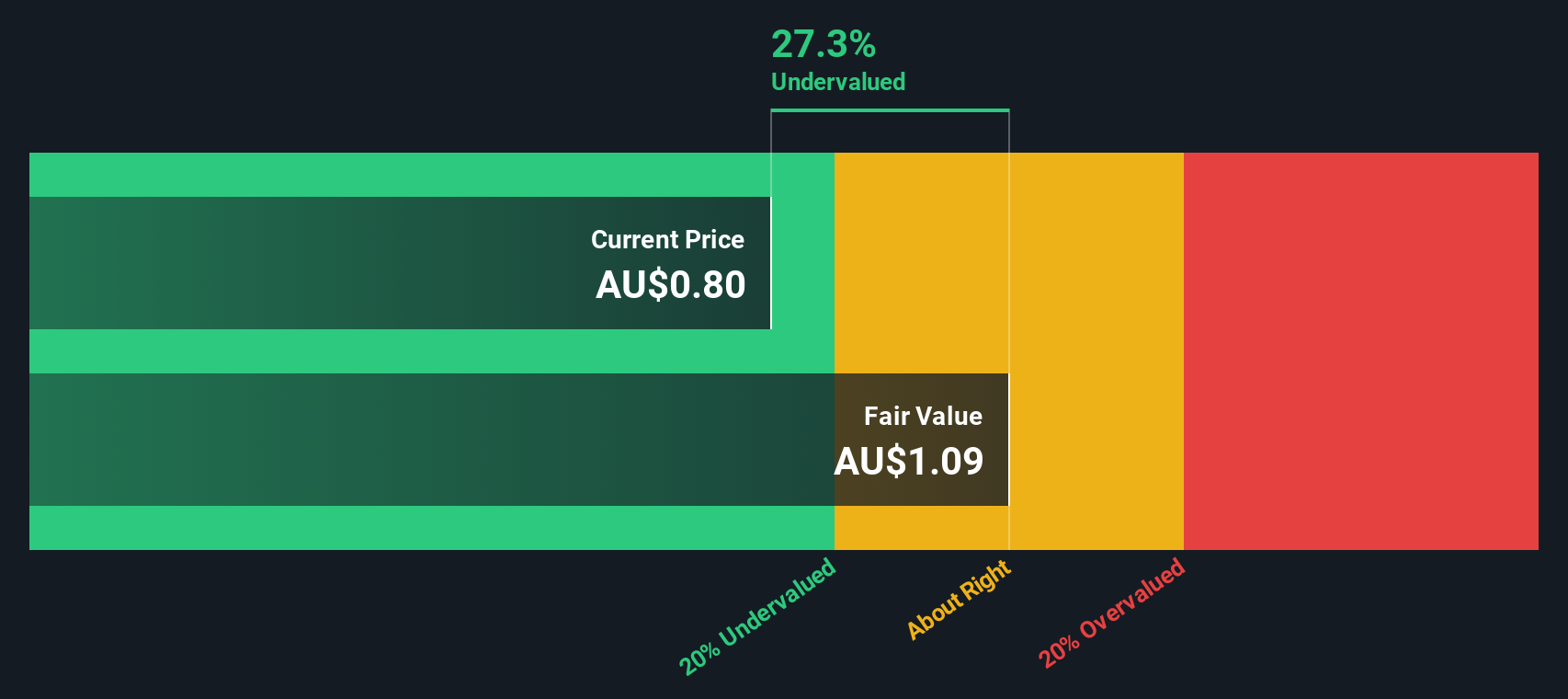

Yet with solid recent gains and a share price hovering below analyst targets, the big question is whether Vault Minerals remains undervalued or if the current momentum has already incorporated anticipated growth, leaving little room for upside.

Price-to-Earnings of 20.7x: Is it justified?

Vault Minerals is currently trading at a price-to-earnings (P/E) ratio of 20.7x, exactly in line with the Australian Metals and Mining industry average of 20.7x. At a last close price of A$4.70, this positions the company as neither obviously cheap nor expensive on this key metric versus its sector peers.

The P/E ratio measures how much investors are willing to pay today per dollar of current earnings, making it a widely used gauge of value for companies that are profitable. For resource producers like Vault Minerals, where profits can be cyclical, the P/E can hint at market expectations for future growth or risk.

With a P/E matching the industry, the market is valuing Vault Minerals in line with sector norms, potentially recognizing both its recent shift to profitability and its near-term growth profile. This is further reinforced by our fair value analysis, which also puts the preferred multiple at 20.7x. This points to a valuation level that the market could gravitate toward as performance is proven.

Explore the SWS fair ratio for Vault Minerals

Result: Price-to-Earnings of 20.7x (ABOUT RIGHT)

However, slowing revenue growth or unexpected swings in net income could challenge Vault Minerals' premium valuation and test investor confidence in the future.

Find out about the key risks to this Vault Minerals narrative.

Another View: The SWS DCF Model

While the market appears to be valuing Vault Minerals in line with sector averages on earnings, our SWS DCF model offers a different perspective. This approach estimates Vault’s fair value at A$7.11 per share, nearly 34% above the current price. This suggests the stock could be significantly undervalued. Could the market be underappreciating Vault’s long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vault Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vault Minerals Narrative

If you have your own perspective or prefer hands-on analysis, you can use our tools to assemble your personal view of Vault Minerals in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vault Minerals.

Ready for More Investment Strategies?

If you want to seize tomorrow’s winners ahead of the crowd, check out these unique opportunities handpicked by the Simply Wall Street Screener.

- Spot profitable trends early and target growth with these 3589 penny stocks with strong financials. These combine value with financial strength and may offer potential for standout gains.

- Maximize your income stream by selecting these 15 dividend stocks with yields > 3%. This features companies with attractive yields above 3 percent and consistent track records.

- Stay on the frontier of innovation by leveraging these 26 quantum computing stocks. This uncovers businesses positioned at the cutting edge of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives