- Australia

- /

- Metals and Mining

- /

- ASX:SVY

Shareholders May Be More Conservative With Stavely Minerals Limited's (ASX:SVY) CEO Compensation For Now

Under the guidance of CEO Chris Cairns, Stavely Minerals Limited (ASX:SVY) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 12 November 2021. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Stavely Minerals

How Does Total Compensation For Chris Cairns Compare With Other Companies In The Industry?

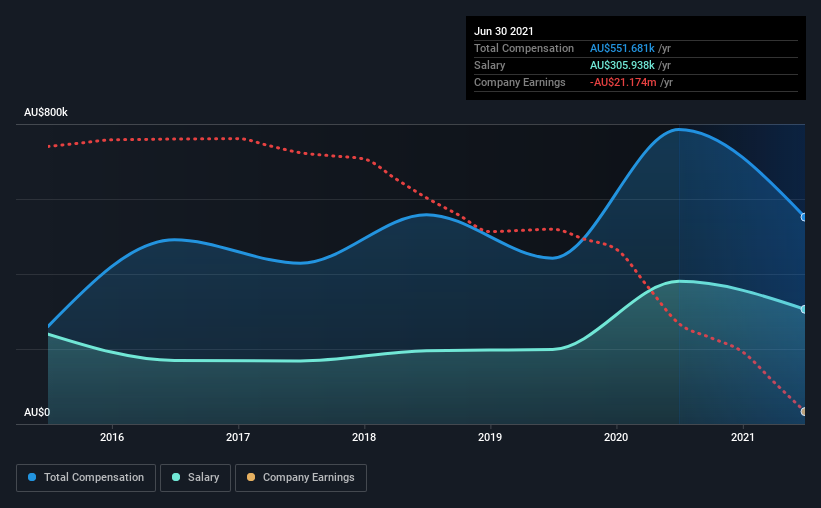

At the time of writing, our data shows that Stavely Minerals Limited has a market capitalization of AU$120m, and reported total annual CEO compensation of AU$552k for the year to June 2021. We note that's a decrease of 30% compared to last year. We note that the salary of AU$305.9k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under AU$270m, the reported median total CEO compensation was AU$359k. Accordingly, our analysis reveals that Stavely Minerals Limited pays Chris Cairns north of the industry median. Furthermore, Chris Cairns directly owns AU$3.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$306k | AU$380k | 55% |

| Other | AU$246k | AU$405k | 45% |

| Total Compensation | AU$552k | AU$785k | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. Our data reveals that Stavely Minerals allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Stavely Minerals Limited's Growth Numbers

Over the last three years, Stavely Minerals Limited has shrunk its earnings per share by 14% per year. Its revenue is up 20% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Stavely Minerals Limited Been A Good Investment?

We think that the total shareholder return of 59%, over three years, would leave most Stavely Minerals Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Stavely Minerals (of which 3 make us uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Stavely Minerals, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SVY

Stavely Minerals

A mineral resource company, engages in the exploration and development of mineral projects in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success