- Australia

- /

- Metals and Mining

- /

- ASX:SRL

Could Sunrise Energy Metals’ (ASX:SRL) Scandium Update Signal a Turning Point in Its Value Story?

Reviewed by Simply Wall St

- Sunrise Energy Metals recently held a special call to discuss an update on its Scandium Project mineral resources, following an earnings announcement for the year ended June 30, 2025.

- This combination of a reduced annual net loss to A$6.21 million and operational updates highlights both an improving financial profile and continued project development.

- We'll explore how the Scandium Project resource update informs Sunrise Energy Metals’ long-term value proposition and investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Sunrise Energy Metals' Investment Narrative?

For anyone considering Sunrise Energy Metals, the core belief is in the company's potential to capitalize on a globally significant scandium resource. The recent special call, centered on a Scandium Project resource update shortly after improved annual results, could sharpen attention on project timelines and possible commercialization routes. While reductions in net loss show a slightly more favorable financial profile, Sunrise’s near-zero revenue and continued need for capital reinforce that future value likely hinges on resource development rather than current earnings. The operational update itself, while meaningful for long-term confidence, may not be a game changer for the most pressing short-term catalysts, which remain further technical milestones, funding progress, and evidence of market demand. Persistent volatility and the impact of recent dilutions are risks that may weigh on sentiment moving forward.

Yet, the history of capital raisings and share price swings is something investors should watch closely.

Exploring Other Perspectives

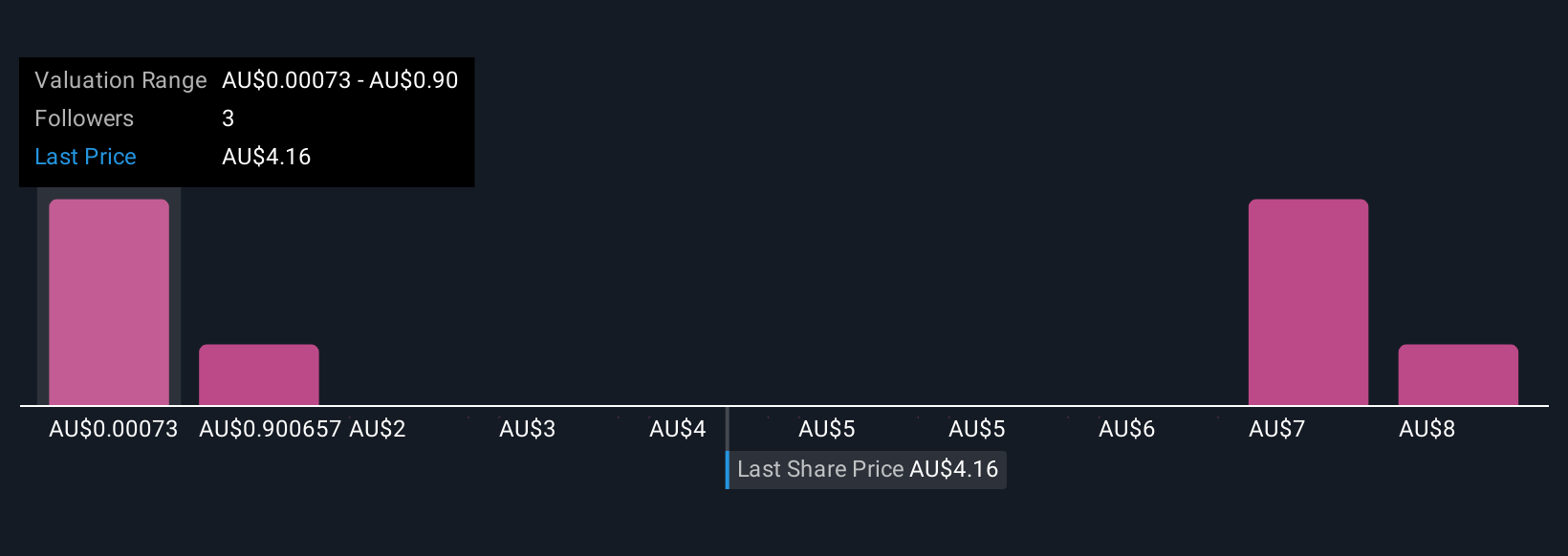

Explore 5 other fair value estimates on Sunrise Energy Metals - why the stock might be worth as much as 79% more than the current price!

Build Your Own Sunrise Energy Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrise Energy Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sunrise Energy Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrise Energy Metals' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRL

Sunrise Energy Metals

Engages in the mineral exploration activities in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives