- Australia

- /

- Metals and Mining

- /

- ASX:SLR

If You Had Bought Silver Lake Resources (ASX:SLR) Stock Five Years Ago, You Could Pocket A 317% Gain Today

Silver Lake Resources Limited (ASX:SLR) shareholders might be concerned after seeing the share price drop 24% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. Indeed, the share price is up a whopping 317% in that time. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Silver Lake Resources

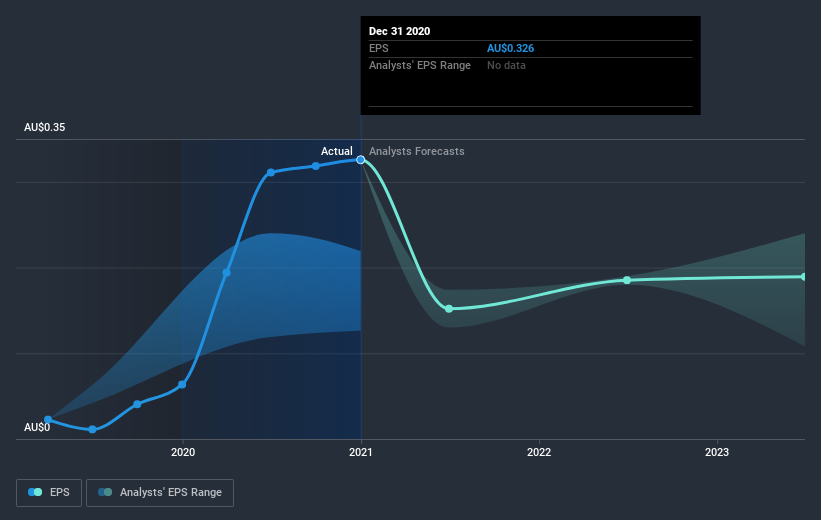

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Silver Lake Resources became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Silver Lake Resources has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Silver Lake Resources had a tough year, with a total loss of 25%, against a market gain of about 9.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 33%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Silver Lake Resources (2 are concerning!) that you should be aware of before investing here.

But note: Silver Lake Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Silver Lake Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SLR

Silver Lake Resources

Engages in the exploration, mine development, mine operation, and sale of gold and copper concentrates in Australia and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives