It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Sims (ASX:SGM). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Sims

How Fast Is Sims Growing Its Earnings Per Share?

In the last three years Sims' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Sims' EPS has risen over the last 12 months, growing from AU$2.14 to AU$2.37. This amounts to a 10% gain; a figure that shareholders will be pleased to see.

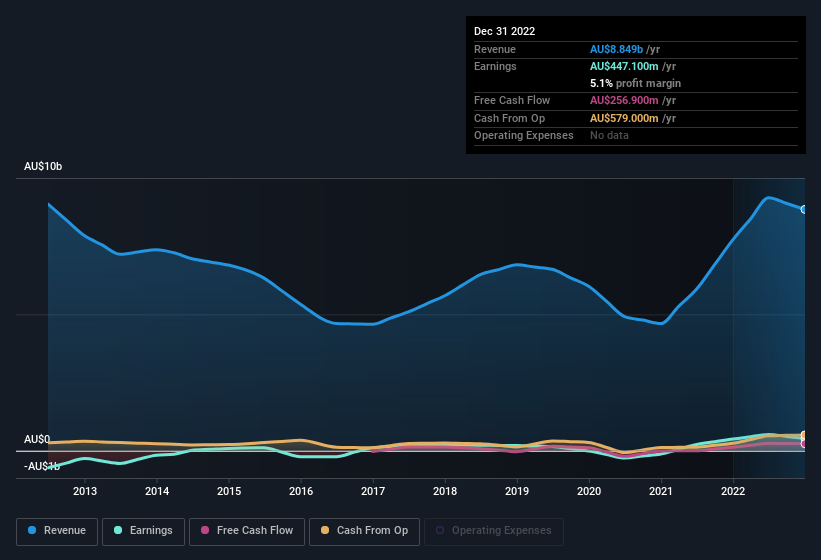

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Sims remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 14% to AU$8.8b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Sims' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Sims Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Sims insiders spent AU$106k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

The good news, alongside the insider buying, for Sims bulls is that insiders (collectively) have a meaningful investment in the stock. Holding AU$104m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Is Sims Worth Keeping An Eye On?

As previously touched on, Sims is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. However, before you get too excited we've discovered 2 warning signs for Sims that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Sims isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SGM

Sims

Engages in buying, processing, and selling of ferrous and non-ferrous recycled metals in Australia, China, India, Thailand, Turkey, the United States, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives