- Australia

- /

- Metals and Mining

- /

- ASX:SGM

3 Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has risen 1.7%, driven by gains of 12% in the Materials sector, although the Financials sector is down 3.2%. Over the past 12 months, the market is up 17%, with earnings forecast to grow by 12% annually. In this context, identifying undervalued small-cap stocks with insider buying can be a strategic move for investors looking to capitalize on potential growth opportunities within a robust market environment.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.3x | 1.5x | 41.91% | ★★★★★★ |

| Magellan Financial Group | 7.5x | 4.8x | 37.48% | ★★★★★☆ |

| Bigtincan Holdings | NA | 1.1x | 48.65% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.5x | 20.01% | ★★★★★☆ |

| Mader Group | 21.0x | 1.4x | 49.66% | ★★★★☆☆ |

| Centuria Capital Group | 23.2x | 5.2x | 41.48% | ★★★★☆☆ |

| Eagers Automotive | 11.0x | 0.3x | 36.82% | ★★★★☆☆ |

| Dicker Data | 21.1x | 0.8x | -73.23% | ★★★☆☆☆ |

| Coventry Group | 221.9x | 0.4x | -11.64% | ★★★☆☆☆ |

| Corporate Travel Management | 21.9x | 2.6x | -2.46% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

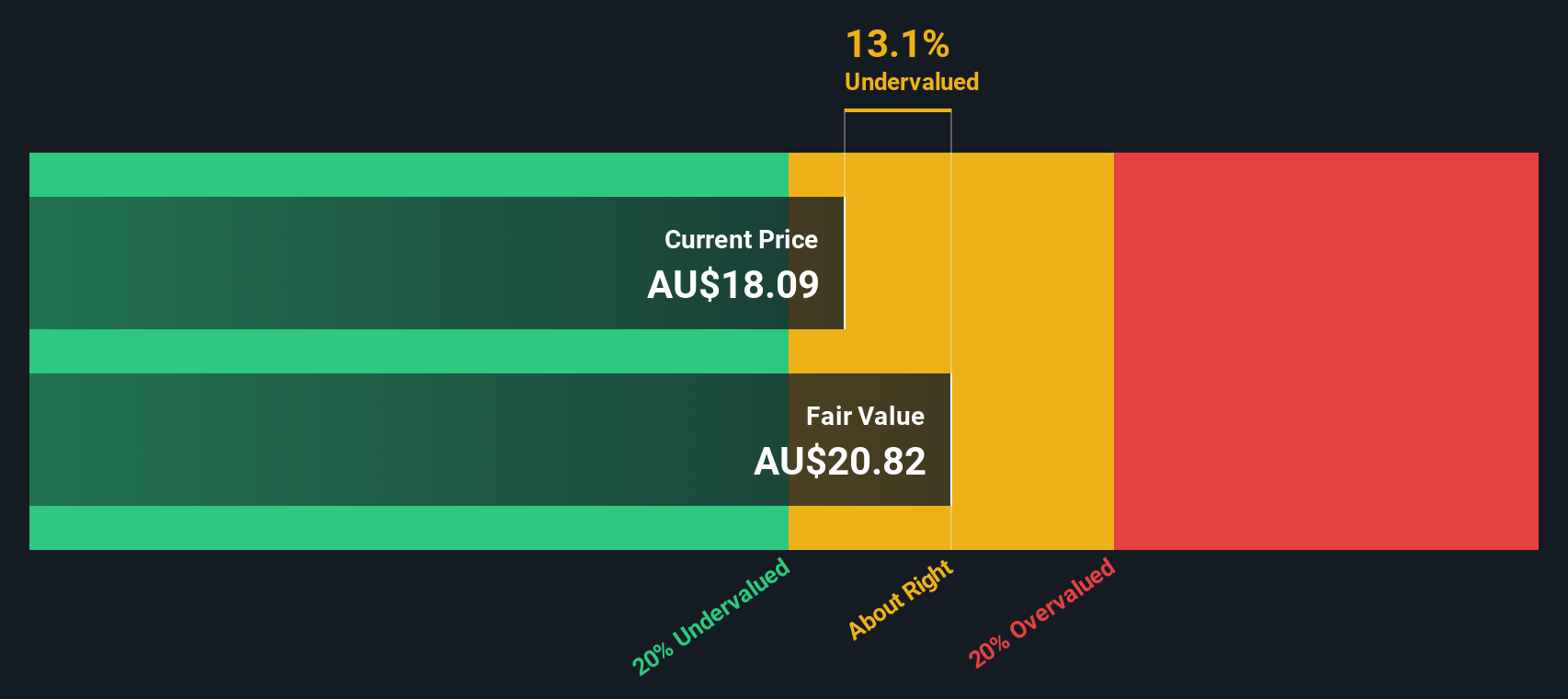

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a major car retailing company with operations primarily focused on the automotive sector and a market cap of approximately A$3.81 billion.

Operations: The company generates revenue primarily from car retailing, with a gross profit margin of 18.37% as of the latest period. Operating expenses and non-operating expenses are significant cost components, impacting net income margins which stood at 2.47%.

PE: 11.0x

Eagers Automotive, a small Australian company, recently reported A$5.46 billion in sales for the first half of 2024, up from A$4.82 billion the previous year. Despite this growth, net income dipped to A$116 million from A$137.76 million. Insider confidence is evident with Nicholas Politis purchasing 200,000 shares worth approximately A$2.09 million between July and August 2024. The company's reliance on external borrowing highlights its higher risk profile but also underscores potential undervaluation opportunities for investors seeking growth in smaller companies.

- Navigate through the intricacies of Eagers Automotive with our comprehensive valuation report here.

Explore historical data to track Eagers Automotive's performance over time in our Past section.

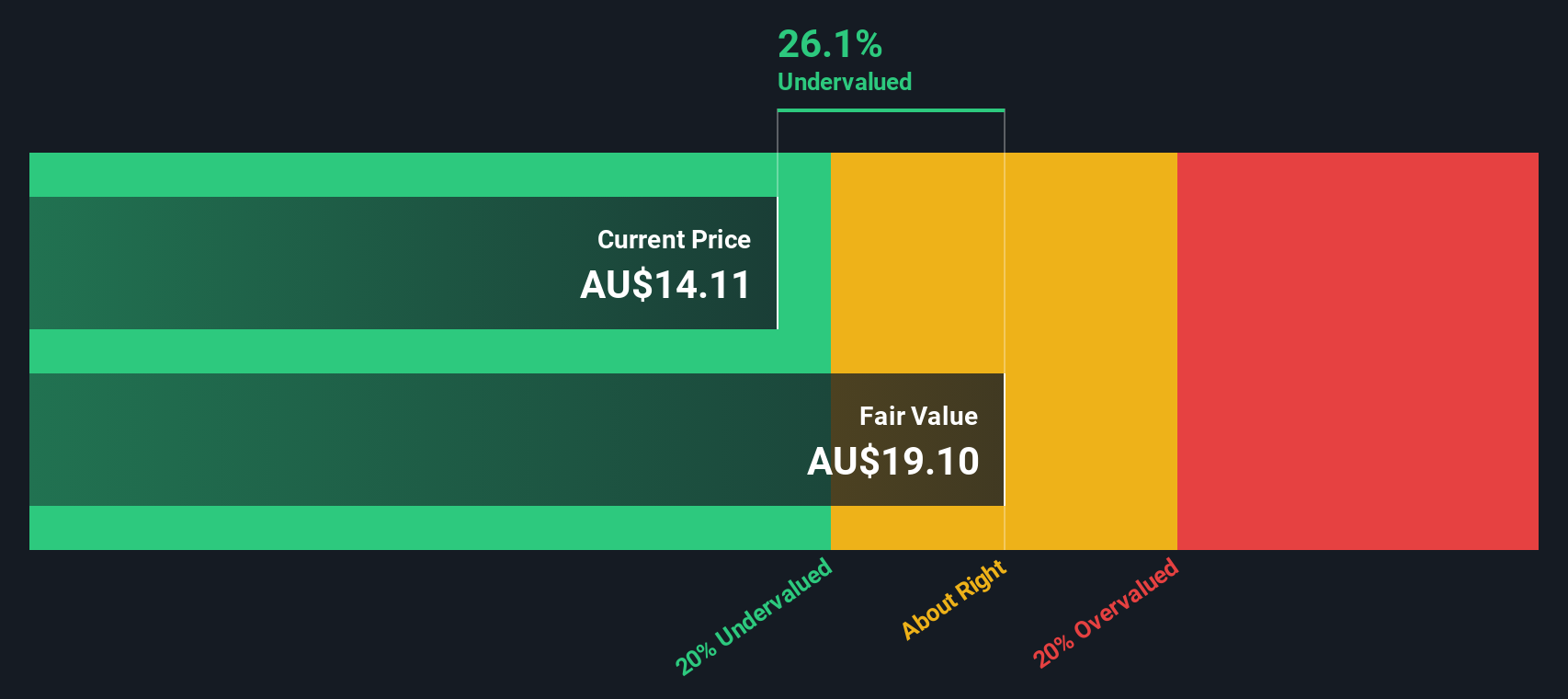

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals develops therapies for neurodevelopmental disorders and has a market cap of A$1.20 billion.

Operations: Neuren Pharmaceuticals generates revenue primarily from product sales, with recent figures showing a significant increase to A$193.34 million as of June 30, 2024. The company's cost of goods sold (COGS) for the same period was A$32.90 million, resulting in a gross profit margin of 82.98%. Operating expenses are relatively low compared to revenue, at A$5.28 million for the quarter ending June 30, 2024. Net income reached A$117.29 million with a net income margin of 60.67% during this period.

PE: 16.5x

Neuren Pharmaceuticals has caught attention with its insider confidence, as insiders have been buying shares consistently over the past six months. Despite a dip in earnings for the half year ending June 30, 2024—sales dropped to A$24.33 million from A$62.93 million—the company remains optimistic about future growth, forecasting net sales of A$340-370 million for 2024. Recent Phase 2 trials also showed promising results for Angelman syndrome treatment, potentially boosting long-term prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Neuren Pharmaceuticals.

Understand Neuren Pharmaceuticals' track record by examining our Past report.

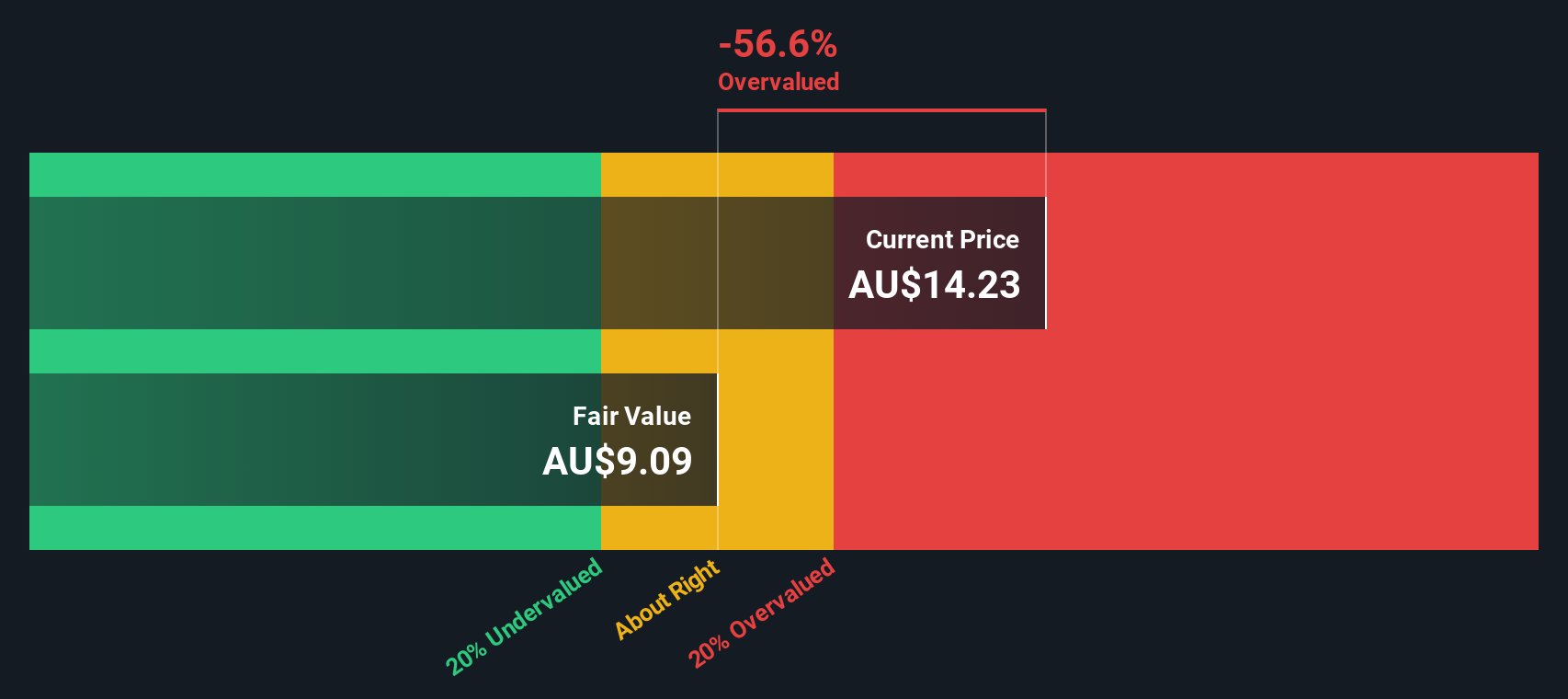

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sims operates in the recycling industry, focusing on metal and electronics recycling through segments like Global Trading, North America Metals, Sims Lifecycle Services, and Australia/New Zealand Metals, with a market cap of A$3.50 billion.

Operations: The company generates revenue primarily from its North America Metals (A$4.49 billion) and Australia/New Zealand Metals (A$1.60 billion) segments, with additional contributions from Global Trading and Sims Lifecycle Services. Over the observed periods, gross profit margins have fluctuated between 8.37% and 14.38%, reflecting variations in cost of goods sold relative to revenue. Operating expenses include significant allocations for depreciation and amortization, which impact net income margins ranging from -5.39% to 6.46%.

PE: 1365.7x

Sims, a small Australian company, recently reported A$7.22 billion in sales for the year ending June 30, 2024, up from A$6.66 billion last year. Despite this increase, they posted a net loss of A$57.8 million compared to a net income of A$181.1 million previously. Insider confidence is evident with notable share purchases over the past six months. The company's earnings are forecasted to grow by 41% annually despite lower profit margins and reliance on external borrowing for funding.

- Click here and access our complete valuation analysis report to understand the dynamics of Sims.

Examine Sims' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Navigate through the entire inventory of 24 Undervalued ASX Small Caps With Insider Buying here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGM

Sims

Engages in buying, processing, and selling of ferrous and non-ferrous recycled metals in Australia, Bangladesh, China, India, Turkey, the United States, and internationally.

Good value with adequate balance sheet.