- Australia

- /

- Metals and Mining

- /

- ASX:SGA

ASX Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 up around 1% to 8,210 points as sectors across the board gain ground amid ongoing US election developments. Penny stocks, while considered a niche area of investment today, still present intriguing opportunities for growth in smaller or newer companies. When backed by strong financial health, these stocks can offer a blend of value and potential that may appeal to investors looking for under-the-radar opportunities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.765 | A$287.37M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$798.83M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.155 | A$1.07B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.19 | A$141.71M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$129.2M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$104.27M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoGraf Limited focuses on the exploration and production of graphite products for the lithium-ion battery and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$37.23 million.

Operations: The company's revenue segment is solely from Australia, amounting to A$3.49 million.

Market Cap: A$37.23M

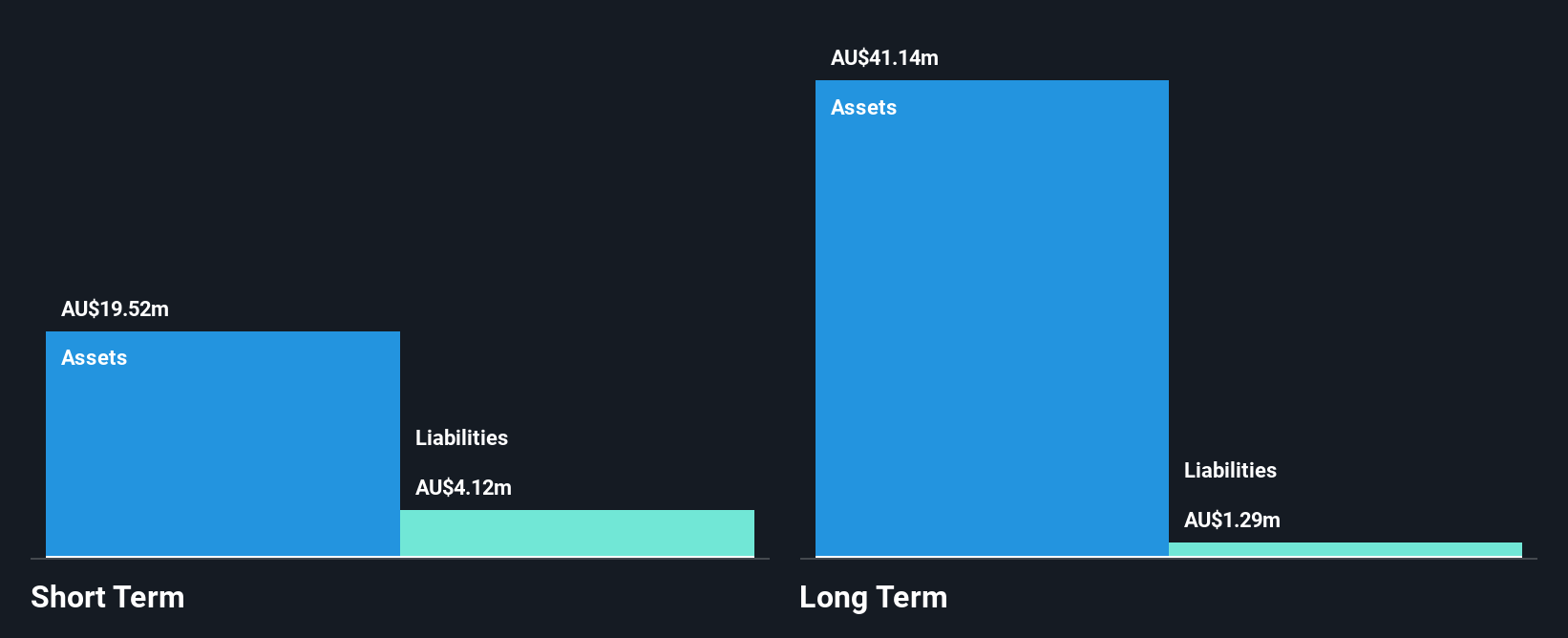

EcoGraf Limited, with a market cap of A$37.23 million, is pre-revenue and focuses on graphite production for battery markets in Tanzania and Australia. Recent developments include completing the design for a 73,000 tpa graphite processing plant in Tanzania, enhancing project viability. The company is debt-free with sufficient cash runway exceeding one year based on current free cash flow. However, it remains unprofitable with declining earnings over five years at an annual rate of 18.4%. While short-term assets cover liabilities comfortably, management's limited tenure suggests potential challenges ahead as they navigate growth strategies.

- Navigate through the intricacies of EcoGraf with our comprehensive balance sheet health report here.

- Assess EcoGraf's previous results with our detailed historical performance reports.

Sarytogan Graphite (ASX:SGA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sarytogan Graphite Limited is involved in the exploration of graphite properties and has a market capitalization of A$16.36 million.

Operations: Sarytogan Graphite Limited has not reported any revenue segments.

Market Cap: A$16.36M

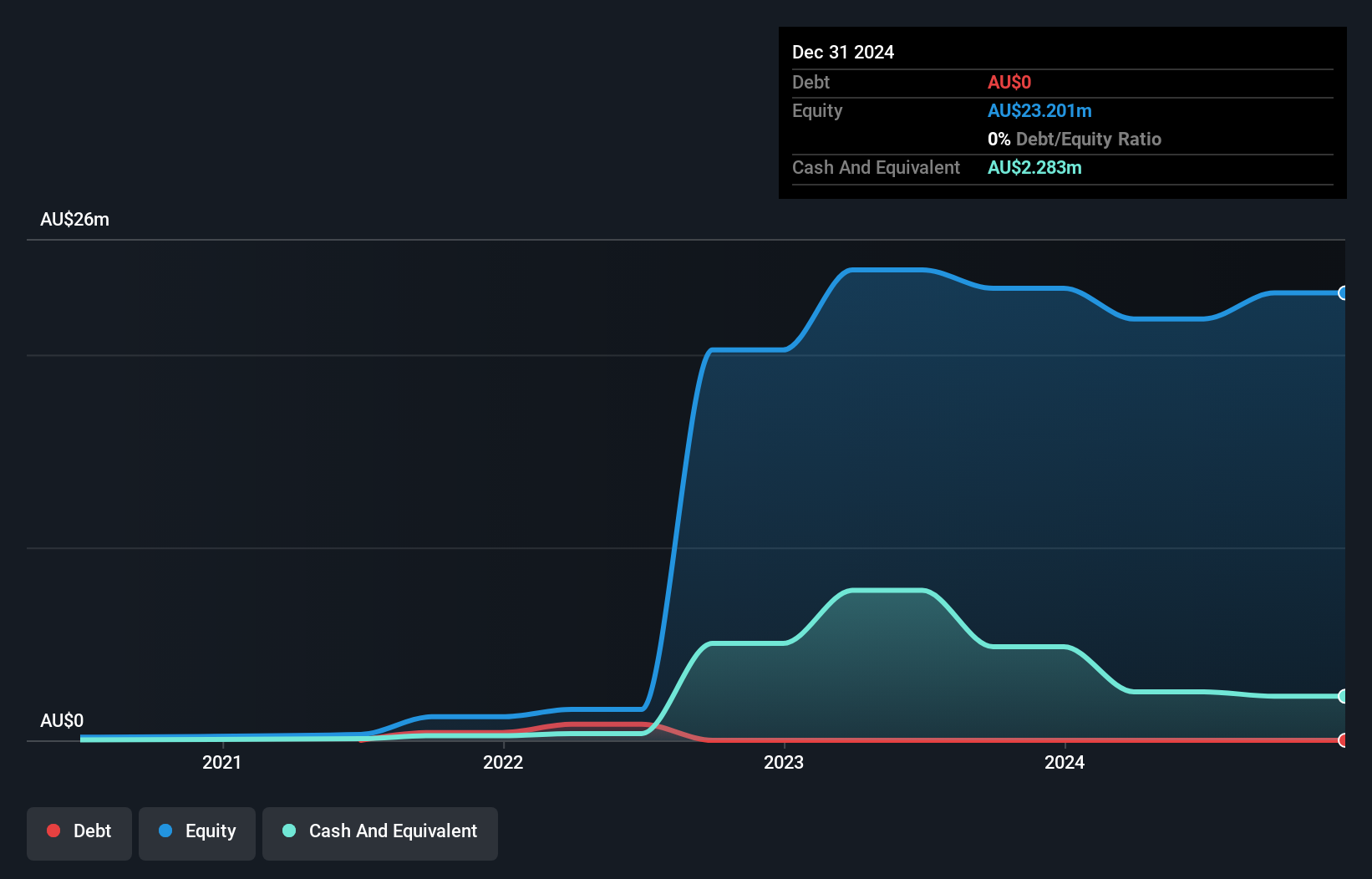

Sarytogan Graphite Limited, with a market cap of A$16.36 million, is pre-revenue and engaged in graphite exploration. The company has experienced high share price volatility over the past three months and remains unprofitable, with losses increasing annually by 45.9% over five years. Despite having no debt and short-term assets of A$3.2 million covering its liabilities of A$220.4K, Sarytogan faces challenges such as a negative return on equity (-14.06%). Recent activities include presenting at IMARC 2024 and filing a follow-on equity offering for A$5 million to bolster its cash runway beyond six months.

- Get an in-depth perspective on Sarytogan Graphite's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Sarytogan Graphite's track record.

Terragen Holdings (ASX:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Terragen Holdings Limited focuses on the research, development, production, and sale of biological products for the agriculture sector in Australia and New Zealand, with a market cap of A$14.76 million.

Operations: The company generates revenue of A$2.14 million from its agricultural biotech segment.

Market Cap: A$14.76M

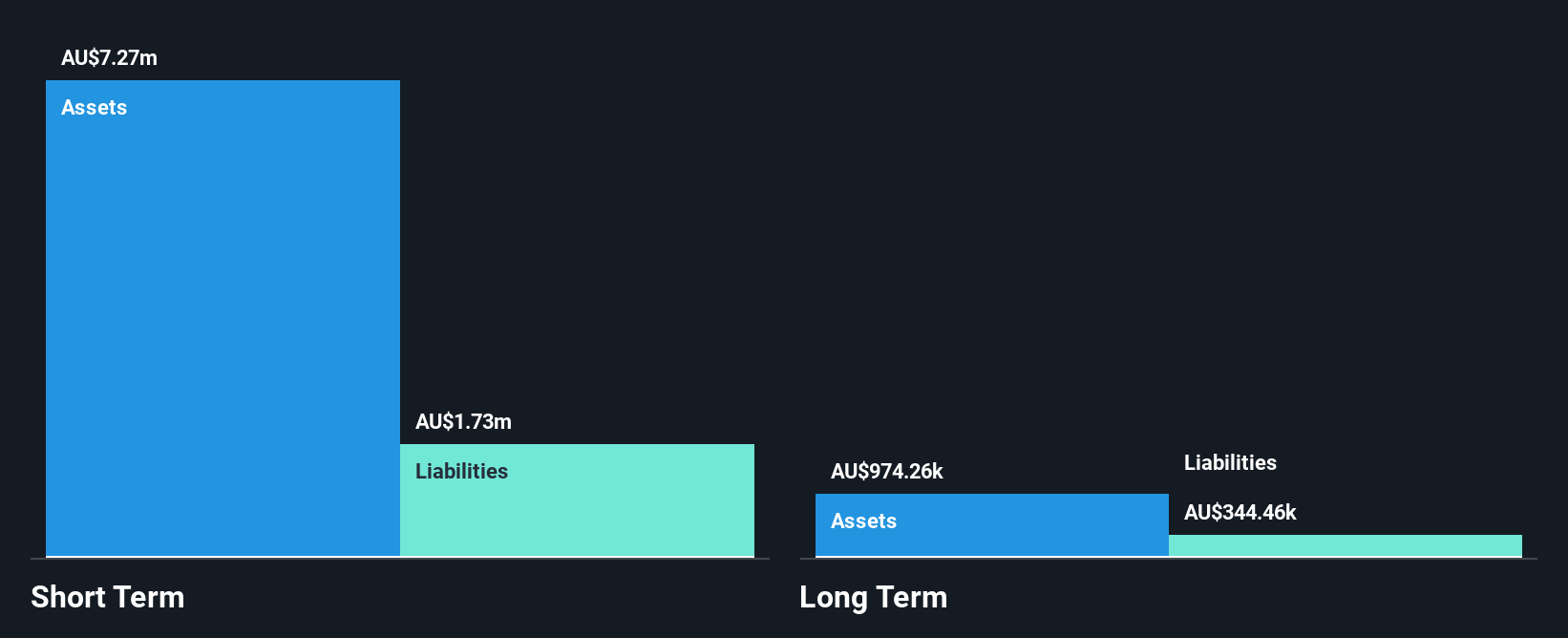

Terragen Holdings Limited, with a market cap of A$14.76 million, operates in the agricultural biotech sector and reported revenue of A$2.14 million for the year ended June 2024, down from A$3.28 million previously. The company remains unprofitable but has reduced losses over five years by 6.1% annually and possesses sufficient cash runway for over a year. Despite having more cash than debt and covering liabilities with short-term assets of A$6.1 million, Terragen faces challenges such as high share price volatility and an inexperienced board and management team averaging 1.1 years in tenure each.

- Click to explore a detailed breakdown of our findings in Terragen Holdings' financial health report.

- Gain insights into Terragen Holdings' historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 1,035 ASX Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGA

Flawless balance sheet moderate.

Market Insights

Community Narratives