- Australia

- /

- Metals and Mining

- /

- ASX:S32

South32 (ASX:S32): Exploring Valuation Opportunities After Recent Share Price Swings

Reviewed by Simply Wall St

See our latest analysis for South32.

Looking beyond the past month's dip, South32’s recent gains over the past quarter hint at building momentum, even as the 1-year total shareholder return comes in at -14%. Short-term bumps aside, the bigger trend suggests a company finding its footing after a volatile stretch.

If you’re looking for even more fresh ideas, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Given South32’s recent share price swings and a modest discount to analyst price targets, is there real value waiting to be unlocked, or has the market already accounted for the company’s future growth prospects?

Most Popular Narrative: 5.2% Undervalued

South32’s most widely followed narrative values the shares above the latest close, suggesting some upside potential remains on the table. This sets the stage for one of the core drivers shaping the outlook: large-scale capital allocation decisions amid strategic portfolio shifts.

Large-scale investment and progress in copper and base metals growth projects (Hermosa, expanded Sierra Gorda capacity) position South32 to benefit from rising demand for metals critical in renewables, electric vehicles, and global decarbonization, supporting revenue and future earnings growth.

Curious about which aggressive financial targets power this valuation? There’s a bold growth path included, spanning top-line expansion, wider margins, and a future market multiple that not everyone will agree with. Feeling the tension between market skepticism and these bullish projections? The narrative is just getting started.

Result: Fair Value of $3.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, energy cost inflation or mine life challenges at core South32 assets could quickly shift expectations and undermine the current valuation outlook.

Find out about the key risks to this South32 narrative.

Another View: Market Pricing Signals Caution

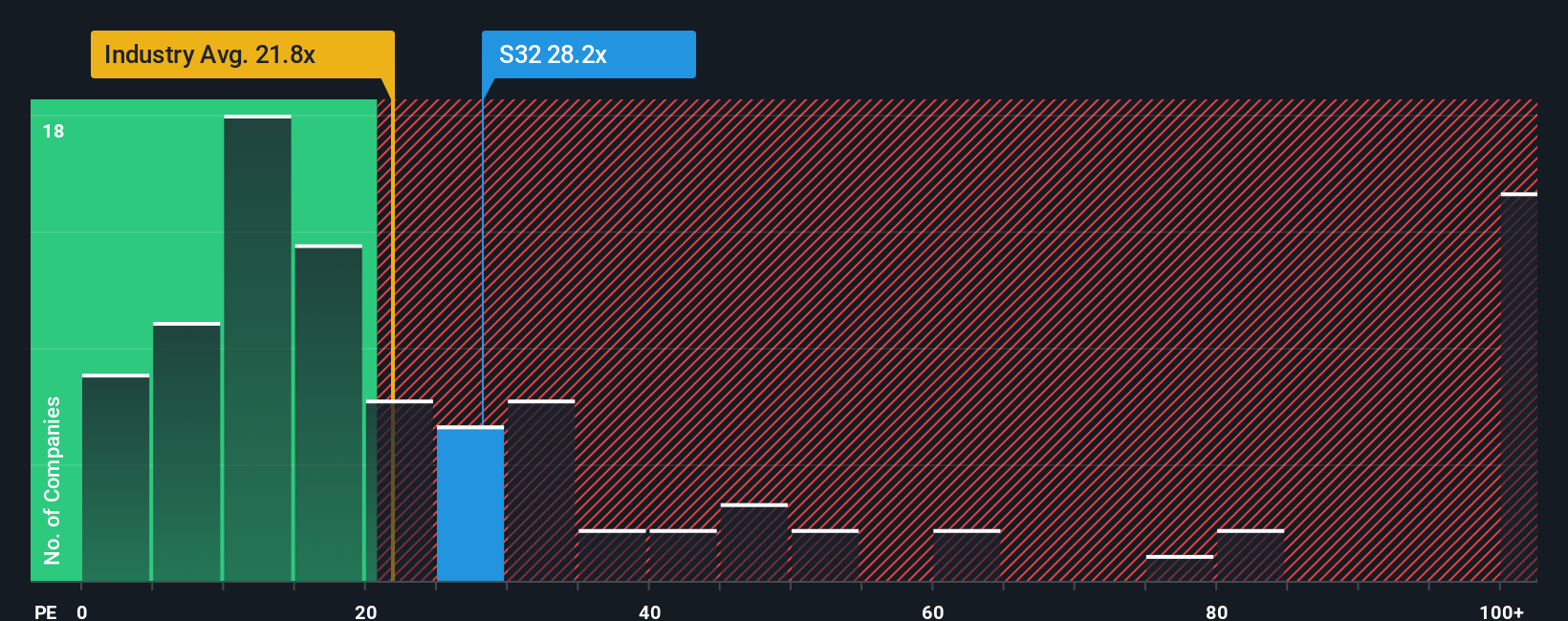

While the growth-driven valuation paints South32 as undervalued, the market price-to-earnings ratio of 28.7x outpaces both the industry average of 20.7x and the peer average of 20.6x. Even relative to the fair ratio of 28.3x, shares look slightly stretched, hinting at valuation risk if expectations are not met. Is the optimism baked into today's price warranted, or is there limited room for error ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own South32 Narrative

If you see things differently or want to dive into the numbers yourself, you can create your own story in just a few minutes. Do it your way

A great starting point for your South32 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want an edge on the market, don’t wait to see where other opportunities are hiding. The next winning idea could be just a click away.

- Start building your steady income strategy by tapping into these 14 dividend stocks with yields > 3% offering yields above 3% and strong payout histories.

- Jump ahead of the curve with these 26 AI penny stocks powering breakthroughs in automation, advanced analytics, and the fast-moving world of artificial intelligence.

- Capture early opportunities in game-changing tech with these 26 quantum computing stocks showing breakthrough potential beyond today's headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success