- Australia

- /

- Metals and Mining

- /

- ASX:S32

How Leadership Changes Will Shape South32's (ASX:S32) Strategic Direction and Investor Outlook

Reviewed by Sasha Jovanovic

- South32 Limited recently announced several key board changes, including the retirement of its Chair Karen Wood AM effective February 2026 and the upcoming succession by Stephen Pearce, alongside the retirement of long-serving independent Non-Executive Directors Frank Cooper AO and Dr. Ntombifuthi Mtoba following the 2025 Annual General Meeting.

- These developments mark a significant refresh of South32’s governance structure, introducing new leadership experience and perspectives at a critical period for the company’s evolving strategy.

- We'll explore how the appointment of Stephen Pearce as incoming Chair could influence South32's investment narrative and future direction.

Find companies with promising cash flow potential yet trading below their fair value.

South32 Investment Narrative Recap

To be a shareholder in South32, you need to believe in its ongoing push to reshape its portfolio toward future-facing commodities, while managing complex operational risks in power, resource access, and project execution. The recent board changes, including the succession of Stephen Pearce as Chair, are unlikely to materially affect the most pressing catalyst, progress on copper and base metals growth projects, or the chief risk, which remains securing stable, affordable long-term power for key aluminum assets.

Among recent announcements, South32’s initiation of a sale process for its Cannington silver mine stands out. This move highlights the company’s focus on portfolio simplification, which is closely linked to the main near-term catalyst: concentrating resources on high-return, energy transition metals to support earnings and margin growth amid global demand shifts.

On the other hand, investors should be aware that persistent uncertainty around electricity supply for Mozal Aluminium means ...

Read the full narrative on South32 (it's free!)

South32's narrative projects $6.8 billion revenue and $1.1 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $782 million earnings increase from $318 million.

Uncover how South32's forecasts yield a A$3.26 fair value, a 3% upside to its current price.

Exploring Other Perspectives

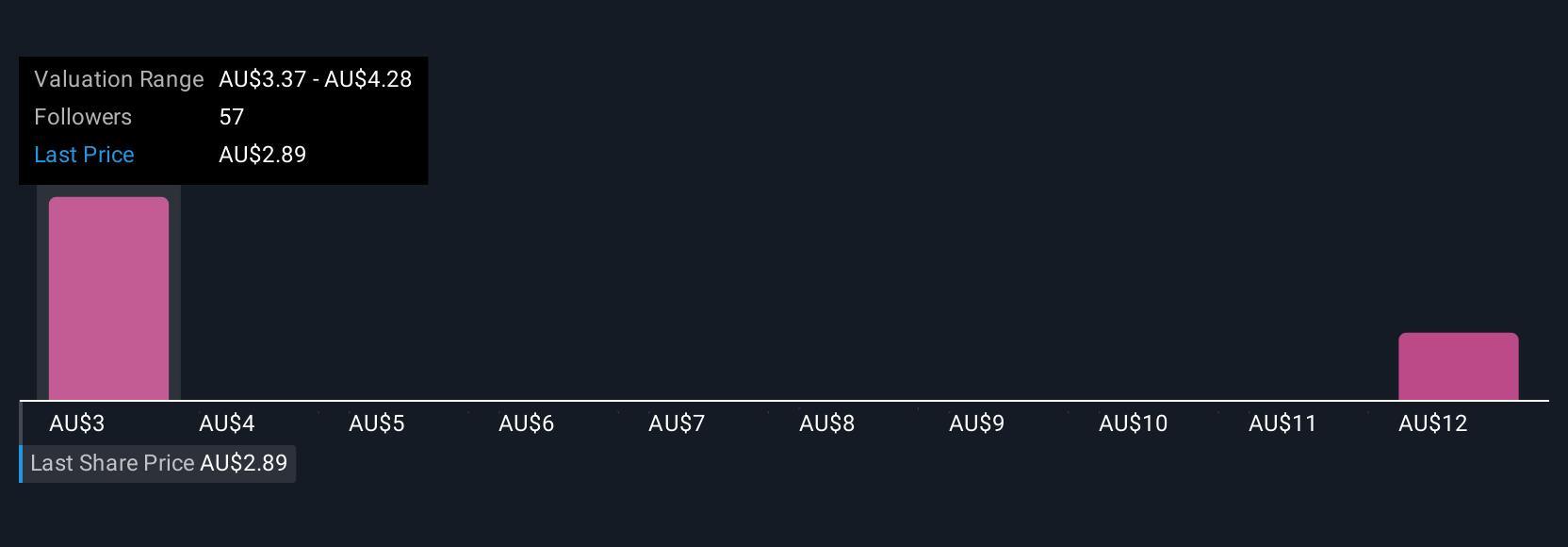

Seven Simply Wall St Community members place South32’s fair value between A$2.50 and A$11.52, with wide-ranging views on future growth. The current focus on simplifying the asset base remains central as you compare these views and consider how supply risks could affect the outlook.

Explore 7 other fair value estimates on South32 - why the stock might be worth 21% less than the current price!

Build Your Own South32 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South32 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free South32 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South32's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives