- Australia

- /

- Metals and Mining

- /

- ASX:RSG

Resolute Mining (ASX:RSG) Is Down 9.4% After Lowered Production and Raised Cost Guidance - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Resolute Mining Limited recently reported that its gold production and sales for the third quarter and first nine months of 2025 were significantly lower than the same periods last year, and the company revised its annual production guidance to the lower end of its previous range, while raising cost guidance due to lower output and higher royalties.

- Despite ongoing regional challenges affecting its Syama Mine in Mali, the company highlighted that operations continue and efforts are underway to diversify supply chains and maintain operational permits.

- We'll explore how the lower production results and narrowed guidance may reshape Resolute Mining's previously optimistic investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Resolute Mining Investment Narrative Recap

To be a shareholder in Resolute Mining right now, you need conviction in the company’s ability to reliably deliver gold production growth from West African projects, despite operational and geopolitical headwinds, particularly at the Syama Mine in Mali. The latest lowering of production guidance and increased cost outlook directly impact the near-term catalyst, consistent output and margin improvement, while reinforcing the risk of supply chain and regional disruptions continuing to pressure margins and delay growth initiatives.

The most relevant recent announcement is the October 2025 revision to full-year guidance, which narrows expected production to 275,000–285,000 ounces and increases forecast all-in sustaining costs to US$1,750–1,850 per ounce. This change spotlights the immediate operational challenges at Syama and highlights just how sensitive the business is to shortfalls in output and elevated royalties, possibly affecting cash generation and the timing of future expansion.

On the other hand, investors should be aware that continued resilience at Syama is critical, but any further escalation in regional instability could...

Read the full narrative on Resolute Mining (it's free!)

Resolute Mining's outlook forecasts $1.2 billion in revenue and $338.5 million in earnings by 2028. This implies an 11.0% annual revenue growth rate and a $329 million increase in earnings from the current $9.5 million.

Uncover how Resolute Mining's forecasts yield a A$1.45 fair value, a 67% upside to its current price.

Exploring Other Perspectives

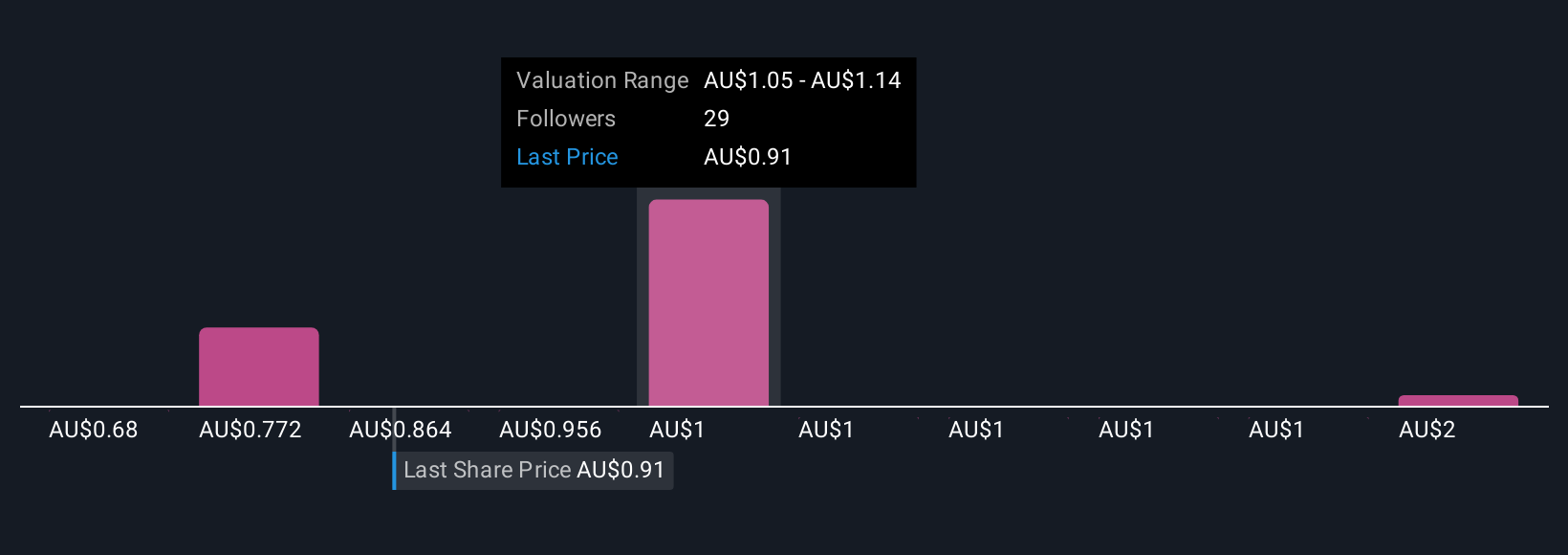

Simply Wall St Community fair value estimates for Resolute Mining range widely from A$0.68 to over A$25.72 across 8 individual views. While the latest guidance underscores sensitivity to operational risk, the community’s broad spread of fair values suggests you are likely to encounter sharply differing opinions on where value and downside risk really lie.

Explore 8 other fair value estimates on Resolute Mining - why the stock might be worth 21% less than the current price!

Build Your Own Resolute Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resolute Mining research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resolute Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resolute Mining's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RSG

Resolute Mining

Engages in mining, prospecting, and exploration of mineral properties in Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives