- Australia

- /

- Metals and Mining

- /

- ASX:RRL

Regis Resources Limited's (ASX:RRL) Business And Shares Still Trailing The Industry

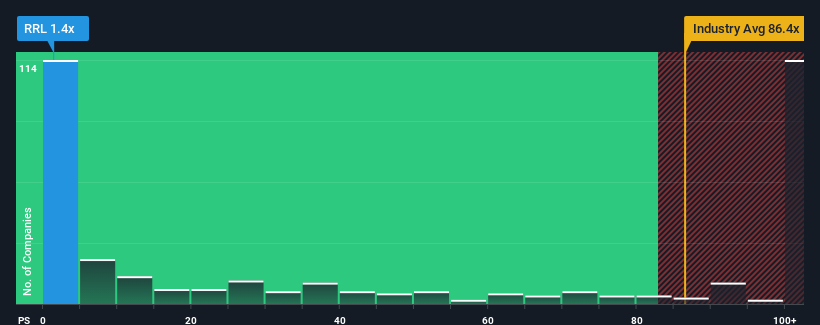

You may think that with a price-to-sales (or "P/S") ratio of 1.4x Regis Resources Limited (ASX:RRL) is definitely a stock worth checking out, seeing as almost half of all the Metals and Mining companies in Australia have P/S ratios greater than 86.4x and even P/S above 535x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Regis Resources

How Has Regis Resources Performed Recently?

With revenue growth that's inferior to most other companies of late, Regis Resources has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Regis Resources will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Regis Resources would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. The latest three year period has also seen an excellent 46% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 0.1% per annum during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 127% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Regis Resources' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Regis Resources' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Regis Resources' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Regis Resources with six simple checks.

If these risks are making you reconsider your opinion on Regis Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RRL

Regis Resources

Engages in the exploration, evaluation, and development of gold projects in Australia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives