- Australia

- /

- Metals and Mining

- /

- ASX:RMS

Ramelius Resources Limited (ASX:RMS) Shares Fly 26% But Investors Aren't Buying For Growth

Ramelius Resources Limited (ASX:RMS) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 33%.

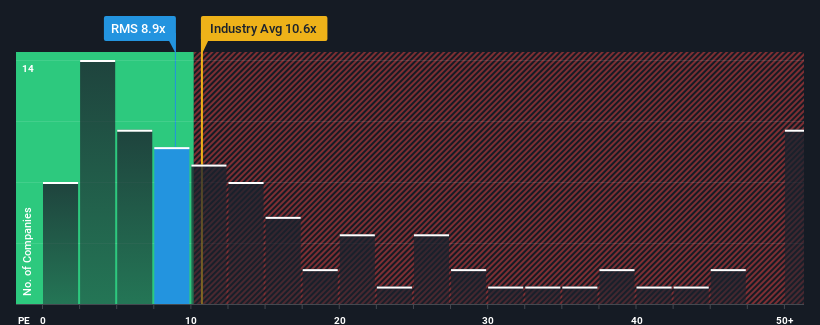

Even after such a large jump in price, Ramelius Resources' price-to-earnings (or "P/E") ratio of 8.9x might still make it look like a buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 17x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Ramelius Resources certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Ramelius Resources

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Ramelius Resources' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 305%. Pleasingly, EPS has also lifted 106% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 16% per year over the next three years. That's not great when the rest of the market is expected to grow by 15% each year.

With this information, we are not surprised that Ramelius Resources is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Ramelius Resources' P/E?

The latest share price surge wasn't enough to lift Ramelius Resources' P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ramelius Resources maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Ramelius Resources that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RMS

Ramelius Resources

Engages in the exploration, evaluation, mine development and operation, production, and sale of gold.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives