- Australia

- /

- Metals and Mining

- /

- ASX:PRU

Perseus Mining Limited (ASX:PRU) Surges 28% Yet Its Low P/E Is No Reason For Excitement

Perseus Mining Limited (ASX:PRU) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.5% in the last twelve months.

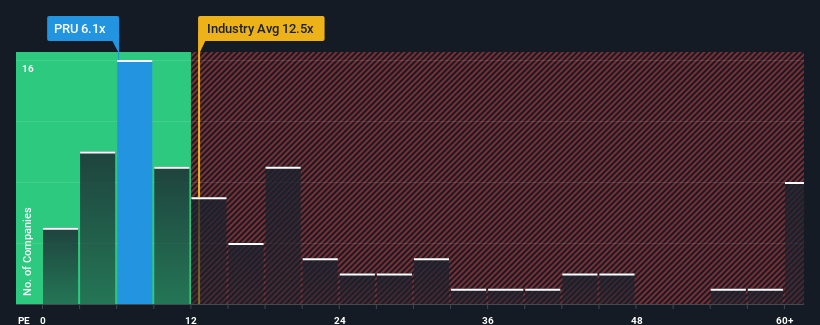

Although its price has surged higher, Perseus Mining's price-to-earnings (or "P/E") ratio of 6.1x might still make it look like a strong buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 20x and even P/E's above 36x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Perseus Mining has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Perseus Mining

How Is Perseus Mining's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Perseus Mining's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. The latest three year period has also seen an excellent 250% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 27% per year over the next three years. That's not great when the rest of the market is expected to grow by 17% per annum.

In light of this, it's understandable that Perseus Mining's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Perseus Mining's P/E?

Perseus Mining's recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Perseus Mining's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Perseus Mining you should be aware of.

If these risks are making you reconsider your opinion on Perseus Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PRU

Perseus Mining

Explores, evaluates, develops, and mines for gold properties in Ghana, Côte d’Ivoire, Tanzania, and Sudan.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives