ASX Dividend Stocks Beacon Lighting Group And 2 More High-Yield Picks

Reviewed by Simply Wall St

The Australian market is up 2.1% over the last week and has climbed 11% in the past year, with earnings expected to grow by 13% per annum over the next few years. In this favorable economic environment, identifying high-yield dividend stocks like Beacon Lighting Group can be a strategic move for investors seeking steady income and potential growth.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.38% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.17% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.43% | ★★★★★☆ |

| Auswide Bank (ASX:ABA) | 9.66% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.05% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 6.84% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.46% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.64% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.21% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.98% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

Beacon Lighting Group (ASX:BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beacon Lighting Group Limited (ASX:BLX) retails lighting products in Australia and internationally, with a market cap of A$569.36 million.

Operations: Beacon Lighting Group Limited generates revenue primarily from the sale of light fittings, fans, and energy-efficient products amounting to A$312.87 million.

Dividend Yield: 3.3%

Beacon Lighting Group's dividend payments have been volatile over the past decade, with occasional drops exceeding 20%. Despite this instability, the dividends are well-covered by earnings (payout ratio: 59.4%) and cash flows (cash payout ratio: 34.3%). Currently trading at a significant discount to its estimated fair value, BLX offers a dividend yield of 3.31%, which is lower than the top quartile of Australian dividend payers at 6.19%.

- Get an in-depth perspective on Beacon Lighting Group's performance by reading our dividend report here.

- Our valuation report here indicates Beacon Lighting Group may be overvalued.

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited (ASX:KSL) operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$290.31 million.

Operations: Kina Securities Limited generates revenue primarily from its Banking & Finance segment at PGK 356.68 million and Wealth Management services at PGK 37.76 million.

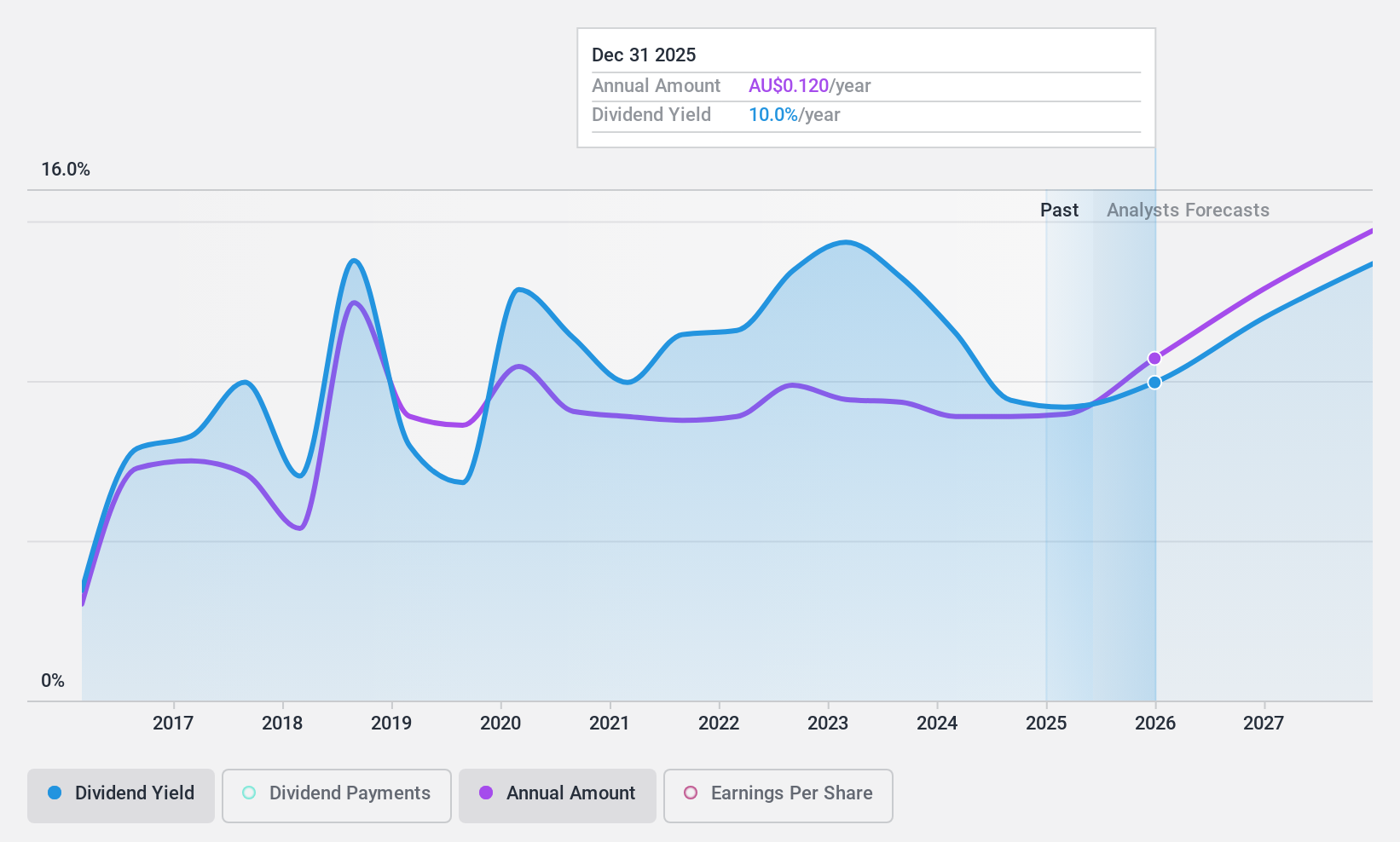

Dividend Yield: 9.7%

Kina Securities' dividend yield is among the top 25% in Australia at 9.67%, but its payments have been volatile over the past eight years. The payout ratio stands at a reasonable 70%, indicating dividends are covered by earnings, and this coverage is expected to continue with a forecasted payout ratio of 68.5% in three years. Recent board changes include appointing Ian Clough as an independent director, bringing extensive retail experience to the company.

- Navigate through the intricacies of Kina Securities with our comprehensive dividend report here.

- According our valuation report, there's an indication that Kina Securities' share price might be on the cheaper side.

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market cap of A$937.42 million.

Operations: Perenti Limited generates revenue from Drilling Services (A$598.10 million), Contract Mining Services (A$2.54 billion), and Mining Services and Idoba (A$239.06 million).

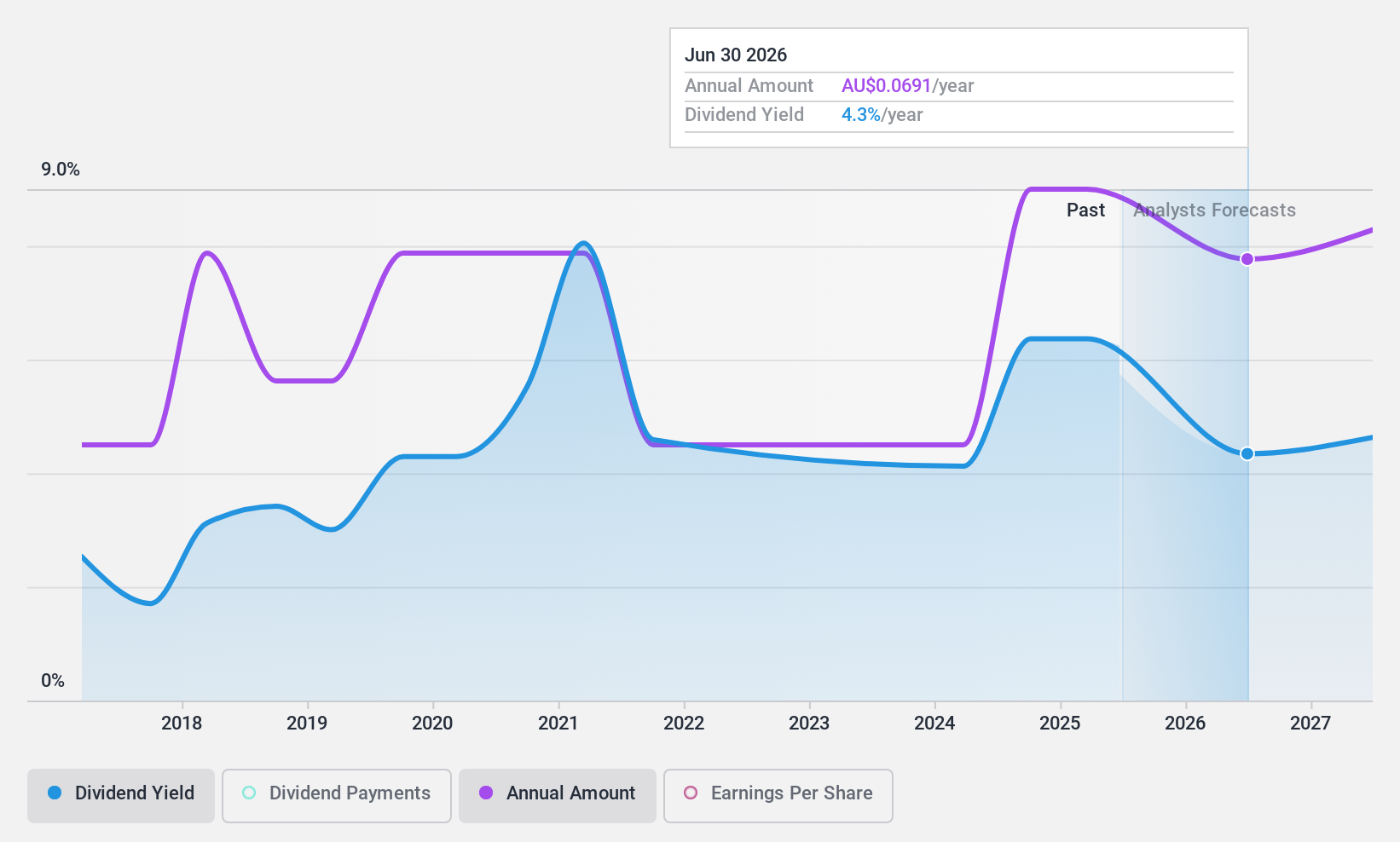

Dividend Yield: 8%

Perenti's dividend yield of 7.96% places it in the top 25% of Australian dividend payers, supported by a reasonable payout ratio of 55.3%. However, dividends have been volatile and declining over the past decade. Despite recent earnings reporting A$3.34 billion in sales for FY2024, net income remained flat at A$95.48 million compared to last year, indicating challenges in maintaining stable dividends amidst fluctuating performance and shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Perenti's dividend report.

- Our valuation report here indicates Perenti may be undervalued.

Seize The Opportunity

- Gain an insight into the universe of 33 Top ASX Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kina Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSL

Kina Securities

Provides commercial banking and financial, fund administration, investment management, and share brokerage services in Papua New Guinea.

Undervalued with reasonable growth potential and pays a dividend.