- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Undiscovered Gems in Australia for August 2024

Reviewed by Simply Wall St

The Australian market has climbed 2.1% in the last 7 days and is up 11% over the past 12 months, with earnings forecast to grow by 13% annually. In this favorable environment, identifying stocks with strong growth potential and solid fundamentals can lead to promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| K&S | 15.24% | -1.53% | 26.68% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| SKS Technologies Group | NA | 34.68% | 47.39% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| Lycopodium | 0.23% | 17.36% | 33.85% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.72 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, amounting to A$339.32 million.

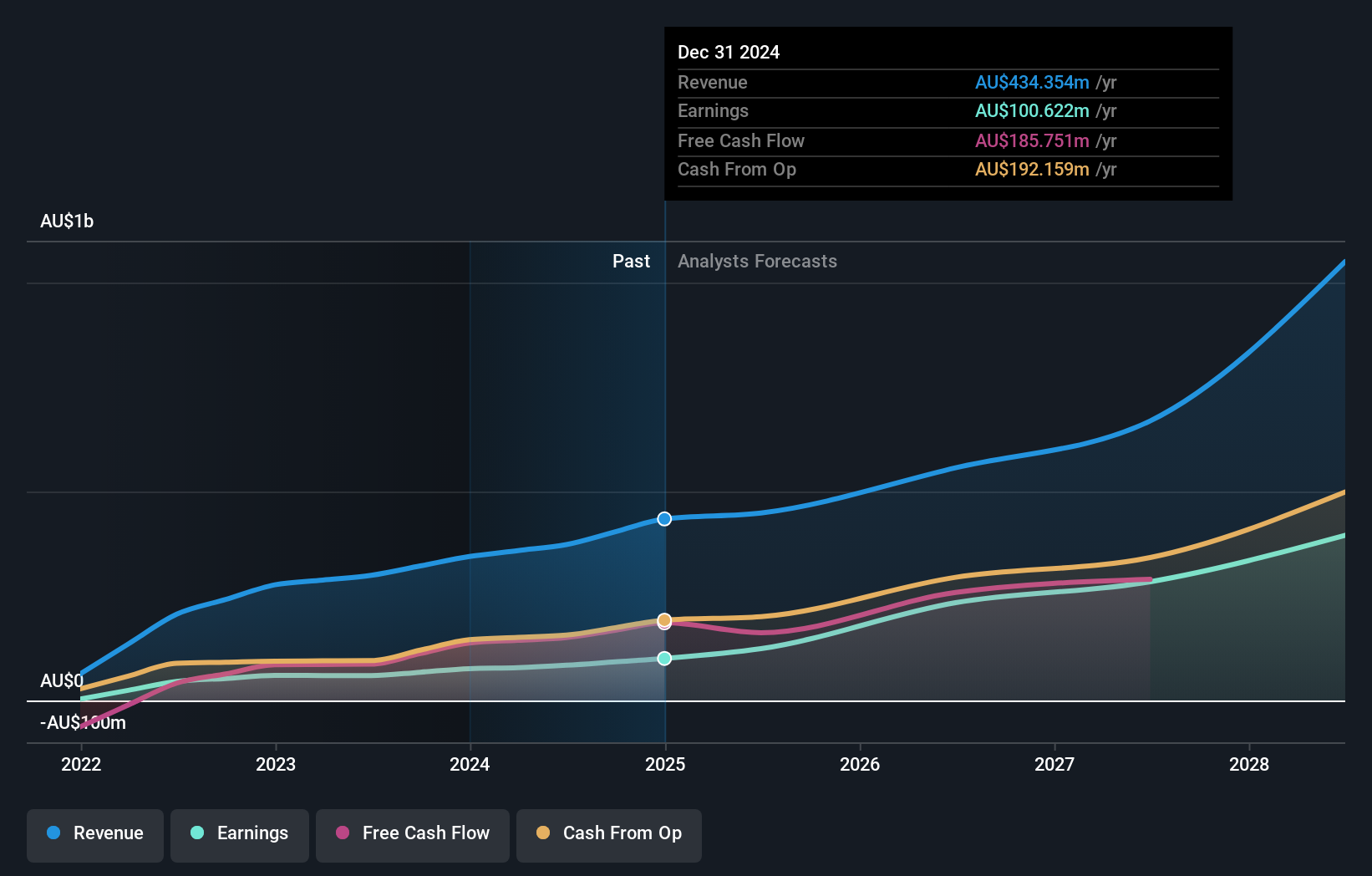

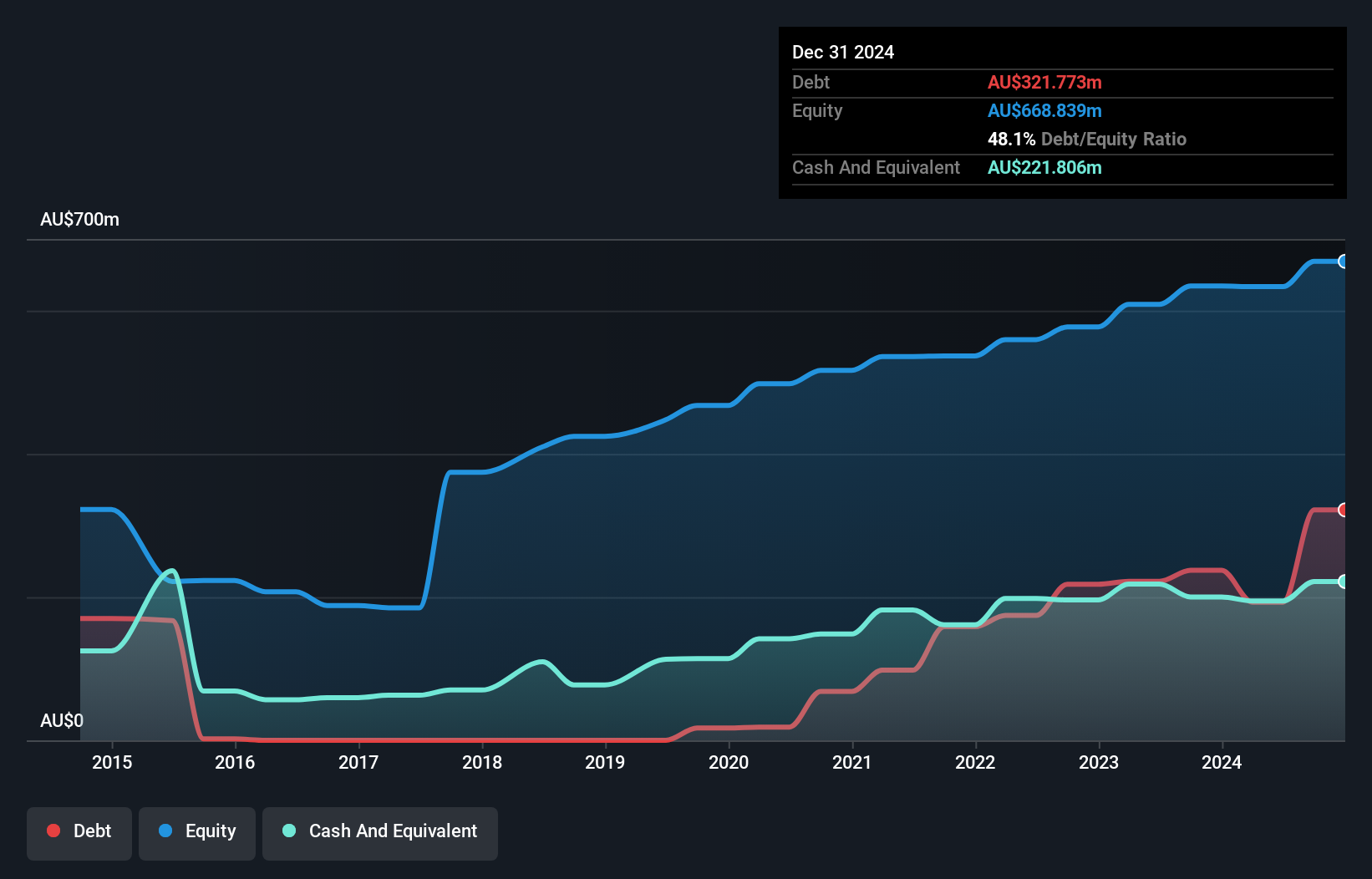

Emerald Resources, a promising player in the mining industry, has demonstrated impressive earnings growth of 53.4% over the past year, significantly outpacing its sector's -19% performance. Trading at 55.3% below its estimated fair value and with an EBIT interest coverage of 14x, it shows strong financial health. However, shareholders experienced dilution last year as the debt-to-equity ratio rose to 14.5%. Future earnings are forecasted to grow by 20.14% annually, suggesting continued potential for investors.

Macmahon Holdings (ASX:MAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to companies in Australia and Southeast Asia, with a market cap of A$662.05 million.

Operations: Macmahon Holdings Limited generates revenue primarily from its mining segment, including civil services, amounting to A$1.89 billion. The company's net profit margin is a key financial metric to consider.

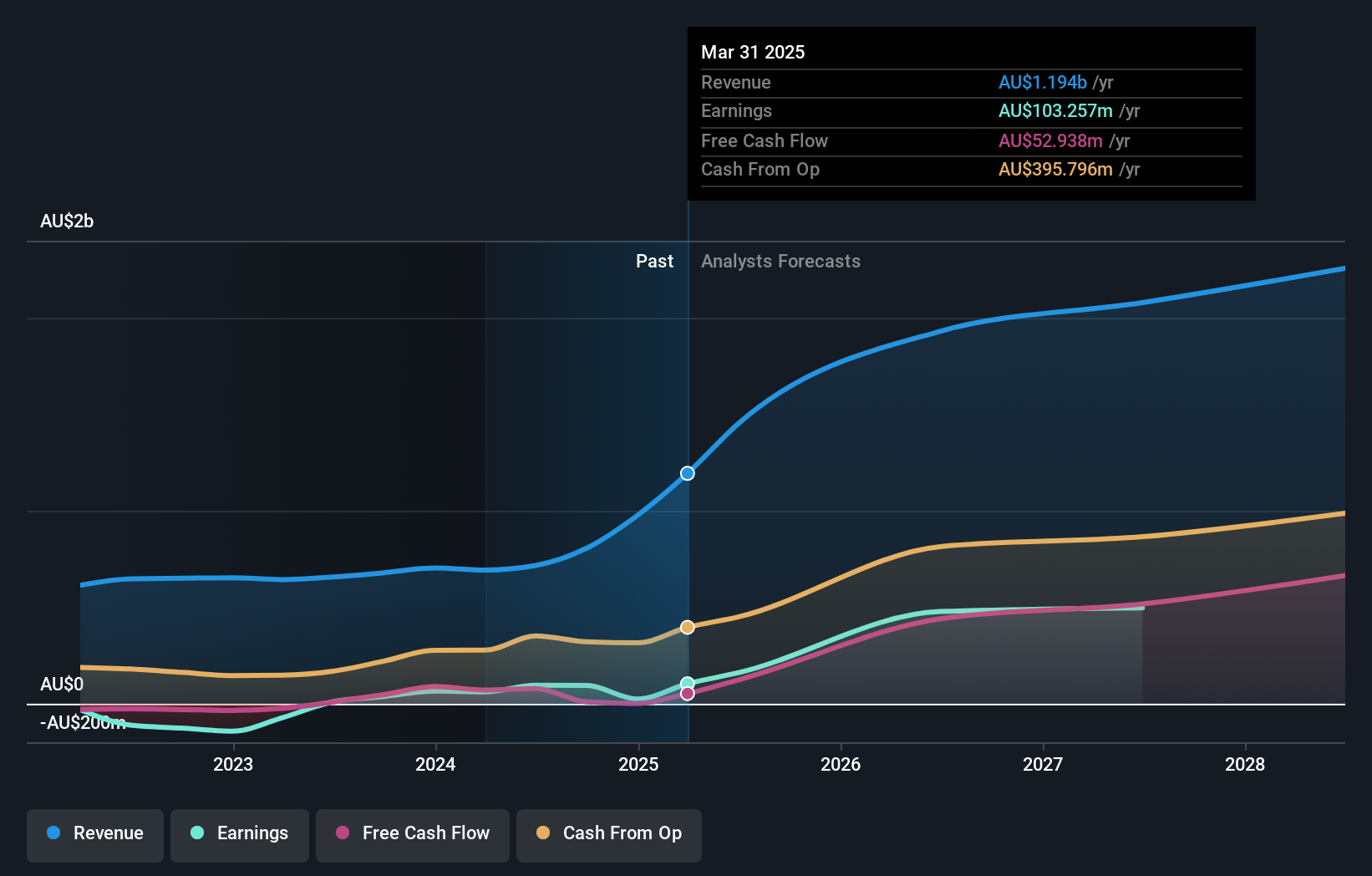

Macmahon Holdings, a notable player in the mining services sector, has shown impressive growth with earnings up 49.7% over the past year, outpacing the industry's -19%. Trading at 60.4% below estimated fair value and with a debt to equity ratio now at 37.4%, it represents good relative value within its industry. The company's interest payments are well covered by EBIT (5.4x), ensuring financial stability moving forward.

- Click here to discover the nuances of Macmahon Holdings with our detailed analytical health report.

Explore historical data to track Macmahon Holdings' performance over time in our Past section.

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited engages in the exploration, operation, development, mining, and treatment of gold assets primarily in Western Australia with a market cap of A$2.88 billion.

Operations: Westgold Resources generates revenue primarily from its Bryah and Murchison segments, with A$153.05 million and A$537.63 million respectively. The company's net profit margin stands at 12%.

Westgold Resources, a burgeoning player in the Australian mining sector, has shown impressive growth. Recently profitable with high-quality earnings and no debt, the company stands out. The Beta Hunt operation's ongoing drilling program revealed significant gold intersections like 4m at 22.45g/t Au and 5.2m at 10.13g/t Au, promising rapid value creation. Additionally, the South Junction mine's ore reserve increased by 233% to 277koz of gold, reinforcing its robust resource base and future production potential.

- Click to explore a detailed breakdown of our findings in Westgold Resources' health report.

Assess Westgold Resources' past performance with our detailed historical performance reports.

Seize The Opportunity

- Unlock our comprehensive list of 53 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

High growth potential with solid track record.