- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Pilbara Minerals (ASX:PLS) Valuation in Focus Following Lithium Price Surge and Share Rally

Reviewed by Simply Wall St

Pilbara Minerals (ASX:PLS) shares are attracting attention following a surge in lithium prices, as supply disruptions and rising demand from electric vehicles fuel optimism for major producers in the sector.

See our latest analysis for Pilbara Minerals.

Pilbara Minerals has enjoyed a powerful rebound lately, with a 1-month share price return of 41.6% and an even sharper 71% gain so far in 2025. Renewed optimism in lithium prices and tight supply have driven this momentum. While short-term moves have been impressive, the 12-month total shareholder return stands at 18.5%, highlighting both recent excitement and the volatility faced over the past year.

If battery metals are catching your attention, this is the perfect moment to discover more fast-moving names by broadening your search with fast growing stocks with high insider ownership.

With the stock’s powerful rally drawing so much attention, investors are left to consider whether Pilbara Minerals is now trading below its fair value as a lithium leader, or if the market has already priced in the next wave of growth.

Most Popular Narrative: 40.6% Overvalued

With the last close at A$3.78 and the narrative’s fair value at A$2.69, the gap signals that analyst consensus views the stock as notably ahead of its fundamentals. Investors are closely watching whether the recent surge is sustainable or simply an overextension versus projected future value.

Pilbara Minerals has executed major production capacity expansions (for example, Pilgangoora P1000 and the world's largest lithium ore sorter), positioning the company to significantly increase output at a time when global electric vehicle (EV) adoption and energy storage penetration are expected to accelerate. This directly supports higher future revenues and operational leverage.

Want to know how bold expansion forecasts and the EV revolution shape this valuation? The forecast hinges on major jumps in profits and future earnings multiples rarely seen outside tech stocks. Ready to uncover which projections drive this ambitious fair value and what tensions split analysts? Prepare for numbers that could surprise you.

Result: Fair Value of $2.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent lithium price volatility or setbacks in Pilbara Minerals' ongoing expansion projects could quickly shift analyst sentiment and challenge the current optimism.

Find out about the key risks to this Pilbara Minerals narrative.

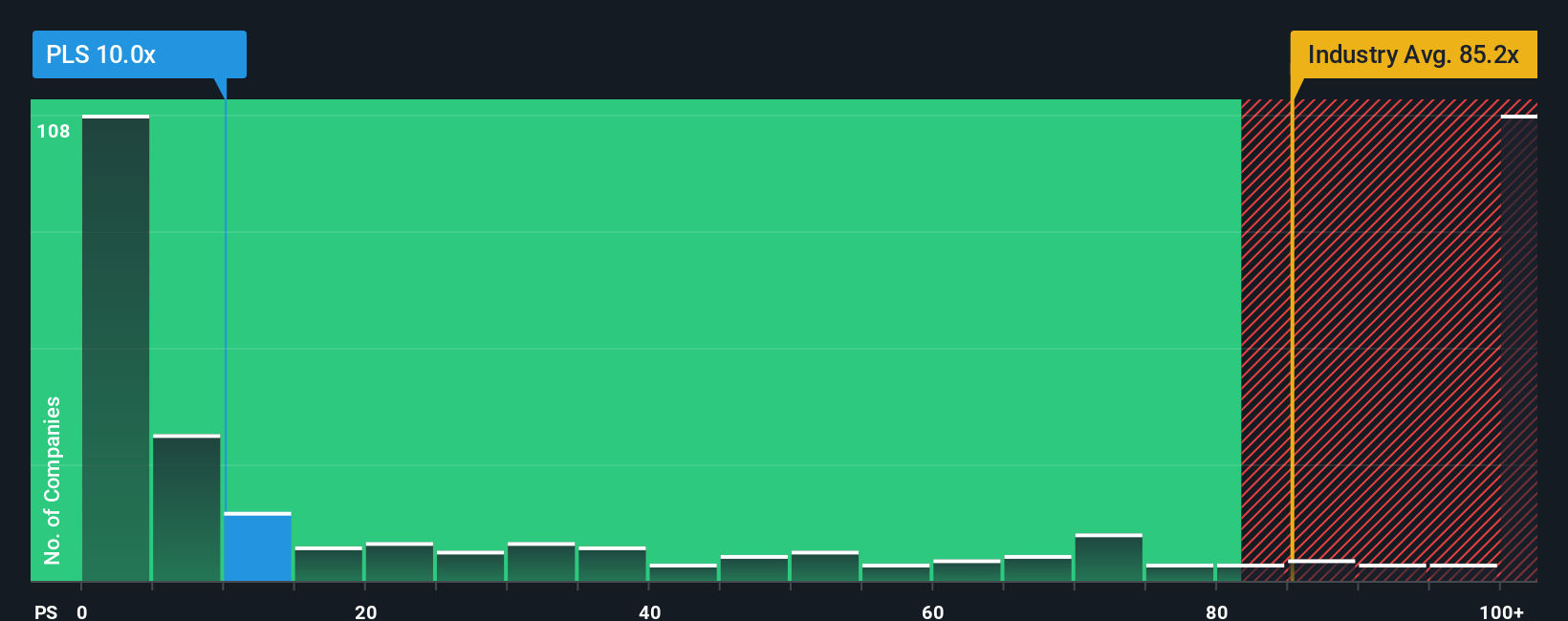

Another View: Multiples Suggest a Steep Premium

Taking a look at valuation through a different lens, Pilbara Minerals trades on a price-to-sales ratio of 15.8x. This is not only well above the Australian Metals and Mining sector average of 128.1x, but also significantly higher than the fair ratio estimate of just 1.4x. The gap highlights potential valuation risks. Could recent optimism be stretching expectations too far, or is the growth story justifying a rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pilbara Minerals Narrative

Don’t just take our word for it. Dive into the numbers firsthand and shape your own perspective on Pilbara Minerals in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pilbara Minerals.

Looking for More Investment Ideas?

Maximize your investing potential and stay ahead of the crowd by uncovering stocks with unique growth, income, or technology tailwinds. Don’t let the next big opportunity slip by. Start building your watchlist today.

- Capture the upside in futuristic healthcare by targeting these 32 healthcare AI stocks that are transforming patient care with AI-driven solutions and advanced medical breakthroughs.

- Unleash the potential of robust cash flows by tracking these 881 undervalued stocks based on cash flows that the market may be overlooking, giving you a head start on hidden value plays.

- Accelerate your portfolio’s income generation by targeting these 14 dividend stocks with yields > 3% offering attractive yields and solid fundamentals for sustainable long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLS

Pilbara Minerals

Engages in the exploration, development, and operation of mineral resources in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives