- Australia

- /

- Construction

- /

- ASX:GNP

Unearthing Australia's Undiscovered Gems In June 2025

Reviewed by Simply Wall St

As the Australian market flirts with record highs, driven by a buoyant energy sector and tempered by sluggish GDP growth, investors are keenly observing small-cap stocks for hidden potential amidst broader market dynamics. In this context, identifying promising stocks involves looking beyond immediate trends to discover companies with robust fundamentals and strategic positioning that could thrive even in fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems across Australia, with a market capitalization of A$607.23 million.

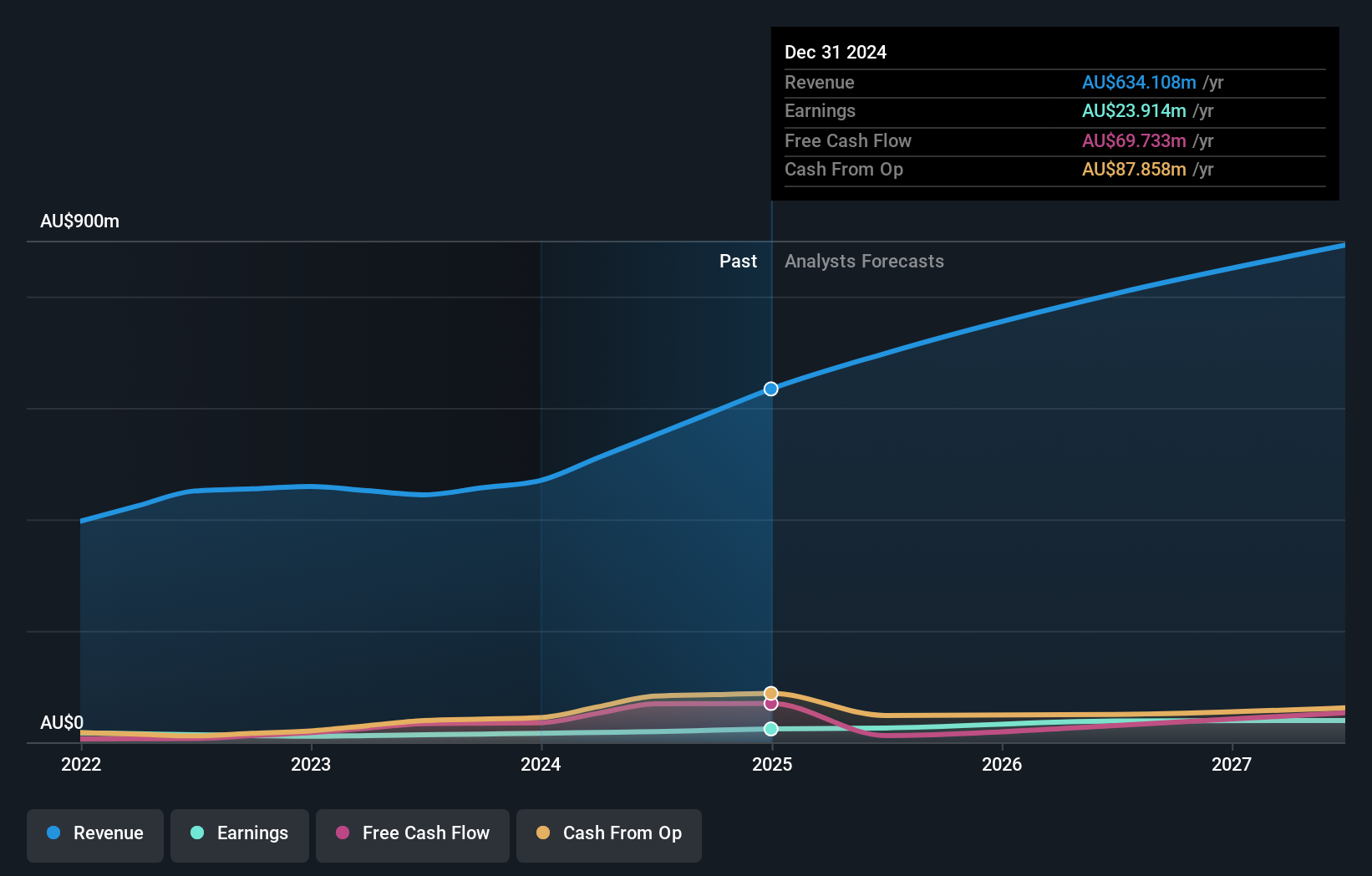

Operations: GenusPlus Group Ltd generates revenue primarily from its Infrastructure segment, contributing A$372.42 million, followed by Industrial at A$187.56 million and Communication at A$86.02 million. The company's financial performance is significantly influenced by its Infrastructure operations, which form the largest portion of its revenue streams.

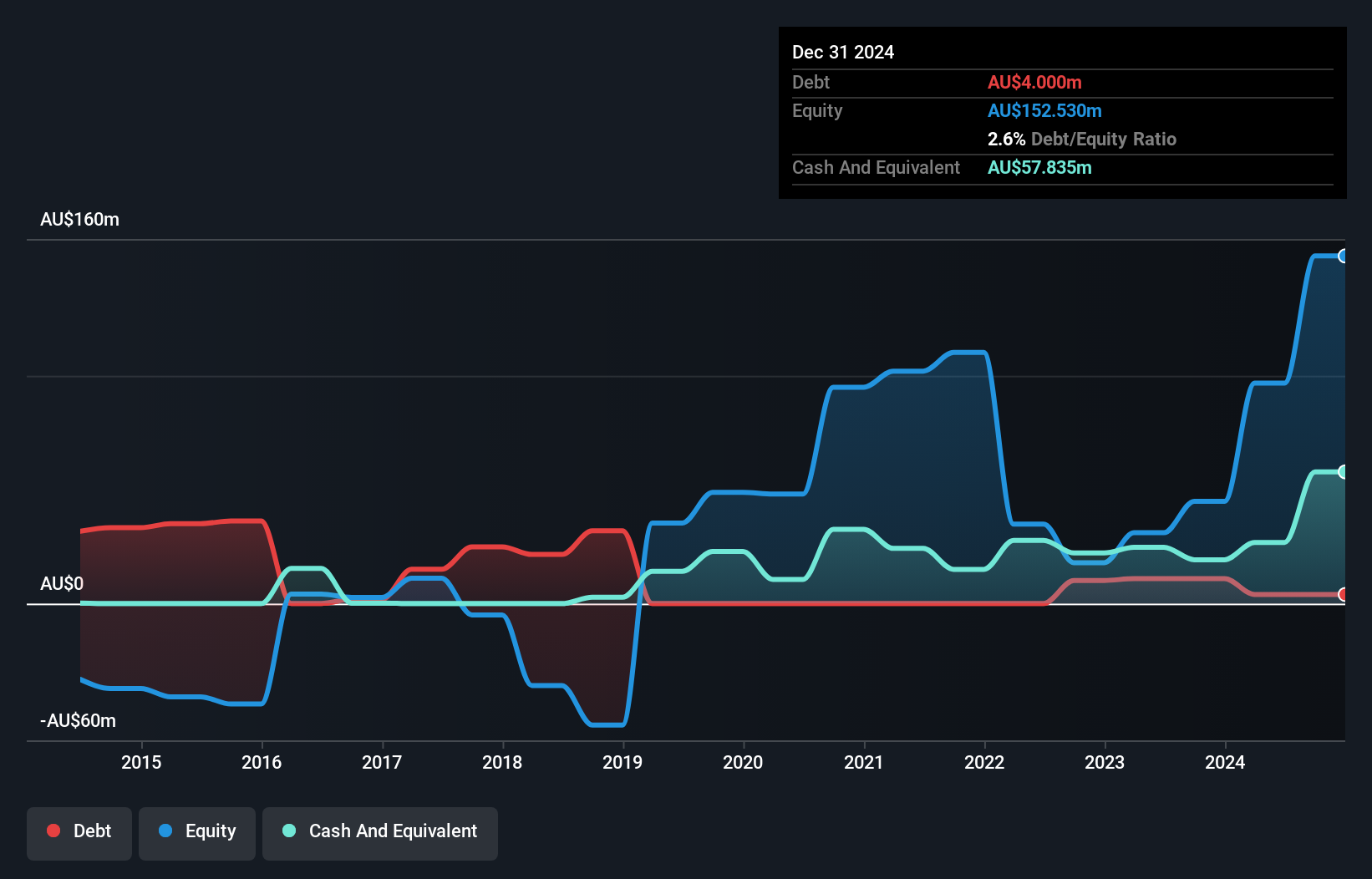

GenusPlus Group is carving out a niche in Australia's infrastructure sector with strategic acquisitions and an impressive order backlog, climbing from A$519 million to nearly A$1.5 billion. This positions the company well for future revenue growth and earnings stability, though challenges such as resourcing issues and acquisition costs could pressure margins. The company's debt-to-equity ratio has significantly improved from 10.3% to 2.6% over five years, reflecting prudent financial management. Analysts forecast a 15% annual revenue growth over the next three years, with profit margins expected to rise from 3.8% to 4.9%, indicating potential for robust long-term performance despite execution risks associated with large-scale projects and new acquisitions integration.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is involved in the exploration, operation, and development of mineral properties in Australia, with a market capitalization of A$2.38 billion.

Operations: Ora Banda Mining generates revenue primarily from its gold mining operations, amounting to A$304.30 million. The company's market capitalization is A$2.38 billion.

Ora Banda Mining is gaining traction with its recent inclusion in the S&P/ASX 300 and Small Ordinaries Indexes, reflecting growing investor confidence. The company's debt-to-equity ratio has risen to 2.6% over five years, yet it holds more cash than total debt, indicating a solid financial footing. Trading at 60.8% below its estimated fair value suggests potential upside for investors. With earnings expected to grow by 41.85% annually and robust non-cash earnings quality, Ora Banda's profitability marks a significant turnaround in the last year, positioning it as an intriguing player in Australia's mining sector landscape.

- Get an in-depth perspective on Ora Banda Mining's performance by reading our health report here.

Assess Ora Banda Mining's past performance with our detailed historical performance reports.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services, with a market capitalization of A$557.61 million.

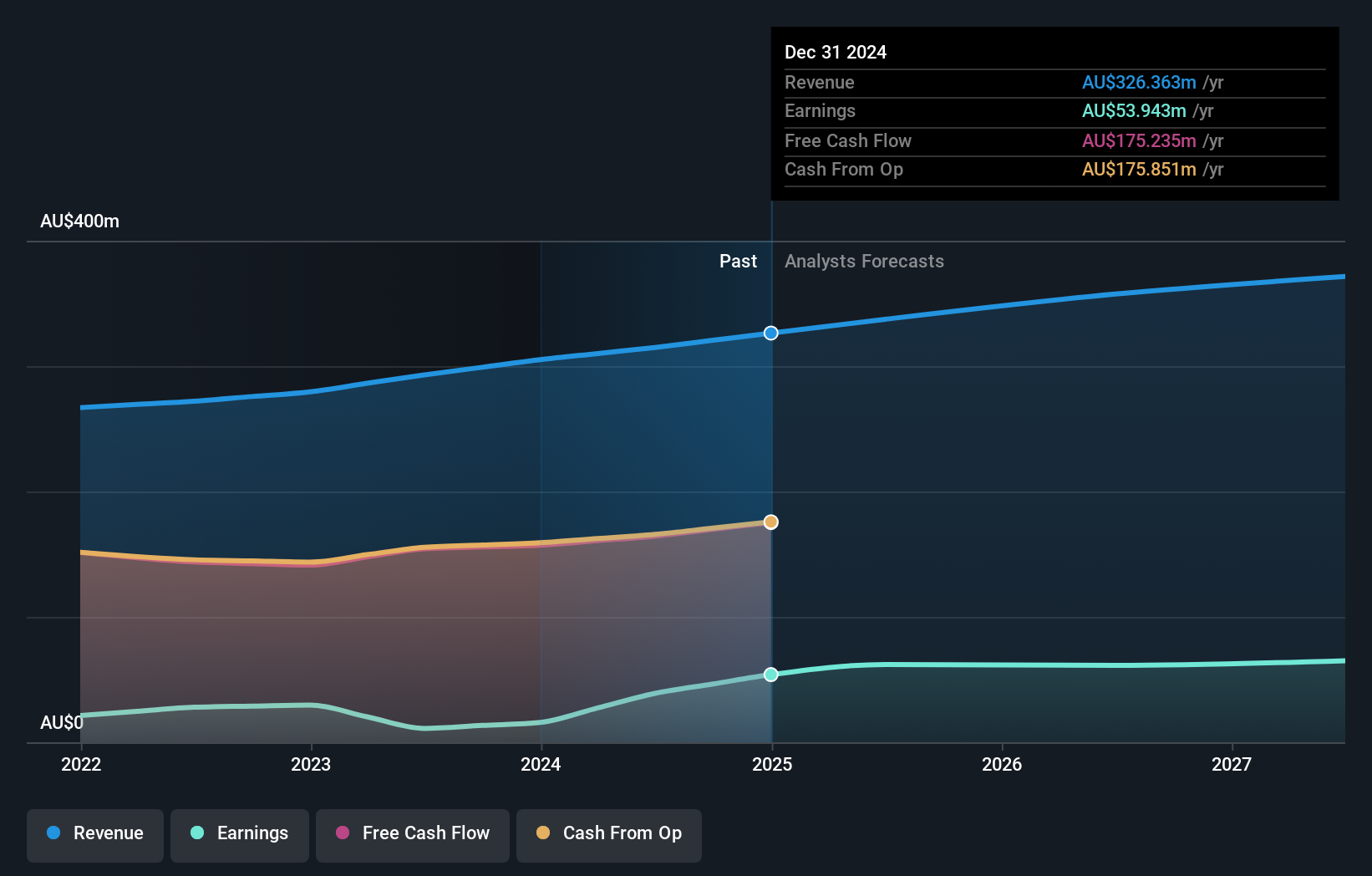

Operations: Servcorp Limited generates revenue primarily from its real estate rental segment, amounting to A$326.36 million.

Servcorp's strategic focus on expansion in Japan and the Middle East, alongside its proprietary Wombat client management system, positions it for future growth. With a debt-free status and earnings that surged 241% over the past year, Servcorp is trading at an attractive value—83.6% below estimated fair value. The company’s commitment to high-quality customer service through a higher staffing ratio could enhance net margins currently at 16.5%, projected to rise to 17.4%. Despite challenges like high operational costs and market saturation risks, analysts foresee annual revenue growth of 5.5%, with potential earnings reaching A$66.9 million by May 2028.

Key Takeaways

- Get an in-depth perspective on all 43 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNP

GenusPlus Group

Engages in the installation, construction, and maintenance of power and communication systems in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion