- Australia

- /

- Metals and Mining

- /

- ASX:OBM

ASX Penny Stocks To Consider In September 2025

Reviewed by Simply Wall St

Australian shares are experiencing a modest upswing, with ASX 200 futures pointing to a slight gain as global market trends influence local sentiment. As the Australian market navigates these shifts, investors often turn their attention to penny stocks—an investment area that remains relevant despite its old-fashioned name. These smaller or newer companies can offer affordability and growth potential, especially when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.52 | A$149.03M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.17 | A$102.37M | ✅ 3 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.84 | A$52.31M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$434.5M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.39 | A$250.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$38.83M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.48 | A$368.9M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.35 | A$1.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.78 | A$373M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 442 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market cap of A$2.15 billion.

Operations: The company generates revenue primarily from its gold mining operations, amounting to A$404.29 million.

Market Cap: A$2.15B

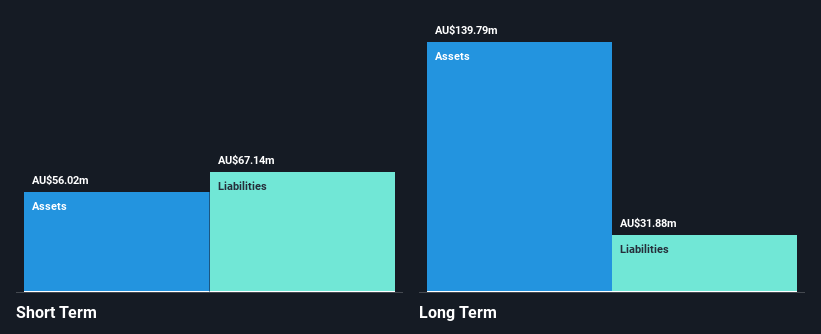

Ora Banda Mining has demonstrated significant financial growth, with recent annual sales of A$404.29 million and net income rising to A$186.08 million from the previous year's A$27.57 million. Despite a relatively inexperienced management team, the company boasts an outstanding return on equity of 65% and strong profit margins at 46%. Its debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating robust financial health. However, earnings are forecast to decline by an average of 4.9% annually over the next three years, which could impact future performance amidst industry volatility.

- Click to explore a detailed breakdown of our findings in Ora Banda Mining's financial health report.

- Gain insights into Ora Banda Mining's future direction by reviewing our growth report.

Raiz Invest (ASX:RZI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raiz Invest Limited operates a mobile micro-investing platform offering financial services and products in Australia, with a market cap of A$77.43 million.

Operations: The company generates revenue primarily from its Raiz Platform, amounting to A$24.07 million.

Market Cap: A$77.43M

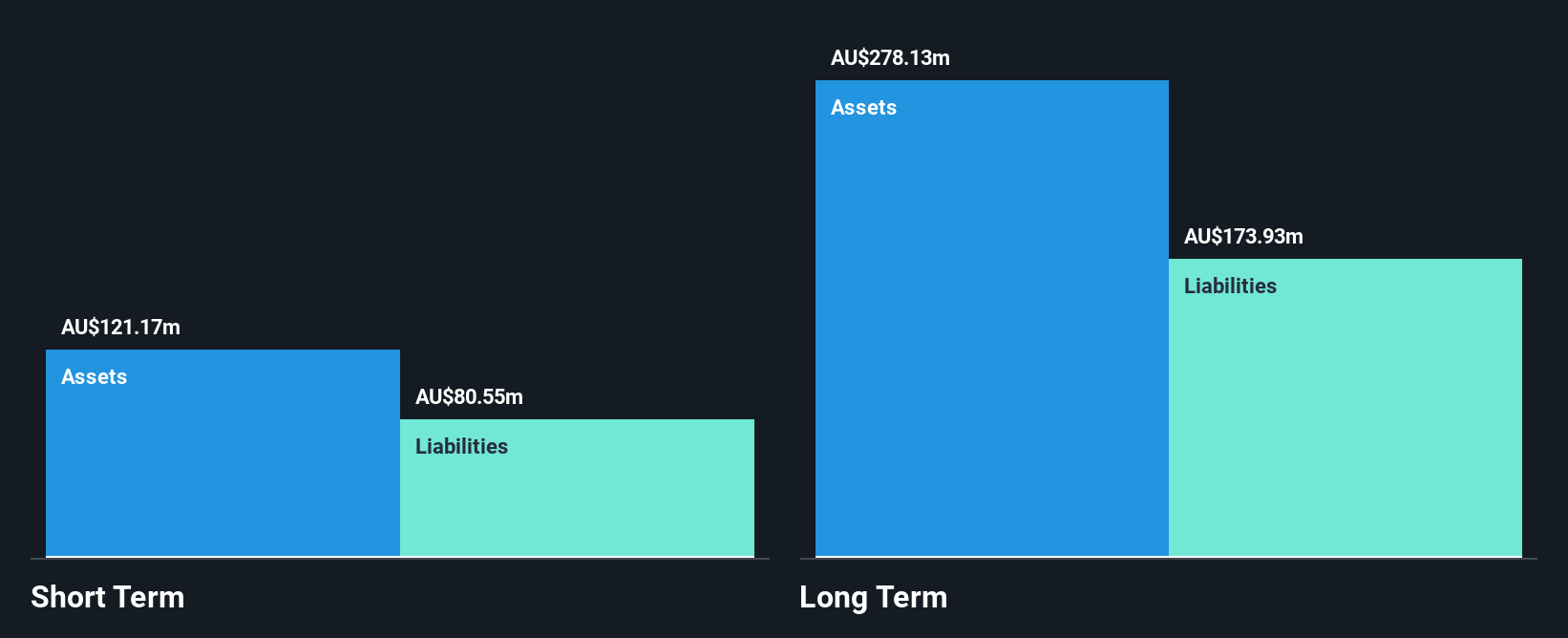

Raiz Invest Limited, with a market cap of A$77.43 million, continues to show financial resilience despite being unprofitable. The company reported annual revenue of A$24.07 million, up from A$21.02 million the previous year, and reduced its net loss significantly from A$1.87 million to A$0.31 million over the same period. Raiz's short-term assets (A$16.4M) comfortably cover both short-term (A$5.1M) and long-term liabilities (A$2.3M), and it remains debt-free with a cash runway exceeding three years under current conditions, indicating strong liquidity management amidst an inexperienced management team.

- Take a closer look at Raiz Invest's potential here in our financial health report.

- Explore historical data to track Raiz Invest's performance over time in our past results report.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wagners Holding Company Limited is involved in the production and sale of construction materials across Australia, the United States, New Zealand, the United Kingdom, PNG & Malaysia, with a market cap of A$493.04 million.

Operations: The company generates revenue through its Construction Materials segment (A$257.69 million), Project Services (A$105.71 million), Earth Friendly Concrete (A$0.16 million), and Composite Fibre Technology (A$68.45 million).

Market Cap: A$493.04M

Wagners Holding Company Limited, with a market cap of A$493.04 million, has demonstrated robust financial performance despite declining sales from A$481.64 million to A$431.27 million over the past year. The company reported a significant increase in net income from A$10.28 million to A$22.72 million, reflecting improved profit margins and high-quality earnings. Its debt management is solid with a reduced debt-to-equity ratio and satisfactory net debt levels covered by operating cash flow. Recent activities include a follow-on equity offering raising approximately A$30 million and an increased annual dividend of AUD 0.032 per share, indicating shareholder value focus amidst stable weekly volatility.

- Dive into the specifics of Wagners Holding here with our thorough balance sheet health report.

- Evaluate Wagners Holding's prospects by accessing our earnings growth report.

Make It Happen

- Reveal the 442 hidden gems among our ASX Penny Stocks screener with a single click here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives