The Australian market has climbed 1.4% in the last 7 days, with a gain of 2.3%, and is up 15% over the last 12 months, with earnings forecasted to grow by 12% annually. In this thriving environment, companies with high insider ownership often signal strong confidence from those who know the business best, making them compelling considerations for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

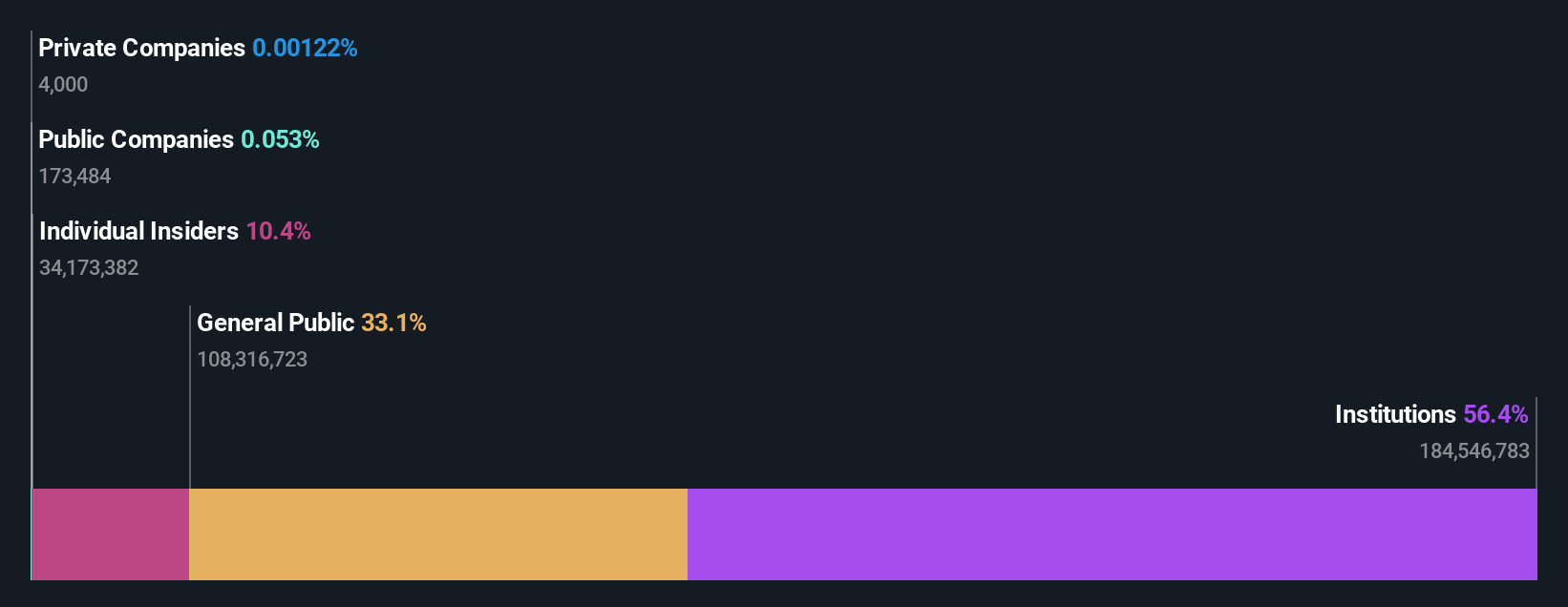

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited offers travel retailing services for leisure and corporate sectors across multiple regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia and has a market cap of A$4.74 billion.

Operations: The company's revenue segments include A$1.35 billion from leisure travel services and A$1.11 billion from corporate travel services.

Insider Ownership: 13.5%

Flight Centre Travel Group demonstrates strong growth potential with earnings forecasted to grow 19.72% annually, outpacing the Australian market's 12.3%. Despite an unstable dividend history, recent financials show significant improvement: net income rose to A$139 million from A$47 million last year. The company trades at a 16% discount to its fair value and plans strategic acquisitions, particularly in Cruise & Touring sales, leveraging a robust balance sheet for future expansion.

- Take a closer look at Flight Centre Travel Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Flight Centre Travel Group shares in the market.

Ora Banda Mining (ASX:OBM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market cap of A$1.28 billion.

Operations: Ora Banda Mining generates revenue primarily from its gold mining operations, amounting to A$166.66 million.

Insider Ownership: 10.2%

Ora Banda Mining's revenue is forecast to grow 46.3% annually, significantly outpacing the Australian market. The company is expected to become profitable within three years, with earnings projected to grow 106.93% per year and a very high return on equity of 46%. Recent executive changes include the appointment of Doug Warden as CFO and Joint Company Secretary, enhancing financial leadership. OBM was recently added to the S&P Global BMI Index but dropped from the S&P/ASX Emerging Companies Index.

- Dive into the specifics of Ora Banda Mining here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Ora Banda Mining's current price could be quite moderate.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.78 billion.

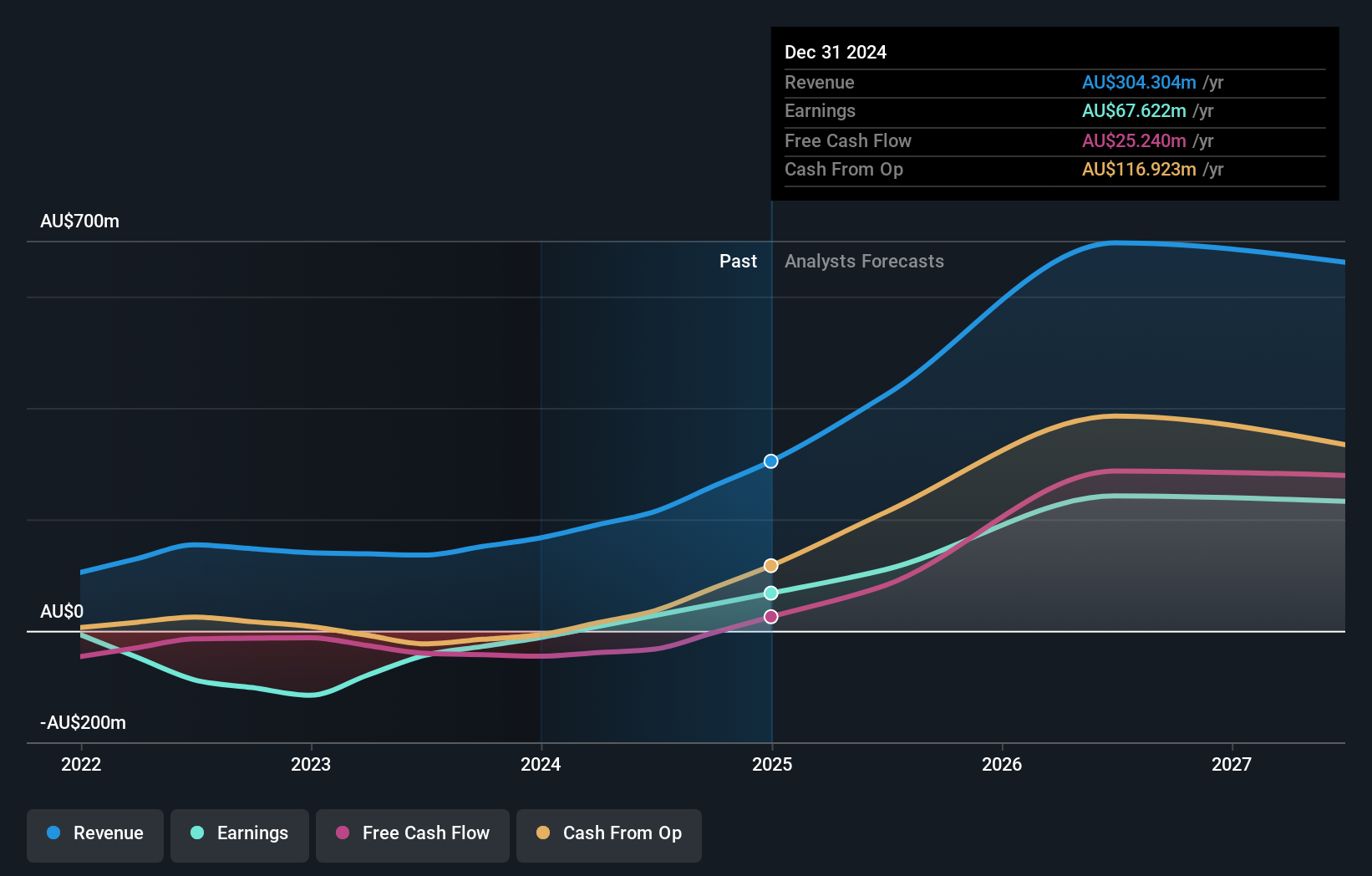

Operations: The company's revenue segments are comprised of Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

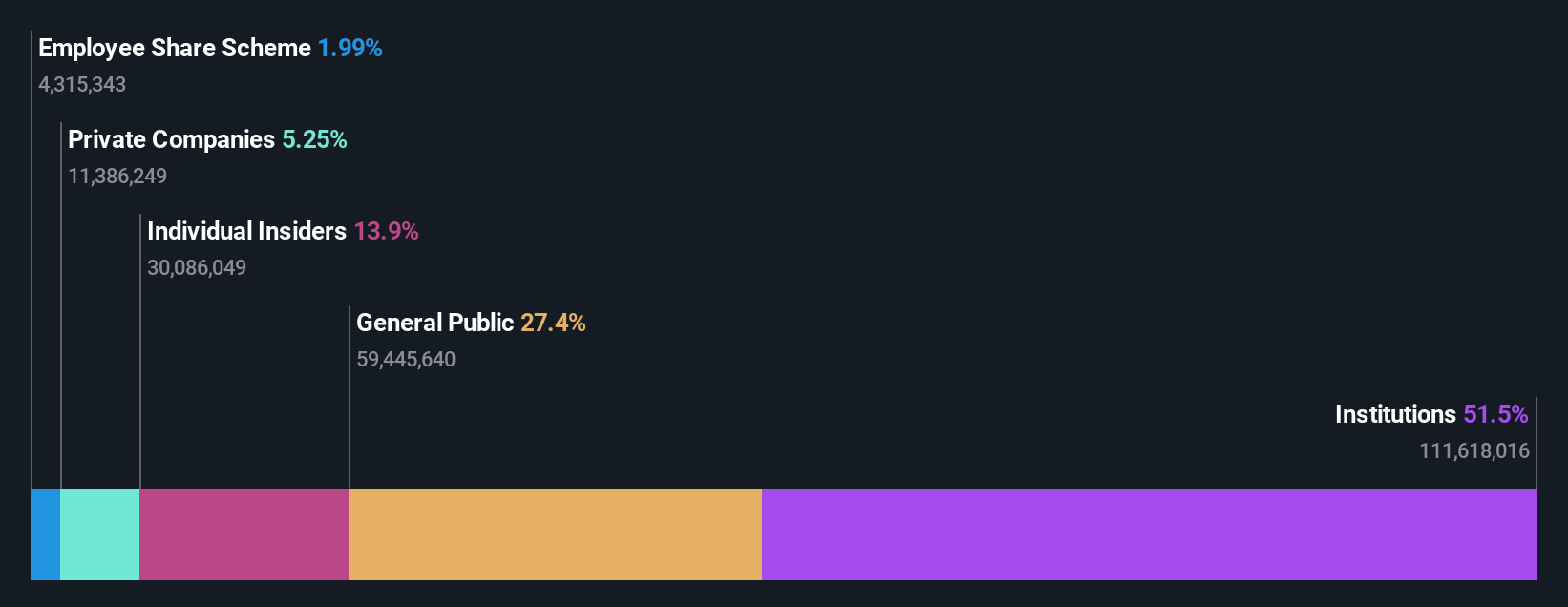

Insider Ownership: 12.3%

Technology One's earnings grew by 13.1% over the past year, with revenue forecasted to grow at 11.5% annually, outpacing the Australian market's 5.4%. Earnings are projected to rise by 14.8% per year, also exceeding market expectations of 12.3%. The recent appointment of Paul Robson as a Non-Executive Director brings valuable SaaS and cloud computing expertise, enhancing strategic transformation and operational efficiency as the company continues its global SaaS platform expansion.

- Unlock comprehensive insights into our analysis of Technology One stock in this growth report.

- The analysis detailed in our Technology One valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Discover the full array of 100 Fast Growing ASX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.