- Australia

- /

- Metals and Mining

- /

- ASX:NWC

We Take A Look At Why New World Resources Limited's (ASX:NWC) CEO Has Earned Their Pay Packet

It would be hard to discount the role that CEO Mike Haynes has played in delivering the impressive results at New World Resources Limited (ASX:NWC) recently. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 25 November 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

View our latest analysis for New World Resources

Comparing New World Resources Limited's CEO Compensation With the industry

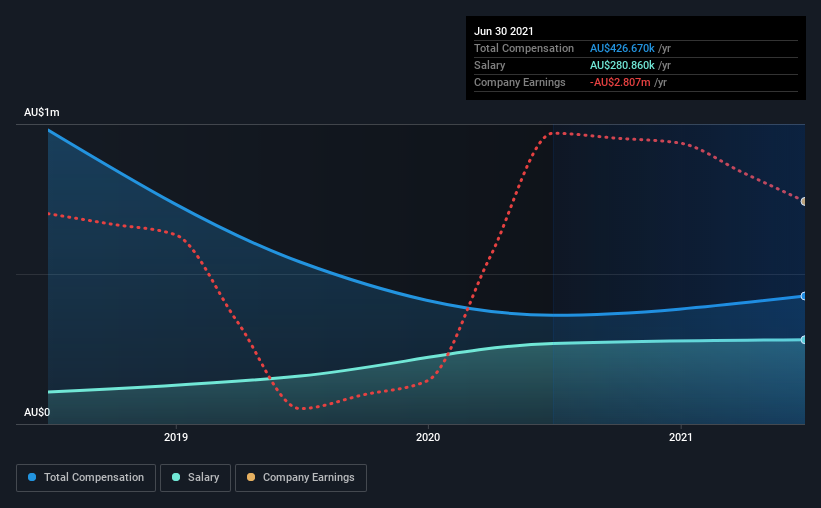

At the time of writing, our data shows that New World Resources Limited has a market capitalization of AU$121m, and reported total annual CEO compensation of AU$427k for the year to June 2021. Notably, that's an increase of 18% over the year before. In particular, the salary of AU$280.9k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under AU$275m, the reported median total CEO compensation was AU$354k. From this we gather that Mike Haynes is paid around the median for CEOs in the industry. Moreover, Mike Haynes also holds AU$2.9m worth of New World Resources stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$281k | AU$268k | 66% |

| Other | AU$146k | AU$94k | 34% |

| Total Compensation | AU$427k | AU$363k | 100% |

On an industry level, roughly 59% of total compensation represents salary and 41% is other remuneration. It's interesting to note that New World Resources pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at New World Resources Limited's Growth Numbers

Over the past three years, New World Resources Limited has seen its earnings per share (EPS) grow by 49% per year. Its revenue is down 20% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has New World Resources Limited Been A Good Investment?

We think that the total shareholder return of 175%, over three years, would leave most New World Resources Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 4 warning signs for New World Resources (2 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New World Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NWC

New World Resources

Engages in the exploration and development of mineral properties in North America.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion