What Does Nufarm’s (ASX:NUF) CEO Exit Reveal About Its Long-Term Transformation Strategy?

Reviewed by Sasha Jovanovic

- Nufarm recently reported a net loss of A$165.32 million for the year ended September 30, 2025, with sales reaching A$3.44 billion and basic loss per share from continuing operations at A$0.488.

- This result was shaped by significant non-cash charges in its Seed Technologies business, price pressures in the plant-based omega-3 market, and was accompanied by the departure of its long-serving CEO.

- We’ll consider how the CEO transition and Seed Technologies challenges could reshape Nufarm’s investment narrative moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Nufarm Investment Narrative Recap

To be a Nufarm shareholder right now, you need to believe in the company’s ability to navigate industry headwinds while capitalizing on long-term demand for sustainable crop solutions. Recent results have made the performance of the Seed Technologies segment, and particularly progress with plant-based omega-3, a key short-term catalyst, while the biggest risk remains prolonged pricing pressure in these markets; the CEO transition also introduces execution risk but does not materially shift the main near-term drivers.

The formal review of options for Nufarm’s Seed Technologies arm, including a potential sale or external partnership, is particularly relevant in this context. This announcement links directly to ongoing challenges in diversification, giving investors something concrete to monitor as management seeks to reduce leverage and position the Seeds business for recovery or reinvention.

But just as potential value could be unlocked, investors should be aware that if soft omega-3 prices and oversupply persist, Seed Technologies could remain structurally challenged for years…

Read the full narrative on Nufarm (it's free!)

Nufarm's narrative projects A$4.6 billion revenue and A$148.4 million earnings by 2028. This requires 10.5% yearly revenue growth and an increase of A$194.9 million in earnings from the current A$-46.5 million.

Uncover how Nufarm's forecasts yield a A$3.10 fair value, a 26% upside to its current price.

Exploring Other Perspectives

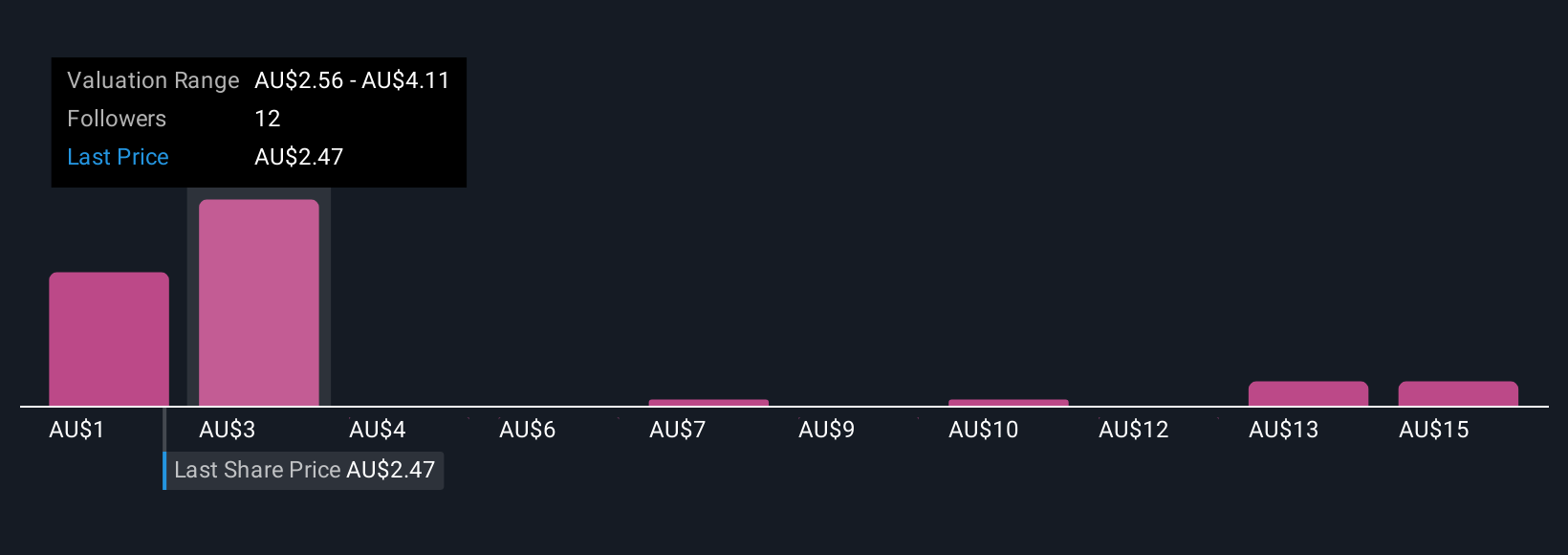

Eleven individual fair value estimates from the Simply Wall St Community for Nufarm range widely, from A$1.01 to A$16.52 per share. With performance now hinging on the fate of Seed Technologies, these different views highlight how much broader opinion can shift as risks and catalysts evolve, explore several viewpoints to inform your own stance.

Explore 11 other fair value estimates on Nufarm - why the stock might be worth less than half the current price!

Build Your Own Nufarm Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nufarm research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nufarm research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nufarm's overall financial health at a glance.

No Opportunity In Nufarm?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nufarm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NUF

Nufarm

Develops, manufactures, and sells crop protection solutions and seed technologies in Europe, the Middle East, Africa, North America, and the Asia Pacific.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives