- Australia

- /

- Metals and Mining

- /

- ASX:MYE

Metarock Group Limited's (ASX:MYE) Price Is Right But Growth Is Lacking After Shares Rocket 30%

Despite an already strong run, Metarock Group Limited (ASX:MYE) shares have been powering on, with a gain of 30% in the last thirty days. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

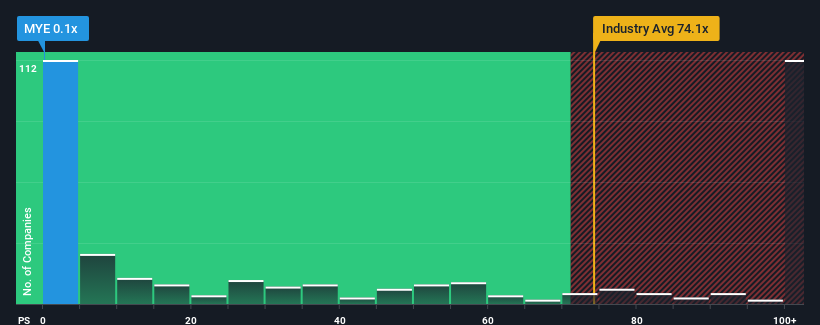

In spite of the firm bounce in price, Metarock Group may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 74.1x and even P/S higher than 472x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Metarock Group

What Does Metarock Group's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Metarock Group over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Metarock Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Metarock Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. Even so, admirably revenue has lifted 84% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 137% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Metarock Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Even after such a strong price move, Metarock Group's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Metarock Group revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Metarock Group (3 are significant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MYE

Mastermyne Group

Provides mine operation, contracting, training, and related services in the mining and supporting industries in Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026